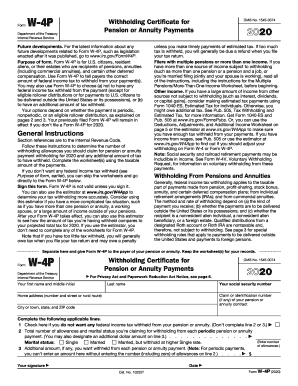

IN W-4P Instructions 2011-2025 free printable template

Get, Create, Make and Sign w4p instructions form

How to edit indiana w4p form online

Uncompromising security for your PDF editing and eSignature needs

How to fill out 4p instructions withholding form

How to fill out IN W-4P Instructions

Who needs IN W-4P Instructions?

Video instructions and help with filling out and completing how to fill out a w4

Instructions and Help about indiana state w4p

Welcome my friends to another edition of the heritage wealth planning YouTube channel today we're gonna talk about the state of Indiana and how that taxes retirees unfortunately I Say kept in the end I went from Illinois directly to Iowa, so I got to come back and get on the Hoosier State so my apologies to you my good friends in Indiana I didn't mean to exclude you, so I want to reach back to you and talk about how you tax retirees so what we do here is we start as we always do with me minimizing myself excuse me and then going to Kip lingers because Kip lingers is my resource go to Greece for most of this stuff and I dive into a couple other websites that you watch me as I go through to show you how Indian attacks retirees and to my chagrin I was stunned to see Indiana in dark blue because according to Kip lingers dark blue is equivalent to being the least tax friendly so let's see what that's about that uh that is actually kind of surprising to me that Indiana would be two of the quin tiles below Illinois if you can believe that my friends, so you got five quin tiles of Quinn tops 20 each Illinois is the middle quin tile Indiana's in the least the lowest quin tile that's a shocking to me so let's talk about what Indiana does here the least tax friendly the Hoosier state promotes itself as a low tax haven, but some retirees may beg to differ remember this video is how states tax retirees state-by-state guide tacked to taxes on retirees well the state does exempt Social Security benefits and offers limited exemption for military pensions and civil service pensions I raised 401 k plans private pensions are fully taxable in addition estate taxes counties and school districts can levy income taxes as well is one of the one of kibbles the least tax friendly states retirees they get a little type of their kit just has a couple typos I see so if you're watching this at a Kipling your editor I do some research here because this is probably the third or fourth type I've seen not a big deal but at the end of the day a typo keep in mind to that counties have the authority to levy their own income taxes on top of the state's flat tax ranging from 02 in Vermilion County 233 Pulaski County alright so let me just say this again for the millionth time because this might be your first and only episode you watch I hope not, but it might be each you cannot just look at the state tax bracket for anything from sales proper income tax you got to look at the big picture because just look at that three point three eight percent in Pulaski County on top of the Amanda state tax as well so if you just look at the state of Indiana so Indiana's good or bad we're going to Pulaski County you're going to be in for a rude awakening state sales taxes seven percent good at night the Hoosier taxes didn't come at a flat rate of three and point two three but counties levy their own income tax, and we talked about what it ranges from well effective income tax rate is three point...

People Also Ask about indiana instructions withholding pension form

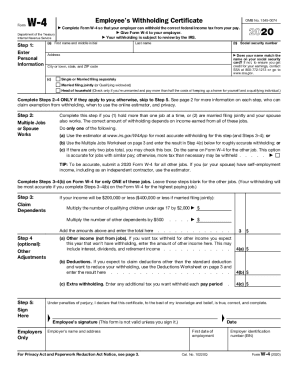

How do I fill out a W-4 withholding certificate?

Is pension income taxable in Indiana?

What is a w4 certificate?

How to fill out a W 4 in Indiana?

What is a w4 withholding certificate for pension or annuity payments?

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I manage my indiana w4p pdf directly from Gmail?

How do I edit indiana form w instructions payments printable online?

How do I edit indiana form w 4p instructions withholding search on an iOS device?

What is IN W-4P Instructions?

Who is required to file IN W-4P Instructions?

How to fill out IN W-4P Instructions?

What is the purpose of IN W-4P Instructions?

What information must be reported on IN W-4P Instructions?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.