IL IL-2848 2009 free printable template

Show details

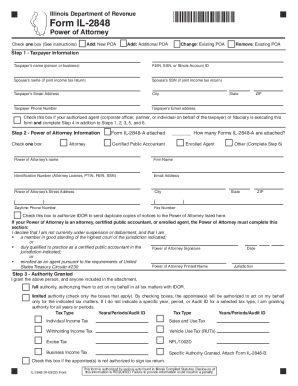

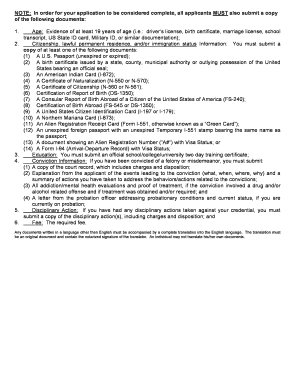

Illinois Department of Revenue IL-2848 Power of Attorney Read this information first Attach a copy of this form to each specific tax return or item of correspondence for which you are requesting power of attorney. Signature of witness appeared this day before a notary public and acknowledged Signature of notary Notary seal IL-2848 back R-12/14 This form is authorized as outlined under the Illinois Income Tax Act. File a protest to a proposed asse...

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign IL IL-2848

Edit your IL IL-2848 form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your IL IL-2848 form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing IL IL-2848 online

Follow the guidelines below to benefit from the PDF editor's expertise:

1

Create an account. Begin by choosing Start Free Trial and, if you are a new user, establish a profile.

2

Simply add a document. Select Add New from your Dashboard and import a file into the system by uploading it from your device or importing it via the cloud, online, or internal mail. Then click Begin editing.

3

Edit IL IL-2848. Rearrange and rotate pages, insert new and alter existing texts, add new objects, and take advantage of other helpful tools. Click Done to apply changes and return to your Dashboard. Go to the Documents tab to access merging, splitting, locking, or unlocking functions.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

pdfFiller makes dealing with documents a breeze. Create an account to find out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

IL IL-2848 Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out IL IL-2848

How to fill out IL IL-2848

01

Obtain the IL IL-2848 form from the Illinois Department of Revenue website or through a tax professional.

02

Fill in your personal information, including your name, address, and Social Security number.

03

Enter the information of the person or entity you are authorizing to represent you.

04

Specify the tax matters for which you are granting authorization, including the relevant tax years.

05

Sign and date the form to validate it.

06

Submit the completed form to the Illinois Department of Revenue.

Who needs IL IL-2848?

01

Individuals who need to authorize a tax preparer or attorney to act on their behalf regarding Illinois tax matters.

02

Anyone filing an appeal or needing assistance with tax issues who requires official representation.

Fill

form

: Try Risk Free

People Also Ask about

Who needs to file form 2848?

You can file Form 2848, Power of Attorney and Declaration of Representative, if the IRS begins a Foreign Bank and Financial Accounts (FBAR) examination as a result of an income tax examination.

Does a power of attorney have to be filed with the court in Illinois?

For real estate transaction, Illinois requires the filing of a standard power of attorney form called the Illinois Statutory Short Form Power of Attorney for Property. It is a boilerplate document anyone can fill out, sign, and have notarized with the help of a licensed attorney.

What is the tax form for power of attorney in Illinois?

An Illinois tax power of attorney (Form IL-2848) can be utilized to delegate a person, usually, an accountant or tax adviser, to represent another person in matters related to your Illinois taxes.

What is a 2848 form in Illinois?

An Illinois tax power of attorney (Form IL-2848) can be utilized to delegate a person, usually, an accountant or tax adviser, to represent another person in matters related to your Illinois taxes.

What is a durable power of attorney for finances in Illinois?

An Illinois durable power of attorney form is a document that allows someone to designate an agent, which is typically a trusted friend or relative, who can make financial decisions on their behalf. The durable version of this form remains in effect even if the principal becomes mentally incapacitated.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I edit IL IL-2848 on a smartphone?

The pdfFiller mobile applications for iOS and Android are the easiest way to edit documents on the go. You may get them from the Apple Store and Google Play. More info about the applications here. Install and log in to edit IL IL-2848.

How do I fill out the IL IL-2848 form on my smartphone?

Use the pdfFiller mobile app to complete and sign IL IL-2848 on your mobile device. Visit our web page (https://edit-pdf-ios-android.pdffiller.com/) to learn more about our mobile applications, the capabilities you’ll have access to, and the steps to take to get up and running.

Can I edit IL IL-2848 on an iOS device?

Use the pdfFiller mobile app to create, edit, and share IL IL-2848 from your iOS device. Install it from the Apple Store in seconds. You can benefit from a free trial and choose a subscription that suits your needs.

What is IL IL-2848?

IL IL-2848 is a form used in Illinois for Power of Attorney purposes, allowing an individual to authorize another person to act on their behalf regarding tax matters before the Illinois Department of Revenue.

Who is required to file IL IL-2848?

Any individual who wants to appoint someone to represent them or handle their tax affairs with the Illinois Department of Revenue must file the IL IL-2848 form.

How to fill out IL IL-2848?

To fill out IL IL-2848, complete the form by providing the taxpayer's information, the representative's information, and the specific powers granted to the representative. Ensure all necessary signatures are included.

What is the purpose of IL IL-2848?

The purpose of IL IL-2848 is to formally grant authority to a designated individual to act on behalf of the taxpayer in matters related to taxes, ensuring that the representative can receive and respond to communications from the Illinois Department of Revenue.

What information must be reported on IL IL-2848?

The form must report the taxpayer's name, address, Social Security number or tax identification number, the representative's name and address, and the specific powers granted. It also requires signatures from both the taxpayer and the representative.

Fill out your IL IL-2848 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

IL IL-2848 is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.