IL DoR CPP-1 2010 free printable template

Show details

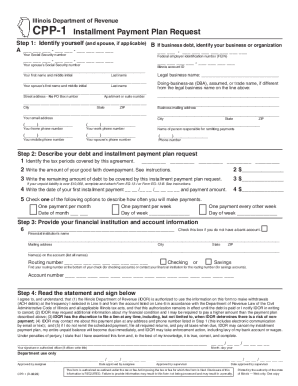

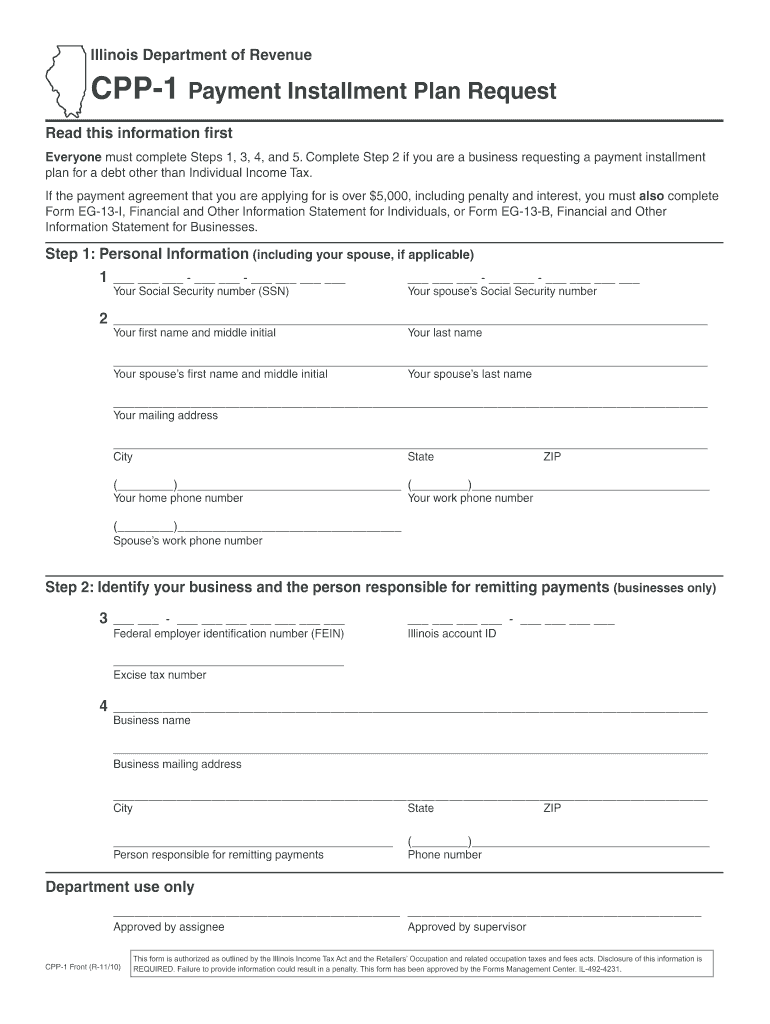

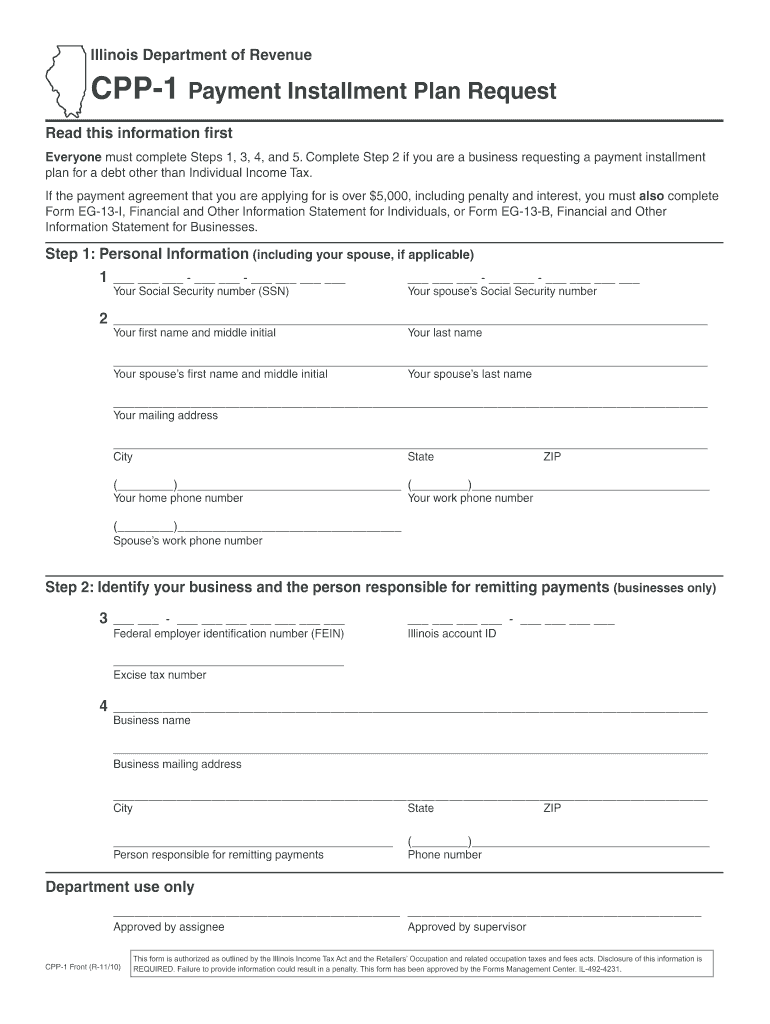

Use your Mouse or Tab key to move through the fields. Illinois Department of Revenue CPP-1 Payment Installment Plan Request Read this information first Everyone must complete Steps 1 3 4 and 5. Complete Step 2 if you are a business requesting a payment installment plan for a debt other than Individual Income Tax. If the payment agreement that you are applying for is over 5 000 including penalty and interest you must also complete Form EG-13-I Financial and Other Information Statement for...

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign IL DoR CPP-1

Edit your IL DoR CPP-1 form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your IL DoR CPP-1 form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit IL DoR CPP-1 online

To use our professional PDF editor, follow these steps:

1

Set up an account. If you are a new user, click Start Free Trial and establish a profile.

2

Upload a document. Select Add New on your Dashboard and transfer a file into the system in one of the following ways: by uploading it from your device or importing from the cloud, web, or internal mail. Then, click Start editing.

3

Edit IL DoR CPP-1. Rearrange and rotate pages, add new and changed texts, add new objects, and use other useful tools. When you're done, click Done. You can use the Documents tab to merge, split, lock, or unlock your files.

4

Save your file. Select it in the list of your records. Then, move the cursor to the right toolbar and choose one of the available exporting methods: save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud.

pdfFiller makes working with documents easier than you could ever imagine. Register for an account and see for yourself!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

IL DoR CPP-1 Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out IL DoR CPP-1

How to fill out IL DoR CPP-1

01

Obtain the IL DoR CPP-1 form from the Illinois Department of Revenue website.

02

Fill in your name and contact information at the top of the form.

03

Provide your tax identification number or Social Security number as required.

04

Indicate the tax year for which you are filing the CPP-1.

05

Complete any sections that apply to your specific circumstances, such as business income or deductions.

06

Review the instructions provided with the form to ensure all required information is included.

07

Sign and date the form at the bottom.

08

Submit the completed form to the Illinois Department of Revenue through the specified method.

Who needs IL DoR CPP-1?

01

Individuals or businesses filing for an Illinois tax credit.

02

Taxpayers who need to report changes in their income or deductions.

03

Anyone seeking to claim adjustments related to previous tax filings.

