IL PTAX-329 2015 free printable template

Show details

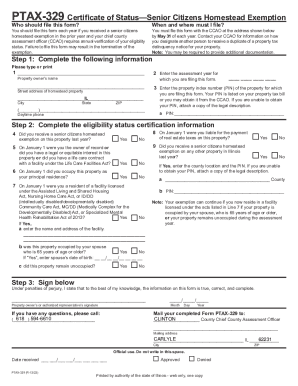

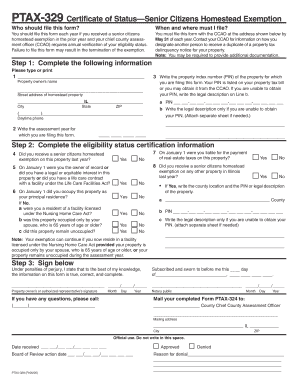

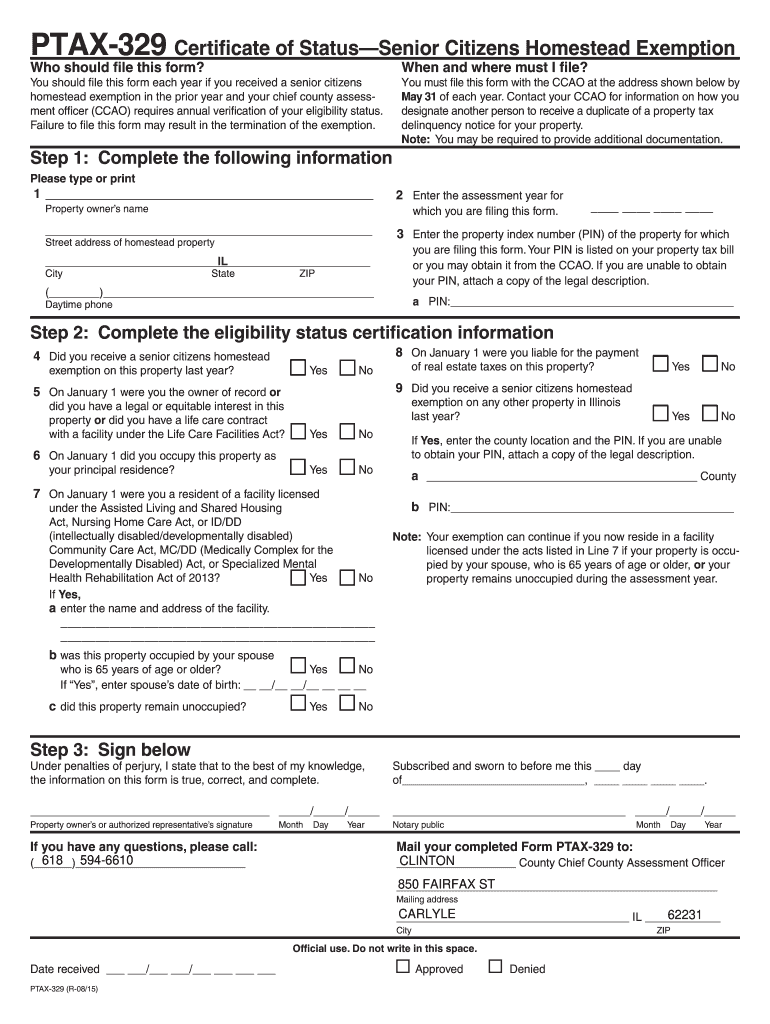

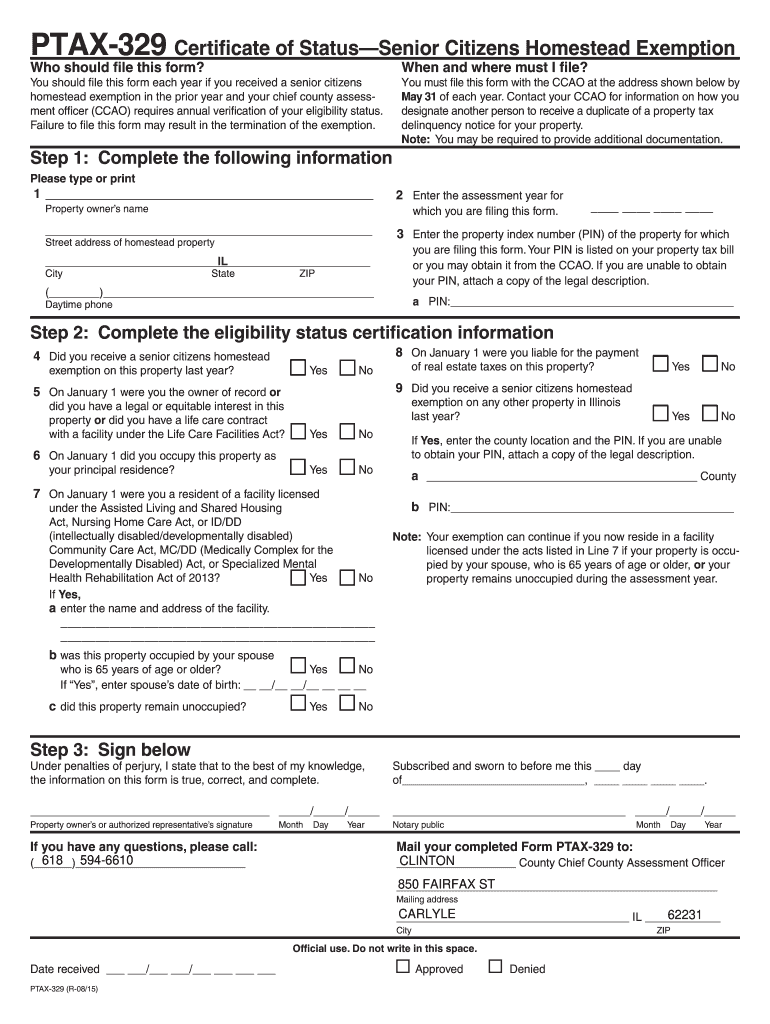

Use your mouse or Tab key to move through the fields. Use your mouse or space bar to enable check boxes.PTAX329 Certificate of Status Senior Citizens Homestead Exemption

Who should file this form?

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign IL PTAX-329

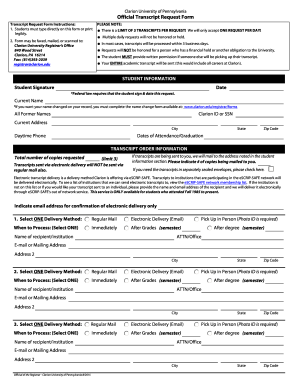

Edit your IL PTAX-329 form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your IL PTAX-329 form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit IL PTAX-329 online

Use the instructions below to start using our professional PDF editor:

1

Register the account. Begin by clicking Start Free Trial and create a profile if you are a new user.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit IL PTAX-329. Replace text, adding objects, rearranging pages, and more. Then select the Documents tab to combine, divide, lock or unlock the file.

4

Save your file. Select it from your list of records. Then, move your cursor to the right toolbar and choose one of the exporting options. You can save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud, among other things.

It's easier to work with documents with pdfFiller than you could have ever thought. You may try it out for yourself by signing up for an account.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

IL PTAX-329 Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out IL PTAX-329

How to fill out IL PTAX-329

01

Obtain the IL PTAX-329 form from the Illinois Department of Revenue website or your local tax office.

02

Fill out the identification section with your name, address, and contact information.

03

Provide the details of the property in question, including the property type, location, and legal description.

04

Indicate the reason for filing the form, such as a claim for exemption or an appeal of assessed value.

05

Complete additional sections related to the specific exemption or appeal you are requesting.

06

Review the form for accuracy and completeness before submission.

07

Sign and date the form.

