IL PTAX-329 2009 free printable template

Show details

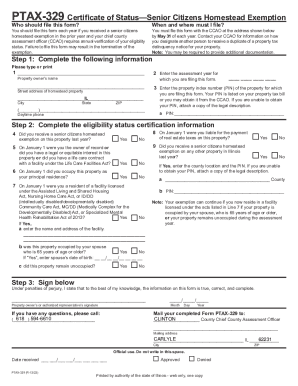

Subscribed and sworn to before me this day Month Day Year Notary public If you have any questions please call Mail your completed Form PTAX-329 to Mailing address Official use. PTAX-329 Certificate of Status Senior Citizens Homestead Exemption Who should file this form When and where must I file homestead exemption in the prior year and your chief county assess- ment officer CCAO requires annual verification of your eligibility status. Do not wri...

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign IL PTAX-329

Edit your IL PTAX-329 form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your IL PTAX-329 form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit IL PTAX-329 online

Use the instructions below to start using our professional PDF editor:

1

Set up an account. If you are a new user, click Start Free Trial and establish a profile.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit IL PTAX-329. Text may be added and replaced, new objects can be included, pages can be rearranged, watermarks and page numbers can be added, and so on. When you're done editing, click Done and then go to the Documents tab to combine, divide, lock, or unlock the file.

4

Get your file. When you find your file in the docs list, click on its name and choose how you want to save it. To get the PDF, you can save it, send an email with it, or move it to the cloud.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

IL PTAX-329 Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out IL PTAX-329

How to fill out IL PTAX-329

01

Begin by downloading the IL PTAX-329 form from the official Illinois Department of Revenue website.

02

Fill out your personal information at the top, including your name, address, and phone number.

03

Indicate the property location and the tax year for which the claim is being made.

04

Provide details about the property, including the property's PIN (Parcel Identification Number) and its assessed value.

05

Complete the income information section, providing necessary documentation to support your claim for the exemption.

06

Review the eligibility requirements for the exemption and check the appropriate boxes indicating your eligibility.

07

Sign and date the form at the bottom.

08

Submit the form to your local assessor's office by the specified deadline.

Who needs IL PTAX-329?

01

Property owners in Illinois who are seeking to apply for a property tax exemption.

Fill

form

: Try Risk Free

People Also Ask about

How do you qualify for homestead exemption in Texas?

To qualify for the general residence homestead exemption an individual must have an ownership interest in the property and use the property as the individual's principal residence. An applicant is required to state that he or she does not claim an exemption on another residence homestead in or outside of Texas.

At what age do you stop paying property taxes in Michigan?

Applicant or spouse of applicant must reach age 65 by December 31 of the tax year.

How much is the senior freeze in Illinois?

Eligible senior citizens automatically receive a reduction of at least $2,000 in the EAV of their homes. Over time, this program may result in taxes changing minimally or sometimes decreasing as surrounding properties continue to rise in assessed value.

How much is the senior tax exemption in Illinois?

Senior Citizens Homestead Exemption The maximum amount of the reduction in equalized assessed value is $8,000 in Cook County and counties contiguous to Cook County or $5,000 in all other counties.

Do you have to apply for homeowners exemption every year Cook County?

Do I have to apply every year? No. Once you apply, the Homeowner Exemption will renew automatically in subsequent years as long as your residency remains the same.

What is the senior property tax freeze in Illinois?

Senior homeowners are eligible for this exemption if they are over 65 years of age and have a total household annual income of $65,000 or less in the 2021 calendar year. A "Senior Freeze" Exemption provides property tax savings by freezing the equalized assessed value (EAV) of an eligible property.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Where do I find IL PTAX-329?

The pdfFiller premium subscription gives you access to a large library of fillable forms (over 25 million fillable templates) that you can download, fill out, print, and sign. In the library, you'll have no problem discovering state-specific IL PTAX-329 and other forms. Find the template you want and tweak it with powerful editing tools.

How do I make edits in IL PTAX-329 without leaving Chrome?

Adding the pdfFiller Google Chrome Extension to your web browser will allow you to start editing IL PTAX-329 and other documents right away when you search for them on a Google page. People who use Chrome can use the service to make changes to their files while they are on the Chrome browser. pdfFiller lets you make fillable documents and make changes to existing PDFs from any internet-connected device.

How do I edit IL PTAX-329 on an iOS device?

Use the pdfFiller mobile app to create, edit, and share IL PTAX-329 from your iOS device. Install it from the Apple Store in seconds. You can benefit from a free trial and choose a subscription that suits your needs.

What is IL PTAX-329?

IL PTAX-329 is a form used in Illinois for reporting the value of property that is rented or leased.

Who is required to file IL PTAX-329?

Property owners or their agents who lease or rent property in Illinois are required to file IL PTAX-329.

How to fill out IL PTAX-329?

To fill out IL PTAX-329, provide necessary property information, such as the property address, owner's details, rental income, and any applicable deductions.

What is the purpose of IL PTAX-329?

The purpose of IL PTAX-329 is to report rental income and other details related to rental properties, which helps in assessing property taxes.

What information must be reported on IL PTAX-329?

IL PTAX-329 must report property address, owner's name and contact information, rental income received, and other financial details relevant to the rental of the property.

Fill out your IL PTAX-329 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

IL PTAX-329 is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.