MA NHR 2015-2025 free printable template

Show details

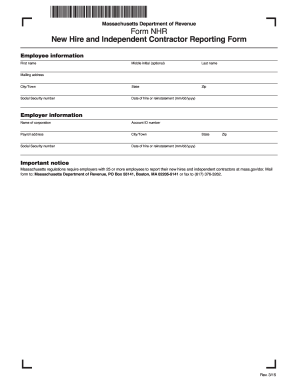

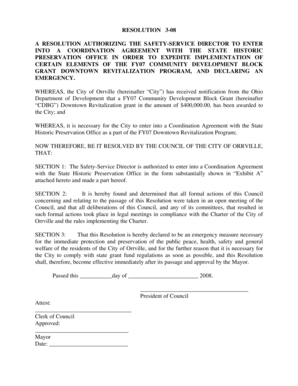

Massachusetts Department of Revenue Form NHR New Hire and Independent Contractor Reporting Form Employee information First name Middle initial optional Last name City/Town State Zip Social Security number Date of hire or reinstatement mm/dd/yyyy Mailing address Name of corporation Account ID number Payroll address Important notice form to Massachusetts Department of Revenue PO Box 55141 Boston MA 02205-5141 or fax to 617 376-3262.

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign MA NHR

Edit your MA NHR form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your MA NHR form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing MA NHR online

Follow the guidelines below to use a professional PDF editor:

1

Check your account. In case you're new, it's time to start your free trial.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit MA NHR. Rearrange and rotate pages, add and edit text, and use additional tools. To save changes and return to your Dashboard, click Done. The Documents tab allows you to merge, divide, lock, or unlock files.

4

Get your file. When you find your file in the docs list, click on its name and choose how you want to save it. To get the PDF, you can save it, send an email with it, or move it to the cloud.

pdfFiller makes working with documents easier than you could ever imagine. Register for an account and see for yourself!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

MA NHR Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out MA NHR

How to fill out MA NHR

01

Gather necessary personal information, including Social Security number, address, and financial details.

02

Obtain the MA NHR form from the official state website or local tax office.

03

Fill out the applicant's details, ensuring accuracy in the identification sections.

04

Provide information regarding your income sources, including wages, pensions, and investments.

05

Indicate any applicable deductions or credits you are eligible for on the form.

06

Review the completed form for errors or omissions.

07

Submit the MA NHR form by the specified deadline, either electronically or via mail.

Who needs MA NHR?

01

Individuals who are residents of Massachusetts for tax purposes.

02

Those who have moved to Massachusetts but retain tax obligations in another state.

03

People looking to claim a non-resident status while filing their taxes in Massachusetts.

04

Individuals who have significant income from sources outside Massachusetts.

Fill

form

: Try Risk Free

People Also Ask about

How do I report a new hire in MA?

How to report Online + If you have 25 or more employees, you must file your new hire reports online through MassTaxConnect. By mail + If you have fewer than 25 employees, you can use the New Hire Reporting Form (Form NHR) to submit your new hire reports by mail. By fax +

