Get the free Audit Information Document - osc nc

Show details

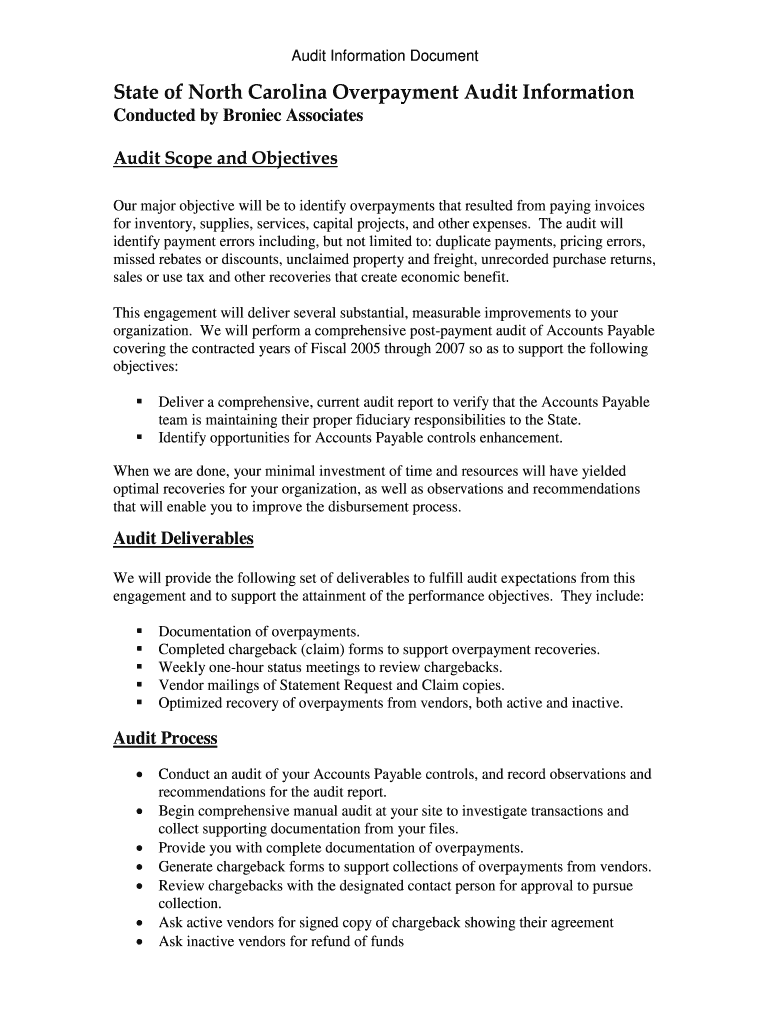

This document provides information regarding an audit conducted by Broniec Associates to identify overpayments made by North Carolina state agencies to vendors, detailing the audit process, objectives,

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign audit information document

Edit your audit information document form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your audit information document form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit audit information document online

Follow the steps below to benefit from the PDF editor's expertise:

1

Check your account. It's time to start your free trial.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit audit information document. Rearrange and rotate pages, insert new and alter existing texts, add new objects, and take advantage of other helpful tools. Click Done to apply changes and return to your Dashboard. Go to the Documents tab to access merging, splitting, locking, or unlocking functions.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

With pdfFiller, dealing with documents is always straightforward.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out audit information document

How to fill out Audit Information Document

01

Start with the title: Write 'Audit Information Document' at the top.

02

Include a section for the audit period: Specify the start and end dates of the audit.

03

Provide organization details: Include the name, address, and contact information of the organization being audited.

04

Detail the purpose of the audit: Explain why the audit is being conducted.

05

List the auditors: Include names and qualifications of the auditors responsible for the audit.

06

Outline the audit scope: Specify what areas or departments will be audited.

07

Collect relevant documentation: Ensure all required financial and operational documents are gathered.

08

Include a timeline: Provide key dates for submissions and audit schedules.

09

Specify any required signatures: Include sections for authorized personnel to sign.

10

Review for completeness: Ensure all sections are filled and correct before submission.

Who needs Audit Information Document?

01

Organizations undergoing an audit: They need the document to guide the audit process.

02

Auditors: They require the document to collect necessary information and records.

03

Regulatory bodies: They may need the document to ensure compliance with laws and regulations.

04

Stakeholders: Such as investors or board members, who may need insights into the audit findings.

05

Internal departments: Such as finance and compliance teams, for ensuring procedural adherence.

Fill

form

: Try Risk Free

People Also Ask about

What is an example of an audit document?

Examples of audit documentation include memoranda, confirmations, correspondence, schedules, audit programs, and letters of representation. Audit documentation may be in the form of paper, electronic files, or other media. 5.

What is an example of audit information?

The auditing evidence is meant to support the company's claims made in the financial statements and their adherence to the accounting laws of their legal jurisdiction. Examples of auditing evidence include bank accounts, management accounts, payrolls, bank statements, invoices, and receipts.

What is an audit report in English?

An audit report is a formal document that communicates an auditor's opinion (or probably your opinion, if you're reading this) on an organization's financial performance and concludes whether it complies with financial reporting regulations.

What is an example of audit information?

The auditing evidence is meant to support the company's claims made in the financial statements and their adherence to the accounting laws of their legal jurisdiction. Examples of auditing evidence include bank accounts, management accounts, payrolls, bank statements, invoices, and receipts.

What is an IDR from the IRS?

The Information Document Request (IDR) that your auditor sends you explains what items on your tax return the IRS is examining and has a list of documents you will need to provide to prove the items in question.

What is audit information in English?

Definition: Audit is the examination or inspection of various books of accounts by an auditor followed by physical checking of inventory to make sure that all departments are following documented system of recording transactions. It is done to ascertain the accuracy of financial statements provided by the organisation.

What do you mean by information audit?

A commonly accepted definition of the concept information audit, is the one developed by the Information Resources Network: "An information audit is a systematic examination of information use, resources and flows, for the verification by reference, with people and existing documents, in order to establish the extent

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is Audit Information Document?

The Audit Information Document (AID) is a formal report that provides essential details required by regulatory authorities to ensure compliance with auditing standards and regulations.

Who is required to file Audit Information Document?

Entities that undergo an audit, including corporations, partnerships, and other organizations that meet specific criteria set by regulatory bodies, are required to file the Audit Information Document.

How to fill out Audit Information Document?

To fill out the Audit Information Document, one must gather relevant financial data, follow the prescribed format from regulatory authorities, and ensure that all sections are populated accurately, including basic information about the entity and details from the audit report.

What is the purpose of Audit Information Document?

The purpose of the Audit Information Document is to provide a concise summary of the audit findings and related financial information to ensure transparency, facilitate regulatory review, and maintain compliance with applicable laws.

What information must be reported on Audit Information Document?

The Audit Information Document must report information such as the entity's financial performance, the auditor's findings, compliance with accounting standards, weaknesses in internal controls, and any significant risks identified during the audit process.

Fill out your audit information document online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Audit Information Document is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.