MA NHR 2010 free printable template

Show details

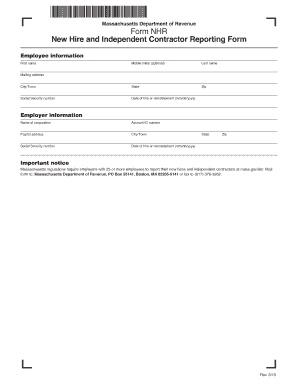

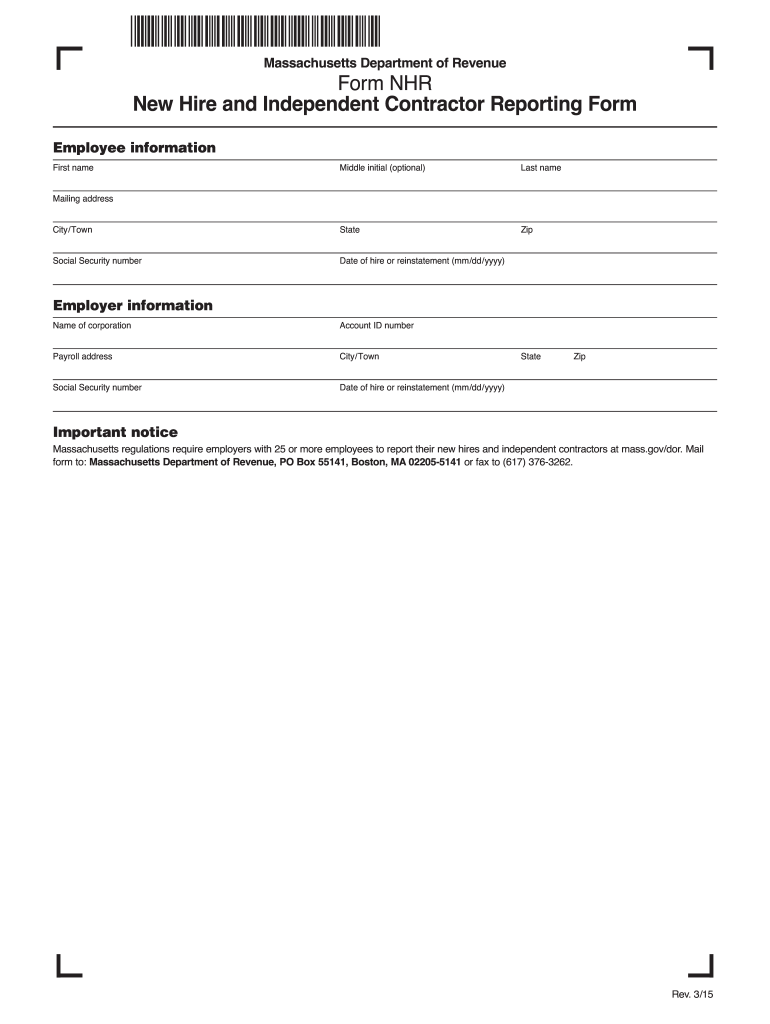

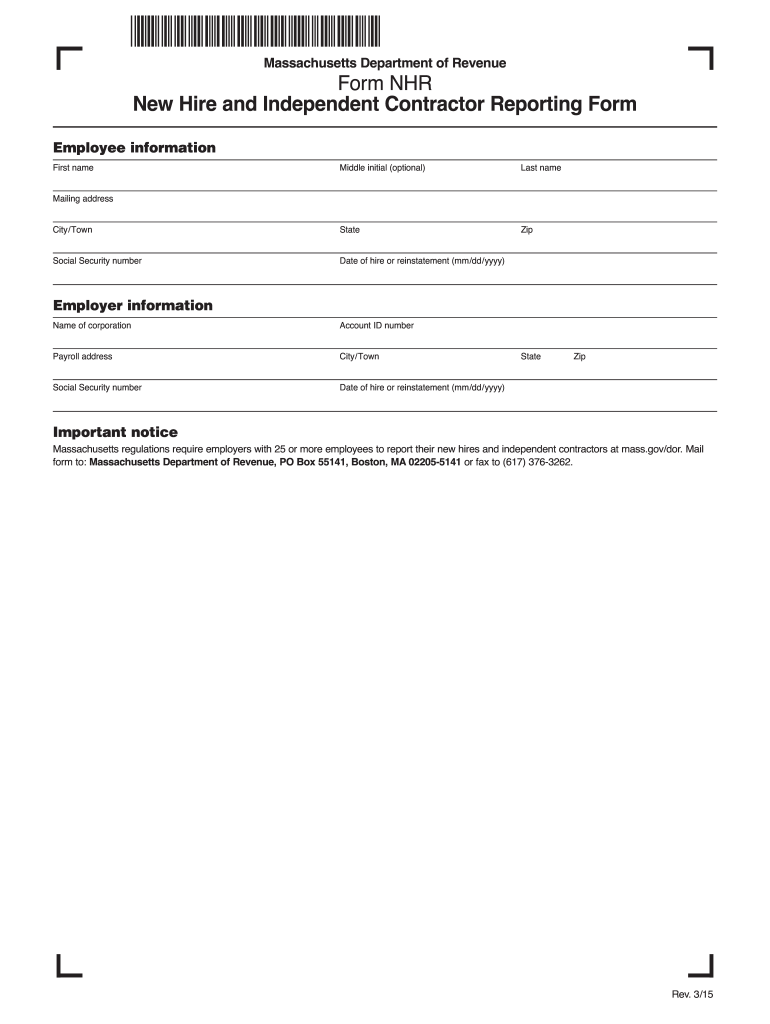

Form NHR New Hire and Independent Contractor Reporting Form Rev. 01/2010 Massachusetts Department of Revenue TO ENSURE ACCURACY PRINT OR TYPE NEATLY IN UPPER-CASE LETTERS AND NUMBERS USING A DARK BALLPOINT PEN. Employee Information FIRST NAME MI LAST NAME SOCIAL SECURITY NUMBER DATE OF HIRE OR REINSTATEMENT - / ADDRESS CITY/TOWN STATE ZIP 4 OPTIONAL IT S THE LAW - Massachusetts regulations require employers with 25 or more employees to report the...

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign MA NHR

Edit your MA NHR form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your MA NHR form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit MA NHR online

To use our professional PDF editor, follow these steps:

1

Log in. Click Start Free Trial and create a profile if necessary.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit MA NHR. Rearrange and rotate pages, insert new and alter existing texts, add new objects, and take advantage of other helpful tools. Click Done to apply changes and return to your Dashboard. Go to the Documents tab to access merging, splitting, locking, or unlocking functions.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

pdfFiller makes working with documents easier than you could ever imagine. Create an account to find out for yourself how it works!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

MA NHR Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out MA NHR

How to fill out MA NHR

01

Gather all required personal information and documents.

02

Visit the official Massachusetts Non-Resident State Income Tax form webpage.

03

Download the MA NHR form (Form 1-NR or Form 1-NR/PY).

04

Complete the form by filling out your personal details, income information, and deductions.

05

Attach any necessary schedules and documentation to support your claims.

06

Review the completed form for accuracy.

07

Sign and date the form.

08

Submit the form either electronically or by mail to the appropriate state tax office.

Who needs MA NHR?

01

Non-residents who earned income in Massachusetts.

02

Part-year residents who need to report Massachusetts income.

03

Individuals who are not full-time residents but have tax obligations in Massachusetts.

Fill

form

: Try Risk Free

People Also Ask about

What forms do new employees need to fill out in Massachusetts?

Forms and notices for newly-hired employees Form I-9 Employment eligibility verification form, US Dept. of Homeland Security. Form M-4: Massachusetts employee's withholding exemption certificate, Mass. Dept. Form NHR: New hire and independent contractor reporting form, Mass. Dept. Form W2 Federal tax withholding, IRS.

What forms employees fill out?

Papers required for hiring paperwork W-4 (or W-9) form. The W-4 form tells employers how much money the employee wants to withhold from their pay for the correct federal tax income. I-9 form. State tax withholding form. Direct deposit form. Internal forms. Personal data for emergencies form.

How long does new hire paperwork take?

