IL PUB-115 2022 free printable template

Show details

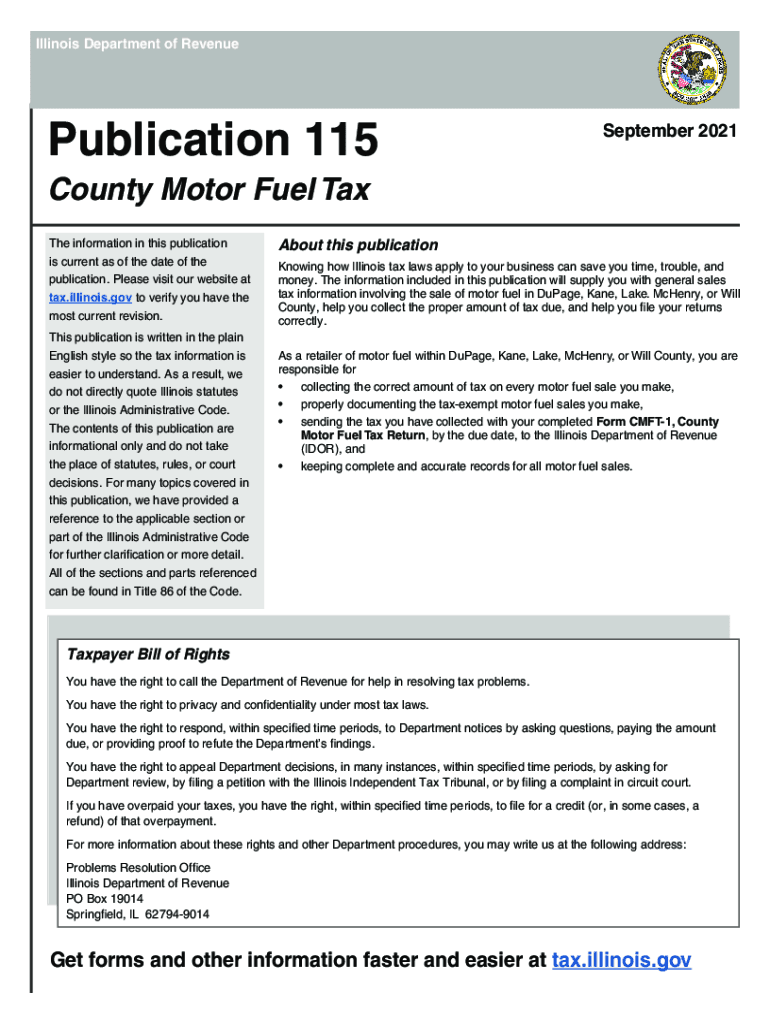

Illinois Department of RevenuePublication 115September 2021County Motor Fuel Tax The information in this publication is current as of the date of the publication. Please visit our website at tax.Illinois.gov

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign illinois pub fuel tax form

Edit your illinois pub motor fuel tax form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your illinois pub fuel blank form via URL. You can also download, print, or export forms to your preferred cloud storage service.

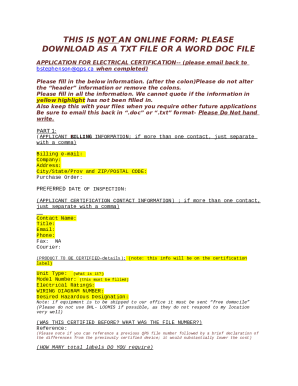

Editing publication 115 pdf online

Follow the steps below to benefit from a competent PDF editor:

1

Check your account. It's time to start your free trial.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit il 115 county fill form. Rearrange and rotate pages, add and edit text, and use additional tools. To save changes and return to your Dashboard, click Done. The Documents tab allows you to merge, divide, lock, or unlock files.

4

Save your file. Choose it from the list of records. Then, shift the pointer to the right toolbar and select one of the several exporting methods: save it in multiple formats, download it as a PDF, email it, or save it to the cloud.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

IL PUB-115 Form Versions

Version

Form Popularity

Fillable & printabley

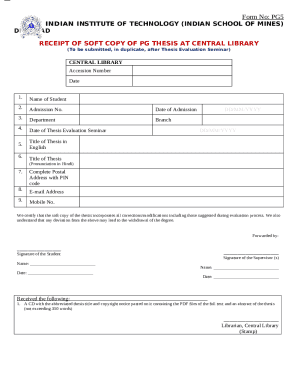

How to fill out 115 motor fuel fill form

How to fill out IL PUB-115

01

Obtain the IL PUB-115 form from the Illinois Department of Revenue's website or your local office.

