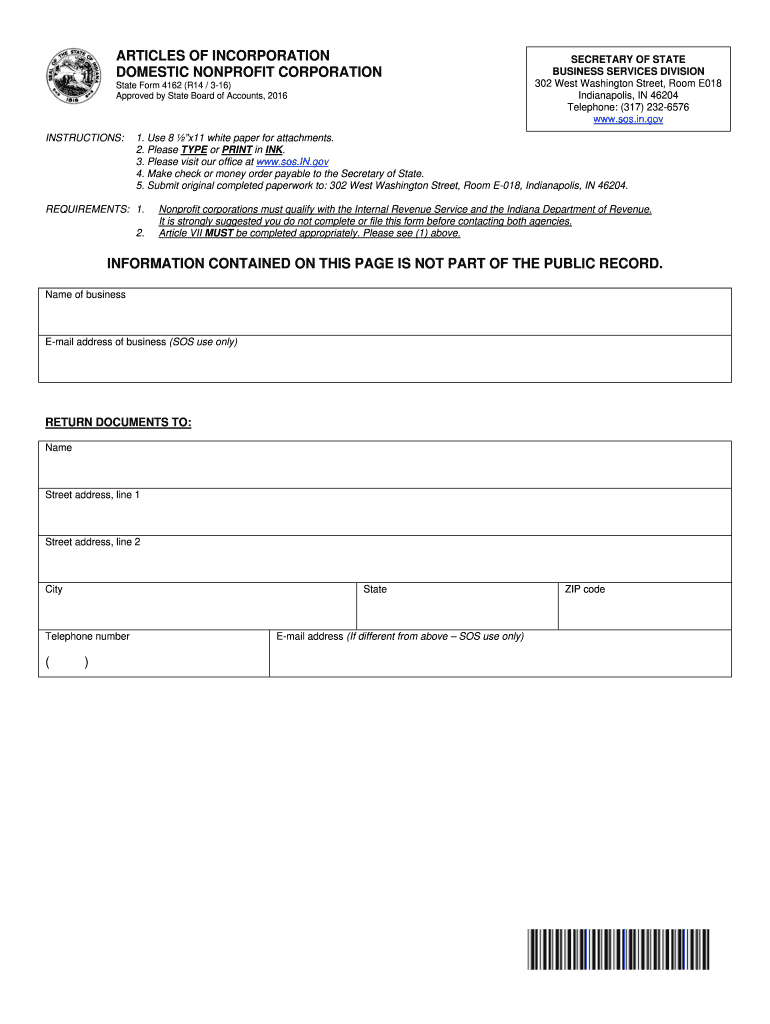

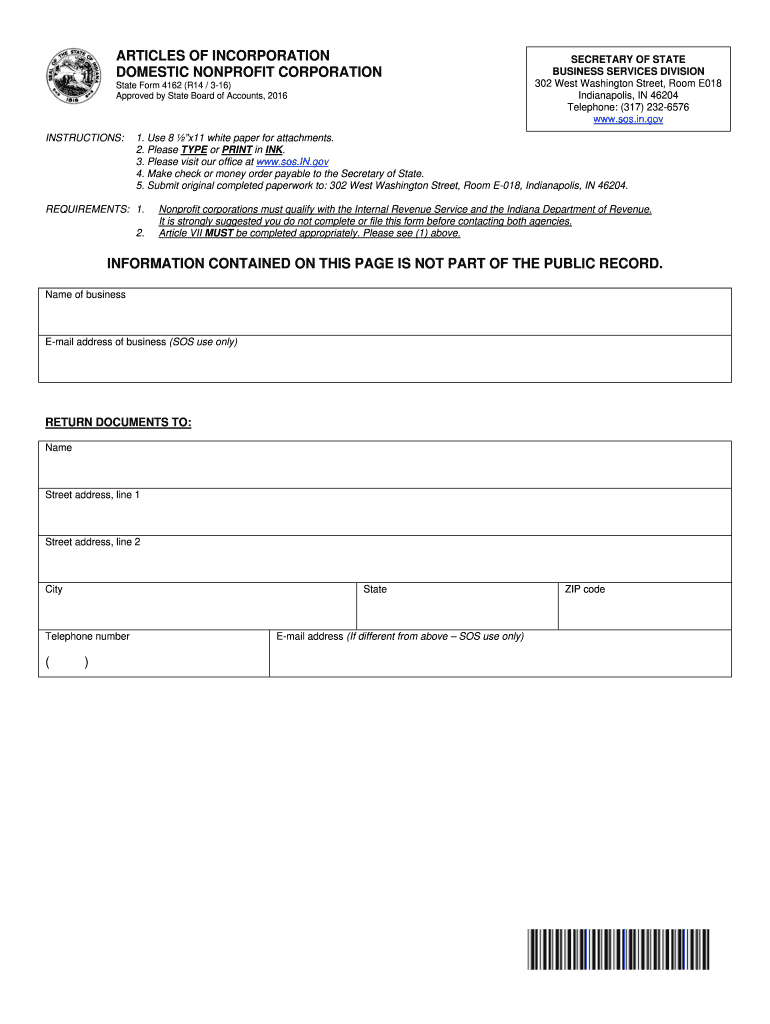

IN SF 4162 2016 free printable template

Get, Create, Make and Sign IN SF 4162

How to edit IN SF 4162 online

Uncompromising security for your PDF editing and eSignature needs

IN SF 4162 Form Versions

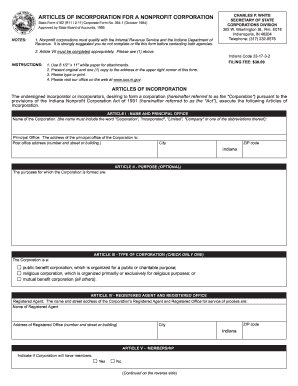

How to fill out IN SF 4162

How to fill out IN SF 4162

Who needs IN SF 4162?

Instructions and Help about IN SF 4162

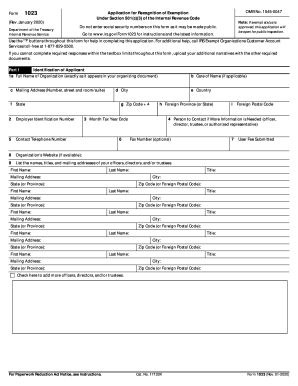

This is Jill from how to form an LLC org, and today we are going to form an LLC the state of Indiana now the first thing they used to do is before we came to get started is select the name of our LLC now the reason why I asked that is because a lot the number one reason why LLC's get rejected at the stay is because people choose a name that already exists in the system so if you go to our website which is in just the description just below in this video you'll see our dis web page, and you want to go to the bottom where the Indiana LLC search link is what this will do is link us right to the secure Secretary of State's website where we could search for other LLC names so for example if we wanted our else you need to be real estate submit, and we'll see that there's a real estate company Inc 106 real estate LLC, but there is no real estate LLC that exists here, so that name is good, so we can go back and start the process so in Indiana there one of those great states that have converted to the times, and you can now apply online they also have it so that you can apply paper but seeing as you are probably a very techie kind of person we're going to show you how to do it online, so you go right to our website click on this link step one the IND gov and this is how you start the process select an entity type we'll do ll domestic LLC you type in your email address right here confirm hit continue and what we'll do they'll do is that just ask you a series of questions that shouldn't take you more than 10 minutes and everything's done online this is state of Indiana and at the end of all the questioning you'll be asked to pay 90 bucks and that's it you'll get your LLC within 10 to 15 business days now if you want to do the paper filing the instructions