Employers are required by law to report all newly hired or rehired employees to the New Employee Registry (NER) within 20 days of their start-of-work date.

How do I report a new hire in MA?

How to report Online + If you have 25 or more employees, you must file your new hire reports online through MassTaxConnect. By mail + If you have fewer than 25 employees, you can use the New Hire Reporting Form (Form NHR) to submit your new hire reports by mail. By fax +

Does new hire paperwork mean I got the job?

In most companies, beginning the onboarding program for a new employee means that the job has been filled. The employee can rest easy, knowing they've likely attained a long-term position where they can grow professionally. However, it's important to read the new hire paperwork.

Do you get paid for filling out new hire paperwork?

Most onboarding processes are required tasks that take place during the business day. These activities prepare new hires to become full-fledged workers. This being the case, yes, employers are required to pay new employees during new hire orientation and onboarding.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Can I create an electronic signature for signing my MA NHR in Gmail?

Create your eSignature using pdfFiller and then eSign your MA NHR immediately from your email with pdfFiller's Gmail add-on. To keep your signatures and signed papers, you must create an account.

How do I fill out MA NHR using my mobile device?

Use the pdfFiller mobile app to complete and sign MA NHR on your mobile device. Visit our web page (https://edit-pdf-ios-android.pdffiller.com/) to learn more about our mobile applications, the capabilities you’ll have access to, and the steps to take to get up and running.

How do I edit MA NHR on an iOS device?

You certainly can. You can quickly edit, distribute, and sign MA NHR on your iOS device with the pdfFiller mobile app. Purchase it from the Apple Store and install it in seconds. The program is free, but in order to purchase a subscription or activate a free trial, you must first establish an account.

What is MA NHR?

MA NHR refers to the Massachusetts Non-Resident Tax Return, which is filed by individuals who earn income in Massachusetts but are not residents of the state.

Who is required to file MA NHR?

Individuals who earn income from sources within Massachusetts but are not residents of the state are required to file the MA NHR.

How to fill out MA NHR?

To fill out the MA NHR, taxpayers must complete the appropriate tax forms, providing their personal information, income earned in Massachusetts, deductions, and credits, as applicable.

What is the purpose of MA NHR?

The purpose of the MA NHR is to ensure that individuals who earn income in Massachusetts pay the appropriate state taxes, even if they do not reside there.

What information must be reported on MA NHR?

The MA NHR requires reporting of personal identification information, all income earned in Massachusetts, credits, deductions, and other relevant financial information.

Fill out your MA NHR online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

MA NHR is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.