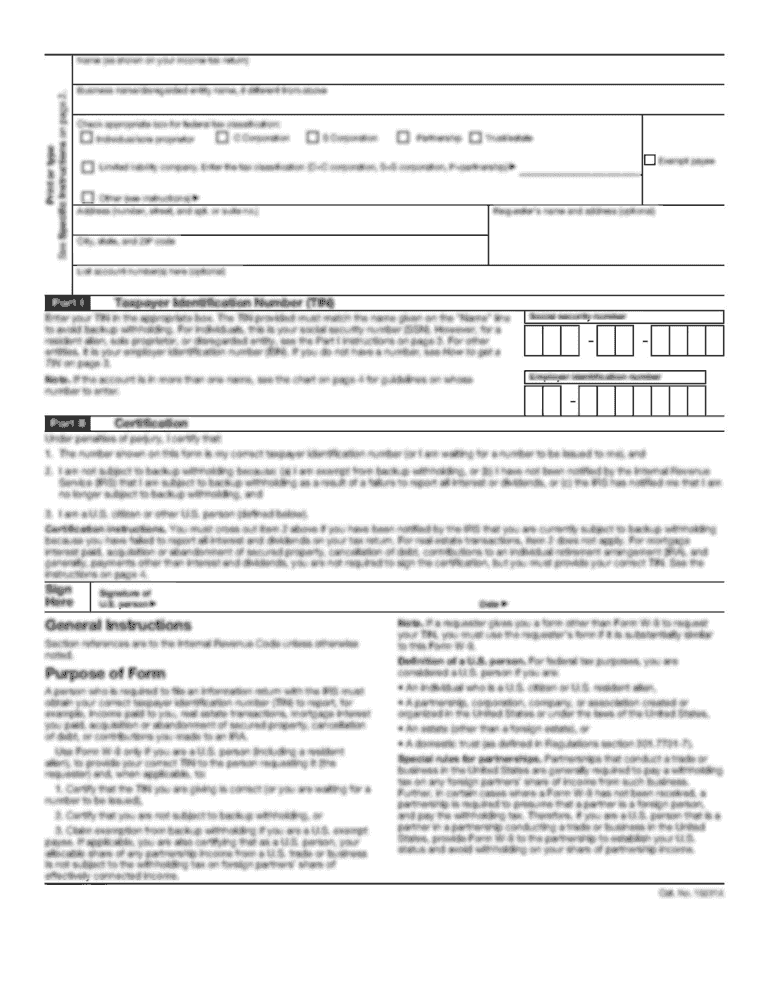

What form do you fill out when you first get hired?

When you start a new job, your employer will ask you to provide information on Form W-4, Employee's Withholding CertificatePDF. This will help your employer determine how much money to withhold from your wages.

What forms do I need for new employee Massachusetts?

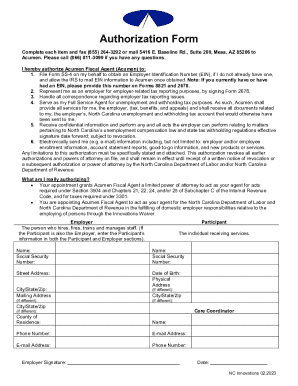

Forms and notices for newly-hired employees Form I-9 Employment eligibility verification form, US Dept. of Homeland Security. Form M-4: Massachusetts employee's withholding exemption certificate, Mass. Dept. Form NHR: New hire and independent contractor reporting form, Mass. Dept. Form W2 Federal tax withholding, IRS.

What forms do I need to hire someone?

Make sure you and new hires complete employment forms required by law. W-4 form (or W-9 for contractors) I-9 Employment Eligibility Verification form. State Tax Withholding form. Direct Deposit form. E-Verify system: This is not a form, but a way to verify employee eligibility in the U.S.

What is the form of new employee?

Form W-4 (Employee's Withholding Certificate) The IRS requires employees to complete a Form W-4 when they start a new job. The form includes instructions for completion, and there is also an online tax withholding estimator they can use for increased accuracy.

What form do you fill out as a new hire?

Ask all new employees to give you a signed Form W-4 when they start work. Make the form effective with the first wage payment. If employees claim exemption from income tax withholding, then they must indicate this on their W-4.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I edit MA NHR from Google Drive?

Simplify your document workflows and create fillable forms right in Google Drive by integrating pdfFiller with Google Docs. The integration will allow you to create, modify, and eSign documents, including MA NHR, without leaving Google Drive. Add pdfFiller’s functionalities to Google Drive and manage your paperwork more efficiently on any internet-connected device.

How can I send MA NHR to be eSigned by others?

When your MA NHR is finished, send it to recipients securely and gather eSignatures with pdfFiller. You may email, text, fax, mail, or notarize a PDF straight from your account. Create an account today to test it.

How do I edit MA NHR on an Android device?

You can make any changes to PDF files, such as MA NHR, with the help of the pdfFiller mobile app for Android. Edit, sign, and send documents right from your mobile device. Install the app and streamline your document management wherever you are.

What is MA NHR?

MA NHR stands for Massachusetts Non-Resident Income Tax Return, which is a form that non-residents use to report income earned in Massachusetts.

Who is required to file MA NHR?

Non-residents who earn income from Massachusetts sources, such as wages, rental income, or business income, are required to file the MA NHR.

How to fill out MA NHR?

To fill out the MA NHR, non-residents need to gather their income information from Massachusetts sources, complete the form accurately with personal and financial details, and submit it to the Massachusetts Department of Revenue.

What is the purpose of MA NHR?

The purpose of the MA NHR is to ensure that non-resident individuals pay taxes on the income they earn within the state of Massachusetts.

What information must be reported on MA NHR?

On the MA NHR, individuals must report their personal information, types of income earned in Massachusetts, any deductions or credits applicable, and calculate their tax liability accordingly.

Fill out your MA NHR online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

MA NHR is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.