are here I don't really want to get into it because that's of the old school, and we lit will show you only the best way to do it now a couple of requirements while you're waiting those 10 to 15 days you're still able to apply for an EIN number now that might sound like Spanish to you but an EIN number is a number that is just like your social security number is to you personally IE I'm number which is right here really employer identification number or the bank might call it a tax ID number, but long story short you need this if you want to make a bank account all you have to do is hit apply online now it's completely free it takes about five minutes and even though it is the IRS I promise you it's very simple, and it's one of the few things that they've really gotten over at the IRS, but you should be set with that but if you have more than one member in your LLC you may want to get an LLC operating agreement because what you'll find is that when you apply they'll ask who the owners are and owners by the way are called members in the LLC world, so I'll ask you what the members are it's really the owner but if you have more than one member in your LLC then you might want to get an LLC operating agreement...

People Also Ask about

How much is an Indiana business entity report?

Where do I find my Indiana Secretary of State Control number?

How do I find out who owns an LLC in Indiana?

What are the benefits of an LLC in Indiana?

What happens if you don t file a business entity report in Indiana?

How do I find out if an LLC is in the US?

Do you have to renew LLC every year in Indiana?

How do I check if the company name I want is already taken?

How do I reserve a business name in Indiana?

Does Indiana require an annual report?

How do you check if an LLC name is taken in Indiana?

What is Indiana business entity report?

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I get IN SF 4162?

Can I create an eSignature for the IN SF 4162 in Gmail?

How can I edit IN SF 4162 on a smartphone?

What is IN SF 4162?

Who is required to file IN SF 4162?

How to fill out IN SF 4162?

What is the purpose of IN SF 4162?

What information must be reported on IN SF 4162?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.