08

Submit the form to the appropriate local assessment office by the specified deadline.

Who needs IL PTAX-329?

01

Property owners who are applying for property tax exemptions in Illinois.

02

Individuals who wish to appeal the assessed value of their property.

Fill

form

: Try Risk Free

People Also Ask about

Is buying a property a tax deductible expense?

When you buy a property. These can be deducted from the gain (or added to the loss) when you sell the property. You should keep a record of all the costs together with the supporting receipts so that you can claim Capital Gains Tax relief for the expenditure when you sell.

Can you claim property taxes on your tax return in California?

State and local taxes California does allow deductions for your real estate tax and vehicle license fees.

What is the most property tax you can deduct?

Are property taxes deductible? Generally, yes. You may deduct up to $10,000 ($5,000 if married filing separately) for a combination of property taxes and either state and local income taxes or sales taxes.

Are property taxes deductible in Florida?

State and local property taxes are deductible in Florida, regardless of whether they're paid through an escrow account as part of your mortgage payment (this is how most Florida homeowners pay real estate taxes), or paid directly to the taxing authority.

What IRS form do I use for property tax deduction?

To deduct expenses of owning a home, you must file Form 1040, U.S. Individual Income Tax Return, or Form 1040-SR, U.S. Income Tax Return for Seniors, and itemize your deductions on Schedule A (Form 1040). If you itemize, you can't take the standard deduction.

How do I get my property tax statement in California?

You may request a bill via our online payment system or call (951) 955-3900. You may also obtain a bill in person at one of our office locations. Again, it is your responsibility to obtain your annual tax bill.

Are property taxes deductible IRS?

As an individual, your deduction of state and local income, sales, and property taxes is limited to a combined total deduction of $10,000 ($5,000 if married filing separately). You may be subject to a limit on some of your other itemized deductions also.

Does Ohio have a personal property tax?

The tangible personal property tax is paid by two types of taxpayers: inter-county and single-county. An inter-county taxpayer is any business holding tax able tangible personal property in more than one county in Ohio.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I modify my IL PTAX-329 in Gmail?

In your inbox, you may use pdfFiller's add-on for Gmail to generate, modify, fill out, and eSign your IL PTAX-329 and any other papers you receive, all without leaving the program. Install pdfFiller for Gmail from the Google Workspace Marketplace by visiting this link. Take away the need for time-consuming procedures and handle your papers and eSignatures with ease.

How do I execute IL PTAX-329 online?

pdfFiller has made it easy to fill out and sign IL PTAX-329. You can use the solution to change and move PDF content, add fields that can be filled in, and sign the document electronically. Start a free trial of pdfFiller, the best tool for editing and filling in documents.

How do I edit IL PTAX-329 straight from my smartphone?

You can do so easily with pdfFiller’s applications for iOS and Android devices, which can be found at the Apple Store and Google Play Store, respectively. Alternatively, you can get the app on our web page: https://edit-pdf-ios-android.pdffiller.com/. Install the application, log in, and start editing IL PTAX-329 right away.

What is IL PTAX-329?

IL PTAX-329 is a form used in Illinois for reporting the value of certain tax-exempt properties and is part of the property tax assessment process.

Who is required to file IL PTAX-329?

Organizations or individuals who own property that qualifies for tax exemption in Illinois are required to file IL PTAX-329.

How to fill out IL PTAX-329?

To fill out IL PTAX-329, you should provide accurate and complete information about the property, including ownership details, property type, and the reason for the exemption.

What is the purpose of IL PTAX-329?

The purpose of IL PTAX-329 is to provide the local assessing office with information necessary to determine eligibility for property tax exemptions.

What information must be reported on IL PTAX-329?

The information that must be reported on IL PTAX-329 includes the property owner's name, contact information, property address, type of exemption sought, and relevant supporting documentation.

Fill out your IL PTAX-329 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

IL PTAX-329 is not the form you're looking for?Search for another form here.

Relevant keywords

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.