IL PUB-115 2007 free printable template

Show details

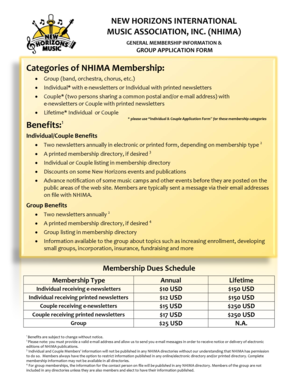

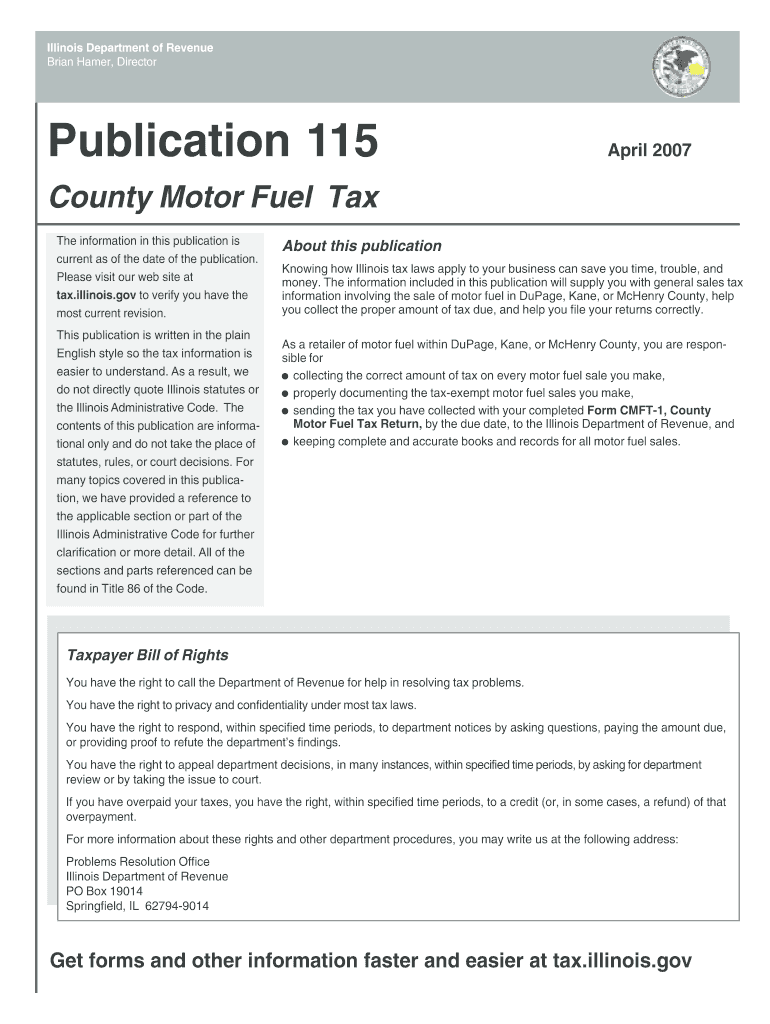

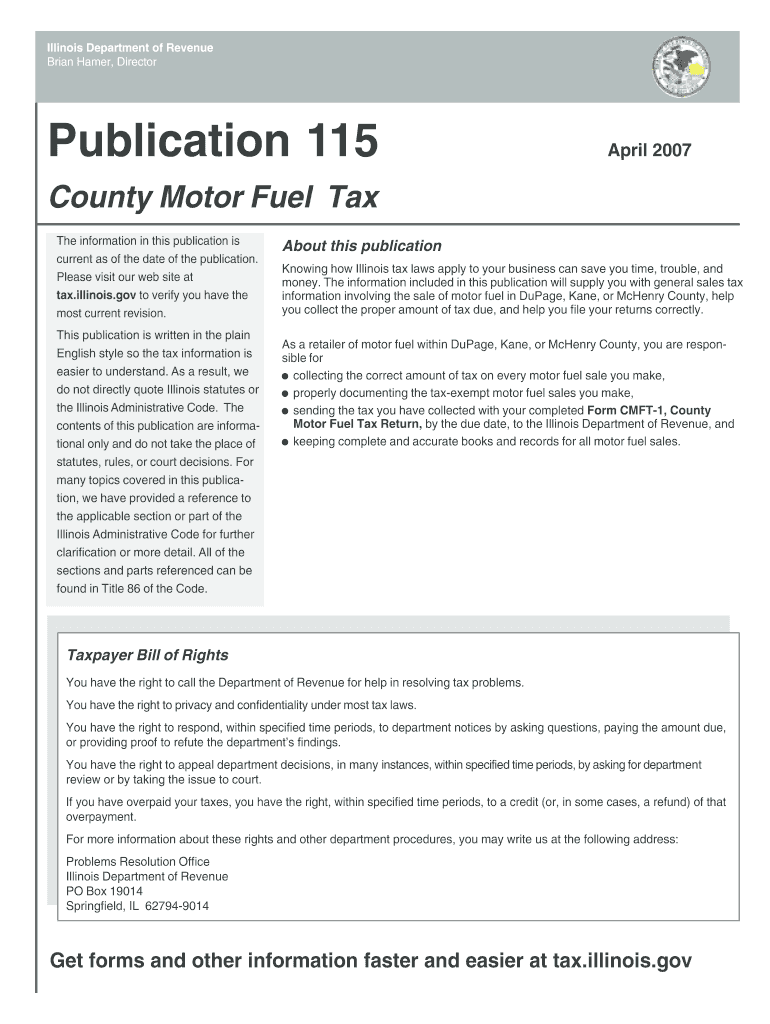

Illinois Department of Revenue Brian Hammer, Director Publication 115 County Motor Fuel Tax The information in this publication is current as of the date of the publication. Please visit our website

