Get the free 2003 Schedule CG Combined Group Schedule

Show details

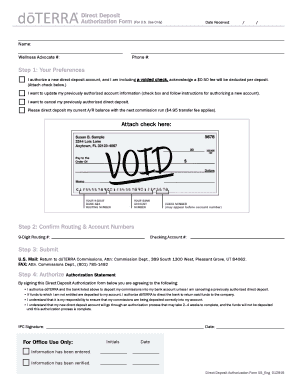

This document is a tax schedule used for reporting total tax due and estimated payments for a combined group of corporations.

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign 2003 schedule cg combined

Edit your 2003 schedule cg combined form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your 2003 schedule cg combined form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing 2003 schedule cg combined online

Here are the steps you need to follow to get started with our professional PDF editor:

1

Check your account. It's time to start your free trial.

2

Upload a document. Select Add New on your Dashboard and transfer a file into the system in one of the following ways: by uploading it from your device or importing from the cloud, web, or internal mail. Then, click Start editing.

3

Edit 2003 schedule cg combined. Text may be added and replaced, new objects can be included, pages can be rearranged, watermarks and page numbers can be added, and so on. When you're done editing, click Done and then go to the Documents tab to combine, divide, lock, or unlock the file.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

pdfFiller makes dealing with documents a breeze. Create an account to find out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out 2003 schedule cg combined

How to fill out 2003 Schedule CG Combined Group Schedule

01

Begin by gathering all necessary financial documents for the combined group.

02

Complete the top section with the group name, employer identification number (EIN), and tax year.

03

List each member of the combined group in the designated section, including their names and EINs.

04

Enter the total income, deductions, and tax credits for each member based on their individual tax returns.

05

Calculate the combined group totals by summing the amounts from all members.

06

Review the worksheet for any additional adjustments required for the combined group.

07

Finalize the schedule by signing and dating it, along with the authorized officer's signature.

Who needs 2003 Schedule CG Combined Group Schedule?

01

Businesses that operate as a combined group for tax purposes.

02

Corporations that are required to file consolidated returns.

03

Tax professionals preparing returns for companies in a combined group.

Fill

form

: Try Risk Free

People Also Ask about

What is Schedule C worksheet?

Use Schedule C (Form 1040) to report income or loss from a business you operated or a profession you practiced as a sole proprietor. An activity qualifies as a business if: Your primary purpose for engaging in the activity is for income or profit.

What is line 5a on tax return?

Line 5a is a manual numeric entry, in the middle column area, for your total Pensions and Annuities. Line 5b is a manual numeric entry in the column. It also has an associated dropdown menu to the left of the column. Enter your taxable Pensions and Annuities in the right column (5b).

Which items are filed on Schedule 3?

The nonrefundable credits on Schedule 3 include: Foreign Tax Credit. Child and Dependent Care Credit. Education credits. Retirement Savings Contribution Credit. residential energy credits.

What is the 5a on Schedule A?

Taxes You Paid (Lines 5-7) Line 5a of this section will ask you to choose between deducting one of two things: a) state and local income taxes, or b) general sales taxes. Line 5b lets you deduct any real estate taxes you paid this year (local or state), as long as they satisfy the following conditions:

What is the Part III of Schedule C?

Part III: Cost of Goods Sold The cost of goods sold (COGS) section of a Schedule C form reports the cost of materials and direct labor used to produce the goods you sold during the year. This is important because the COGS figure is subtracted from your gross receipts to determine your gross profit.

How many parts does Schedule C have?

The Schedule C tax form has five parts. If certain sections/lines don't apply to your business, you can skip them.

What is 5a amount?

PAYG income tax instalment – 5A The amount of your PAYG instalment for the period is shown at 5A (PAYG income tax instalment). If you are lodging a paper statement, you will need to fill in this field. Enter the amount from either: T7 (instalment amount)

What are Schedules 1 2 and 3?

Schedule 1 for additional income and "above the line" deductions. Schedule 2 for additional taxes. Schedule 3 for additional credits and payments.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is 2003 Schedule CG Combined Group Schedule?

The 2003 Schedule CG Combined Group Schedule is a tax form used by corporations to report the income, deductions, and other tax-related information for a combined group of corporations that file as a single entity for state tax purposes.

Who is required to file 2003 Schedule CG Combined Group Schedule?

Corporations that are part of a combined group and choose to file as a single entity for state tax purposes are required to file the 2003 Schedule CG Combined Group Schedule.

How to fill out 2003 Schedule CG Combined Group Schedule?

To fill out the 2003 Schedule CG Combined Group Schedule, gather all relevant financial information for each corporation in the group, complete the designated sections of the form with consolidated data, and ensure that all members’ information and calculations are accurate before submission.

What is the purpose of 2003 Schedule CG Combined Group Schedule?

The purpose of the 2003 Schedule CG Combined Group Schedule is to provide a comprehensive view of the financial activities and tax obligations of a combined group of corporations, facilitating the tax assessment process for state tax authorities.

What information must be reported on 2003 Schedule CG Combined Group Schedule?

The information that must be reported on the 2003 Schedule CG Combined Group Schedule includes combined income, deductions, credits, and other relevant financial data from all member corporations within the combined group.

Fill out your 2003 schedule cg combined online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

2003 Schedule Cg Combined is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.