02

Fill out your personal information including name, address, and contact details at the top of the form.

03

Provide the relevant tax identification numbers as requested on the form.

04

Indicate the specific type of dispute or issue for which you are filing the form in the designated section.

05

Attach any supporting documentation that is required to substantiate your claim or dispute.

06

Review your entries for accuracy and completeness before submission.

07

Sign and date the form at the bottom to certify the information provided.

08

Submit the completed form to the appropriate office as instructed in the guidelines.

Who needs IL PUB-115?

01

Individuals or businesses in Illinois that have a dispute with the Illinois Department of Revenue regarding tax matters.

02

Taxpayers seeking to contest tax assessments or file grievances related to tax obligations.

03

Those who need to formally notify the Department of Revenue about tax-related issues requiring resolution.

Fill

pub fuel tax

: Try Risk Free

People Also Ask about illinois pub motor tax

How do I avoid Illinois state tax penalty?

We will waive the late-payment penalty for underpayment of estimated tax if you timely paid the lesser of 100 percent of the prior year's tax liability or 90 percent of the current year's tax liability. If you elect to complete Form IL-2210, this form reflects that waiver.

How long does it take Illinois Department of Revenue to process?

It can take up to two business days from the time the refund is released to be deposited into your account. If you requested a refund via paper check, your refund will be mailed to you. It can take up to 10 business days from the time the refund is released for you to receive your refund in the mail.

How to avoid Illinois tax penalty?

To avoid penalty, your estimated payment options are to pay: four equal installments, or.Individual Income Tax Estimated Payments income tax paid to other states, Illinois Property Tax paid, education expenses, the Earned Income Credit, and. Schedule 1299-C, Income Tax Subtractions and Credits (for individuals).

Why am I getting a letter from the Illinois Department of Revenue?

The Illinois Department of Revenue (IDOR) sends letters and notices to request additional information and support for information you report on your tax return, or to inform you of a change made to your return, balance due or overpayment amount.

What is the Illinois Department of Revenue property tax credit?

What is the Illinois Property Tax Credit? The Illinois Property Tax Credit is a credit on your individual income tax return equal to 5 percent of Illinois Property Tax (real estate tax) you paid on your principal residence. You must own and reside in your residence in order to take this credit.

How do I get out of tax penalties?

COVID Penalty Relief You may qualify for penalty relief if you tried to comply with tax laws but were unable due to circumstances beyond your control. If you received a notice or letter, verify the information is correct. If the information is not correct, follow the instructions in your notice or letter.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I complete il county motor fuel tax online?

Completing and signing il pub motor fuel tax online is easy with pdfFiller. It enables you to edit original PDF content, highlight, blackout, erase and type text anywhere on a page, legally eSign your form, and much more. Create your free account and manage professional documents on the web.

How do I edit il 115 county tax blank in Chrome?

Get and add pdfFiller Google Chrome Extension to your browser to edit, fill out and eSign your illinois 115 fuel tax download, which you can open in the editor directly from a Google search page in just one click. Execute your fillable documents from any internet-connected device without leaving Chrome.

How do I complete publication motor fuel on an Android device?

Use the pdfFiller mobile app to complete your illinois publication motor fuel tax on an Android device. The application makes it possible to perform all needed document management manipulations, like adding, editing, and removing text, signing, annotating, and more. All you need is your smartphone and an internet connection.

What is IL PUB-115?

IL PUB-115 is a form used by certain entities in Illinois to report specific financial information to the state.

Who is required to file IL PUB-115?

Entities that meet specific criteria set by the Illinois Department of Revenue are required to file IL PUB-115.

How to fill out IL PUB-115?

To fill out IL PUB-115, one must provide accurate financial data as per the form’s instructions, ensuring all required fields are completed.

What is the purpose of IL PUB-115?

The purpose of IL PUB-115 is to ensure compliance with state reporting requirements and to provide the state with necessary financial data.

What information must be reported on IL PUB-115?

IL PUB-115 requires reporting of financial metrics such as income, expenses, and other relevant data as specified in the form instructions.

Fill out your IL PUB-115 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Illinois 115 County Tax Edit is not the form you're looking for?Search for another form here.

Keywords relevant to il 115 county tax online

Related to publication 115

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.