Fill

form

: Try Risk Free

People Also Ask about

How do I get a payment plan letter from the IRS?

Apply online through the Online Payment Agreement tool or apply by phone or by mail by submitting Form 9465, Installment Agreement Request.

How do I set up a payment plan for Illinois Department of Revenue?

If you have tax delinquencies that you cannot pay in full because of a financial hardship, you can request a payment installment plan using MyTax Illinois. Simply log into your MyTax Illinois account and click the Set up a Payment Installment Plan with IDOR link. Use the Sign up Now!

Can I get a copy of my IRS installment agreement online?

You can view details of your current payment plan (type of agreement, due dates, and amount you need to pay) by logging into the Online Payment Agreement tool using the Apply/Revise button below.

How do I get my IRS payment plan agreement?

Apply online through the Online Payment Agreement tool or apply by phone or by mail by submitting Form 9465, Installment Agreement Request.

How to pay Illinois taxes online?

Pay using: MyTax Illinois. If you have a MyTax Illinois account, click here and log in. Credit Card. Check or money order (follow the payment instructions on the form or voucher associated with your filing) ACH Credit - ACH credit is NOT the preferred payment option for most taxpayers.

Can you do a payment plan for Illinois taxes?

If you have tax delinquencies that you cannot pay in full because of a financial hardship, you can request a payment installment plan using MyTax Illinois. Simply log into your MyTax Illinois account and click the Set up a Payment Installment Plan with IDOR link.

What is cpp1?

CPP-1, Installment Payment Plan Request. Page 1. This form is authorized as outlined under the tax or fee Act imposing the tax or fee for which this form is filed. Disclosure of this information is REQUIRED. Failure to provide information may result in this form not being processed and may result in a penalty.

How to setup a payment plan with the Illinois state taxes?

If you have tax delinquencies that you cannot pay in full because of a financial hardship, you can request a payment installment plan using MyTax Illinois. Simply log into your MyTax Illinois account and click the Set up a Payment Installment Plan with IDOR link. Use the Sign up Now!

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Can I create an electronic signature for the IL DoR CPP-1 in Chrome?

Yes. You can use pdfFiller to sign documents and use all of the features of the PDF editor in one place if you add this solution to Chrome. In order to use the extension, you can draw or write an electronic signature. You can also upload a picture of your handwritten signature. There is no need to worry about how long it takes to sign your IL DoR CPP-1.

Can I create an eSignature for the IL DoR CPP-1 in Gmail?

You can easily create your eSignature with pdfFiller and then eSign your IL DoR CPP-1 directly from your inbox with the help of pdfFiller’s add-on for Gmail. Please note that you must register for an account in order to save your signatures and signed documents.

How can I edit IL DoR CPP-1 on a smartphone?

Using pdfFiller's mobile-native applications for iOS and Android is the simplest method to edit documents on a mobile device. You may get them from the Apple App Store and Google Play, respectively. More information on the apps may be found here. Install the program and log in to begin editing IL DoR CPP-1.

What is IL DoR CPP-1?

IL DoR CPP-1 is a form used by the Illinois Department of Revenue to report certain tax information related to a specific tax program.

Who is required to file IL DoR CPP-1?

Any individual or business that is required to report certain tax information under the Illinois tax regulations must file IL DoR CPP-1.

How to fill out IL DoR CPP-1?

To fill out IL DoR CPP-1, you need to provide accurate financial information, taxpayer identification details, and any required supplementary data as outlined in the form's instructions.

What is the purpose of IL DoR CPP-1?

The purpose of IL DoR CPP-1 is to facilitate compliance with Illinois tax laws by ensuring that the necessary information is reported to the Department of Revenue.

What information must be reported on IL DoR CPP-1?

IL DoR CPP-1 requires the reporting of taxpayer identification, income details, deductions, credits, and any additional information relevant to the tax obligations defined by the form.

Fill out your IL DoR CPP-1 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

IL DoR CPP-1 is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.