Get the free Federal PLUS Loan Application and Master Promissory Note (MPN)

Show details

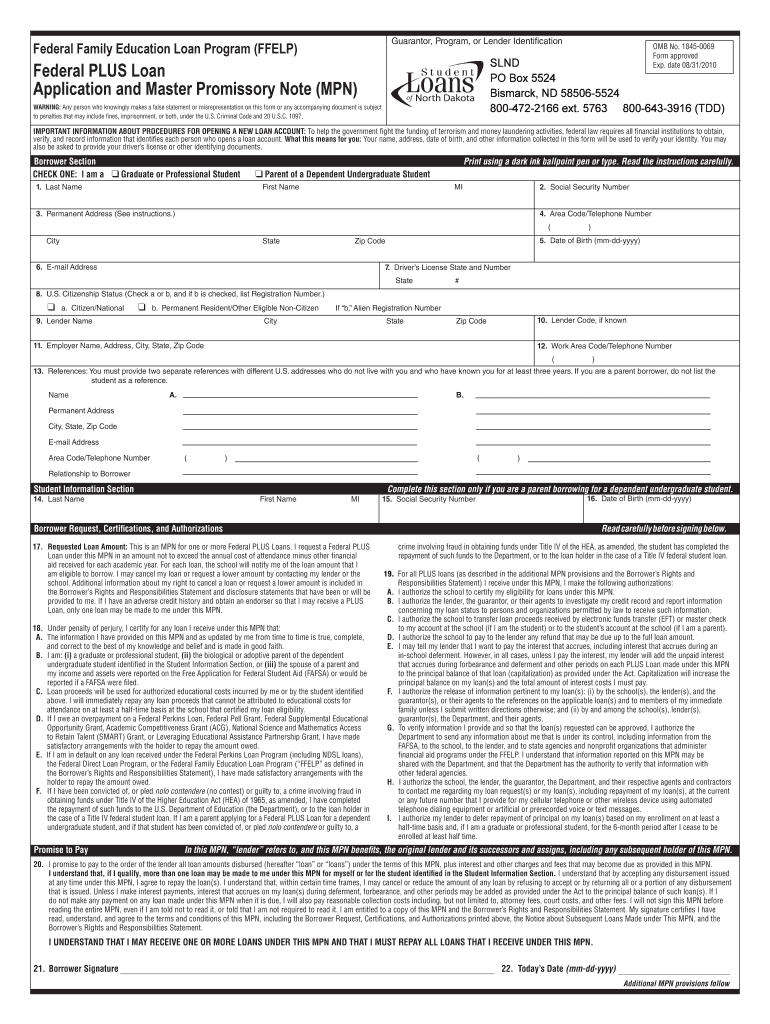

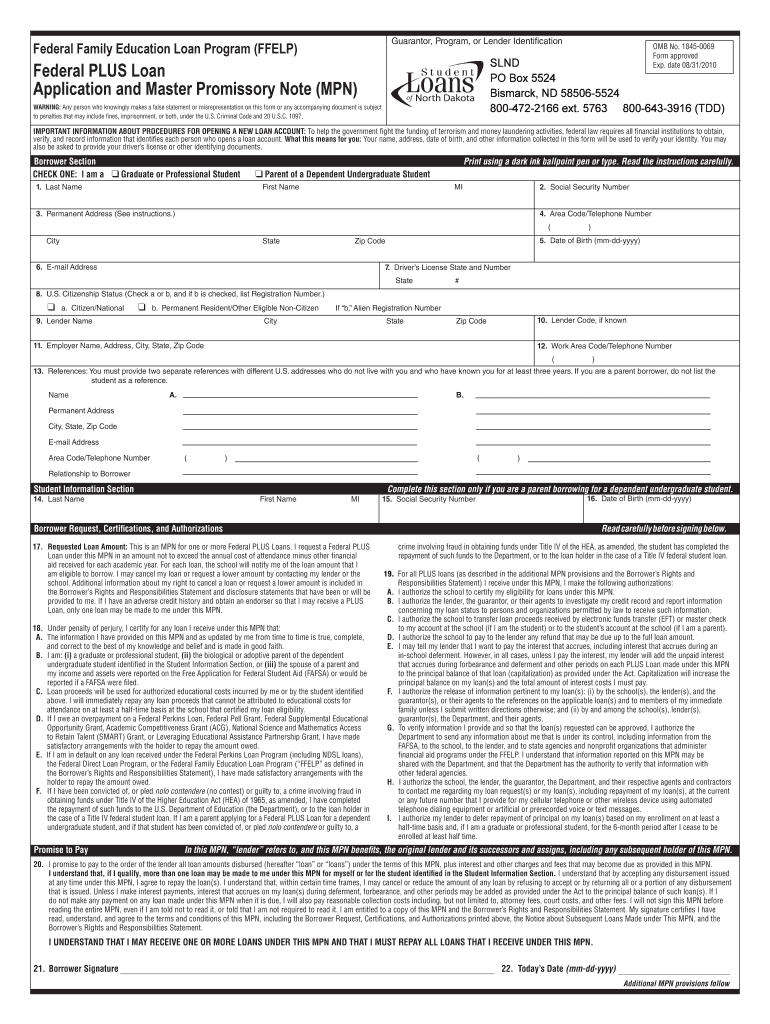

This document serves as an application and promissory note for the Federal PLUS Loan, allowing graduate or professional students and parents of dependent undergraduate students to borrow funds for

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign federal plus loan application

Edit your federal plus loan application form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your federal plus loan application form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing federal plus loan application online

Here are the steps you need to follow to get started with our professional PDF editor:

1

Register the account. Begin by clicking Start Free Trial and create a profile if you are a new user.

