NY TC 403 HA 2009 free printable template

Show details

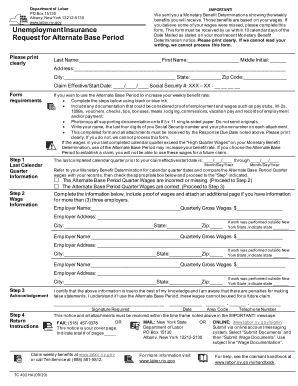

I understand if I use the Alternate Base Period these wages cannot be used for a future claim. Signature Required Date Area Code Telephone Number This notice and all attachments must be received within the timeframe noted above in the IMPORTANT message. FAX 518-457-9378 OR MAIL New York State Department of Labor This notice is your cover page. Indicate total of pages Albany NY 12212-5130 Claim your weekly benefits on the web or by calling Tel-Ser...

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign NY TC 403 HA

Edit your NY TC 403 HA form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your NY TC 403 HA form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit NY TC 403 HA online

To use our professional PDF editor, follow these steps:

1

Set up an account. If you are a new user, click Start Free Trial and establish a profile.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit NY TC 403 HA. Rearrange and rotate pages, insert new and alter existing texts, add new objects, and take advantage of other helpful tools. Click Done to apply changes and return to your Dashboard. Go to the Documents tab to access merging, splitting, locking, or unlocking functions.

4

Save your file. Select it in the list of your records. Then, move the cursor to the right toolbar and choose one of the available exporting methods: save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud.

pdfFiller makes dealing with documents a breeze. Create an account to find out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

NY TC 403 HA Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out NY TC 403 HA

How to fill out NY TC 403 HA

01

Begin with your personal information at the top of the form, including your name, address, and social security number.

02

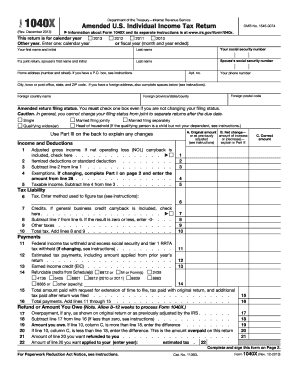

Indicate the tax year for which you are filing the form.

03

Enter the details of your income on the appropriate lines, ensuring all figures are accurate.

04

Deduct any applicable credits or expenses that qualify.

05

Review the instructions carefully for any additional documentation you might need to attach.

06

Complete any required sections regarding tax payments or overpayments.

07

Sign and date the form before submitting it to the appropriate tax authority.

Who needs NY TC 403 HA?

01

NY TC 403 HA is needed by individuals who are seeking a refund of their New York State personal income tax due to a claim for a disability exemption or other qualifying circumstances.

02

It is generally utilized by residents who have experienced changes in their tax situation that warrant adjustments or refunds.

Fill

form

: Try Risk Free

People Also Ask about

How do you find the alternate base period?

The Alternate Base Period is the last four completed calendar quarters prior to the beginning date of the claim.

What is alternate base period EDD California?

The Alternate Base Period is the LAST four completed calendar quarters prior to the beginning date of the claim.

What is the alternate base period for NYS unemployment?

The Alternate Base Period is the last four completed calendar quarters before the quarter in which you file for benefits. IMPORTANT: If you have enough wages in your Basic Base Period, we do not automatically check to see if your benefit rate would be higher if your Alternate Base Period is used instead.

What does alternate base period mean for EDD?

The Alternate Base Period (ABP) program requires the Employment Development Department (EDD) to use more recently earned wages to calculate monetary eligibility for new Unemployment Insurance (UI) claims for unemployed individuals who do not qualify for a UI claim using the Standard Base Period.

What is the alternate base period affidavit in Maryland?

What is alternate base period affidavit Maryland? The Alternate Base Period is the four most recently-completed calendar quarters prior to the date you first applied for UI benefits.

What is alternate base period notification Massachusetts unemployment?

The alternate base period is the last 3 completed calendar quarters and the period of time between the last completed quarter and the effective date of your claim. The alternate base period can only be used if: You don't meet the minimum eligibility requirements using the primary base period.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I fill out the NY TC 403 HA form on my smartphone?

Use the pdfFiller mobile app to fill out and sign NY TC 403 HA on your phone or tablet. Visit our website to learn more about our mobile apps, how they work, and how to get started.

How do I edit NY TC 403 HA on an Android device?

You can make any changes to PDF files, such as NY TC 403 HA, with the help of the pdfFiller mobile app for Android. Edit, sign, and send documents right from your mobile device. Install the app and streamline your document management wherever you are.

How do I fill out NY TC 403 HA on an Android device?

Use the pdfFiller app for Android to finish your NY TC 403 HA. The application lets you do all the things you need to do with documents, like add, edit, and remove text, sign, annotate, and more. There is nothing else you need except your smartphone and an internet connection to do this.

What is NY TC 403 HA?

NY TC 403 HA is a tax credit application form used in New York for claiming benefits related to the Empire State Film Production Tax Credit program.

Who is required to file NY TC 403 HA?

Producers or production companies engaged in qualifying film and television productions in New York State are required to file NY TC 403 HA.

How to fill out NY TC 403 HA?

To fill out NY TC 403 HA, complete the required sections detailing the production, budget, expenses, and any other relevant information as specified in the instructions for the form.

What is the purpose of NY TC 403 HA?

The purpose of NY TC 403 HA is to apply for tax credits that incentivize film and television production in New York, encouraging economic growth and job creation in the industry.

What information must be reported on NY TC 403 HA?

Information that must be reported on NY TC 403 HA includes production details, financing information, budget breakdown, expenses incurred, and any other relevant documentation required by the New York State tax authorities.

Fill out your NY TC 403 HA online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

NY TC 403 HA is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.