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign IL PUB-115

Edit your IL PUB-115 form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your IL PUB-115 form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing IL PUB-115 online

Use the instructions below to start using our professional PDF editor:

1

Register the account. Begin by clicking Start Free Trial and create a profile if you are a new user.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit IL PUB-115. Rearrange and rotate pages, add new and changed texts, add new objects, and use other useful tools. When you're done, click Done. You can use the Documents tab to merge, split, lock, or unlock your files.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

pdfFiller makes dealing with documents a breeze. Create an account to find out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

IL PUB-115 Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out IL PUB-115

How to fill out IL PUB-115

01

Obtain the IL PUB-115 form from the official website or the local tax office.

02

Fill out your personal information in the designated sections, including your name, address, and contact details.

03

Provide information about your income sources and amounts as required.

04

Complete any additional sections that pertain to deductions or credits you may be eligible for.

05

Review your entries for accuracy and completeness.

06

Sign and date the form at the bottom.

07

Submit the form according to the instructions provided, whether by mail or online.

Who needs IL PUB-115?

01

Individuals who are required to report income for tax purposes.

02

Taxpayers seeking to claim deductions or credits.

03

Residents of Illinois who need to comply with state tax regulations.

Fill

form

: Try Risk Free

People Also Ask about

How do I avoid Illinois state tax penalty?

We will waive the late-payment penalty for underpayment of estimated tax if you timely paid the lesser of 100 percent of the prior year's tax liability or 90 percent of the current year's tax liability. If you elect to complete Form IL-2210, this form reflects that waiver.

How long does it take Illinois Department of Revenue to process?

It can take up to two business days from the time the refund is released to be deposited into your account. If you requested a refund via paper check, your refund will be mailed to you. It can take up to 10 business days from the time the refund is released for you to receive your refund in the mail.

How to avoid Illinois tax penalty?

To avoid penalty, your estimated payment options are to pay: four equal installments, or.Individual Income Tax Estimated Payments income tax paid to other states, Illinois Property Tax paid, education expenses, the Earned Income Credit, and. Schedule 1299-C, Income Tax Subtractions and Credits (for individuals).

Why am I getting a letter from the Illinois Department of Revenue?

The Illinois Department of Revenue (IDOR) sends letters and notices to request additional information and support for information you report on your tax return, or to inform you of a change made to your return, balance due or overpayment amount.

What is the Illinois Department of Revenue property tax credit?

What is the Illinois Property Tax Credit? The Illinois Property Tax Credit is a credit on your individual income tax return equal to 5 percent of Illinois Property Tax (real estate tax) you paid on your principal residence. You must own and reside in your residence in order to take this credit.

How do I get out of tax penalties?

COVID Penalty Relief You may qualify for penalty relief if you tried to comply with tax laws but were unable due to circumstances beyond your control. If you received a notice or letter, verify the information is correct. If the information is not correct, follow the instructions in your notice or letter.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I edit IL PUB-115 online?

pdfFiller allows you to edit not only the content of your files, but also the quantity and sequence of the pages. Upload your IL PUB-115 to the editor and make adjustments in a matter of seconds. Text in PDFs may be blacked out, typed in, and erased using the editor. You may also include photos, sticky notes, and text boxes, among other things.

Can I sign the IL PUB-115 electronically in Chrome?

Yes. By adding the solution to your Chrome browser, you may use pdfFiller to eSign documents while also enjoying all of the PDF editor's capabilities in one spot. Create a legally enforceable eSignature by sketching, typing, or uploading a photo of your handwritten signature using the extension. Whatever option you select, you'll be able to eSign your IL PUB-115 in seconds.

How do I complete IL PUB-115 on an Android device?

Complete IL PUB-115 and other documents on your Android device with the pdfFiller app. The software allows you to modify information, eSign, annotate, and share files. You may view your papers from anywhere with an internet connection.

What is IL PUB-115?

IL PUB-115 is a form used by the Illinois Department of Revenue for reporting certain tax information and other relevant details as required by state law.

Who is required to file IL PUB-115?

Individuals or entities that meet specific criteria set by the Illinois Department of Revenue, typically related to tax obligations or reporting standards, are required to file IL PUB-115.

How to fill out IL PUB-115?

To fill out IL PUB-115, you need to gather the necessary information related to your tax situation, follow the provided instructions on the form, and complete all required fields accurately before submitting it to the appropriate Illinois tax authority.

What is the purpose of IL PUB-115?

The purpose of IL PUB-115 is to collect specific tax-related information from taxpayers to ensure compliance with Illinois tax laws and to facilitate accurate reporting and assessment.

What information must be reported on IL PUB-115?

IL PUB-115 requires taxpayers to report information including their identification details, tax payer identification numbers, and any relevant financial data or tax calculations as specified in the form instructions.

Fill out your IL PUB-115 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

IL PUB-115 is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.