2

Upload a file. Select Add New on your Dashboard and upload a file from your device or import it from the cloud, online, or internal mail. Then click Edit.

3

Edit federal plus loan application. Replace text, adding objects, rearranging pages, and more. Then select the Documents tab to combine, divide, lock or unlock the file.

4

Get your file. When you find your file in the docs list, click on its name and choose how you want to save it. To get the PDF, you can save it, send an email with it, or move it to the cloud.

With pdfFiller, dealing with documents is always straightforward.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out federal plus loan application

How to fill out Federal PLUS Loan Application and Master Promissory Note (MPN)

01

Gather required information: Collect your personal information, including your Social Security number, driver's license number, financial information, and school information.

02

Access the application: Visit the official Federal Student Aid website to access the Federal PLUS Loan Application.

03

Complete the application: Fill out the application with the required details, ensuring accuracy and completeness.

04

Submit the application: Review the information and submit the application electronically.

05

Receive a credit decision: Wait for a credit decision from the Department of Education.

06

Complete the Master Promissory Note (MPN): If approved, access the MPN through the Federal Student Aid website.

07

Fill out the MPN: Provide required information, including your references and borrower's signature.

08

Sign and submit the MPN: Review the terms and conditions and submit the MPN electronically.

Who needs Federal PLUS Loan Application and Master Promissory Note (MPN)?

01

Students and parents of dependent students who need to borrow additional funds to pay for college-related expenses.

02

Graduate or professional students who are financing their education through federal loans.

Fill

form

: Try Risk Free

People Also Ask about

Does signing the MPN mean you are accepting the loan?

What happens if I don't complete this? If you accept loans on your package and do not complete the MPN, you will not be able to move through your registration checklist and the aid will not disburse until it has been finished.

When taking out student loans What is the signed agreement?

A Master Promissory Note, or MPN, is a legal document that outlines the terms and conditions of your federal student loans. Promissory notes are used for all types of loans, like auto loans, mortgages, and personal loans, though an MPN is a special type of promissory note used exclusively for federal student loans.

How long does it take for MPN to process?

How long does it take for an MPN to process? After you submit your MPN to the US Department of Education, the government will then get in touch with your school's financial aid office to let them know that it's been completed. This process normally takes between 3 and 5 working days.

Does signing an MPN mean anything?

The Master Promissory Note (MPN) is a legal document in which you promise to repay your loan(s) and any accrued interest and fees to the U.S. Department of Education. It also explains the terms and conditions of your loan(s).

Does a promissory note mean you got the loan?

A promissory note is a legally binding document in which the borrower agrees to repay the loan and any accrued interest and fees. The document also explains the terms and conditions of the loan. A signed, valid promissory note must be signed before loan funds can be disbursed.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is Federal PLUS Loan Application and Master Promissory Note (MPN)?

The Federal PLUS Loan Application is a form that parents of dependent undergraduate students can fill out to apply for a Federal Direct PLUS Loan. The Master Promissory Note (MPN) is a legal document in which the borrower agrees to the terms and conditions of the loan and promises to repay it.

Who is required to file Federal PLUS Loan Application and Master Promissory Note (MPN)?

Parents of dependent undergraduate students who wish to borrow a Federal Direct PLUS Loan are required to file the Federal PLUS Loan Application and complete the Master Promissory Note (MPN).

How to fill out Federal PLUS Loan Application and Master Promissory Note (MPN)?

To fill out the Federal PLUS Loan Application, parents can complete it online at the Federal Student Aid website. The Master Promissory Note (MPN) is also completed online as part of the application process, where borrowers provide necessary information and agree to the loan terms.

What is the purpose of Federal PLUS Loan Application and Master Promissory Note (MPN)?

The purpose of the Federal PLUS Loan Application is to assess eligibility for the loan, while the Master Promissory Note (MPN) establishes a legal agreement to repay the borrowed funds under the terms set by the federal government.

What information must be reported on Federal PLUS Loan Application and Master Promissory Note (MPN)?

On the Federal PLUS Loan Application, parents must report information such as their Social Security number, driver's license number, income information, and details about the student. The MPN requires personal information, the loan amount requested, and acknowledgment of the loan's terms.

Fill out your federal plus loan application online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Federal Plus Loan Application is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.