NY TC 403 HA 2015 free printable template

Show details

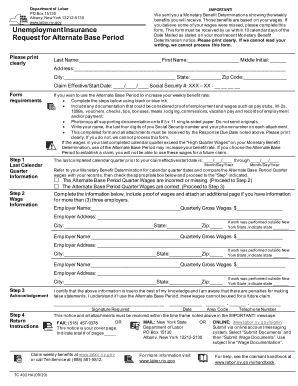

NEW YORK STATE DEPARTMENT OF LABOR P. O. Box 15130 ALBANY, NY 122125130 IMPORTANT! This form must be received within ten calendar days from the Date Mailed of your last Monetary Benefit Determination.

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign NY TC 403 HA

Edit your NY TC 403 HA form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your NY TC 403 HA form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit NY TC 403 HA online

To use our professional PDF editor, follow these steps:

1

Log in to account. Start Free Trial and register a profile if you don't have one yet.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit NY TC 403 HA. Rearrange and rotate pages, add new and changed texts, add new objects, and use other useful tools. When you're done, click Done. You can use the Documents tab to merge, split, lock, or unlock your files.

4

Get your file. Select the name of your file in the docs list and choose your preferred exporting method. You can download it as a PDF, save it in another format, send it by email, or transfer it to the cloud.

pdfFiller makes dealing with documents a breeze. Create an account to find out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

NY TC 403 HA Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out NY TC 403 HA

How to fill out NY TC 403 HA

01

Obtain the NY TC 403 HA form from the New York State Department of Taxation and Finance website or your local tax office.

02

Read the instructions carefully to understand the purpose of the form and the required information.

03

Provide your personal information, including your name, address, and Social Security number.

04

Indicate the tax year for which you are filing the form.

05

Fill out the section regarding the type of credit or exemption you are applying for.

06

If necessary, include any supporting documentation required for your claim.

07

Double-check the information for accuracy and completeness.

08

Sign and date the form before submitting it to the appropriate tax authority.

Who needs NY TC 403 HA?

01

Individuals who have a property tax exemption or credit claim to file.

02

Homeowners who qualify for specific tax relief programs.

03

Taxpayers needing to report changes in their eligibility for tax exemptions.

Fill

form

: Try Risk Free

People Also Ask about

How do you find the base period?

The Standard Base Period is the first four of the last five completed calendar quarters prior to the beginning date of the UI claim.

How do you find the alternate base period?

The Alternate Base Period is the last four completed calendar quarters prior to the beginning date of the claim.

What does alternate base period mean for EDD?

The Alternate Base Period (ABP) program requires the Employment Development Department (EDD) to use more recently earned wages to calculate monetary eligibility for new Unemployment Insurance (UI) claims for unemployed individuals who do not qualify for a UI claim using the Standard Base Period.

What is alternate base period for EDD?

The Alternate Base Period (ABP) program requires the Employment Development Department (EDD) to use more recently earned wages to calculate monetary eligibility for new Unemployment Insurance (UI) claims for unemployed individuals who do not qualify for a UI claim using the Standard Base Period.

What is alternate base period notification Massachusetts unemployment?

The alternate base period is the last 3 completed calendar quarters and the period of time between the last completed quarter and the effective date of your claim. The alternate base period can only be used if: You don't meet the minimum eligibility requirements using the primary base period.

What does alternate base year mean?

An alternate base year uses the four most recently completed quarters. A calendar quarter is a three-month period ending March 31, June 30, Sept. 30, or Dec. 31.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I complete NY TC 403 HA online?

pdfFiller has made filling out and eSigning NY TC 403 HA easy. The solution is equipped with a set of features that enable you to edit and rearrange PDF content, add fillable fields, and eSign the document. Start a free trial to explore all the capabilities of pdfFiller, the ultimate document editing solution.

Can I create an eSignature for the NY TC 403 HA in Gmail?

You can easily create your eSignature with pdfFiller and then eSign your NY TC 403 HA directly from your inbox with the help of pdfFiller’s add-on for Gmail. Please note that you must register for an account in order to save your signatures and signed documents.

How do I fill out NY TC 403 HA on an Android device?

Use the pdfFiller mobile app and complete your NY TC 403 HA and other documents on your Android device. The app provides you with all essential document management features, such as editing content, eSigning, annotating, sharing files, etc. You will have access to your documents at any time, as long as there is an internet connection.

What is NY TC 403 HA?

NY TC 403 HA is a form used in New York to report the details of the New York City tax credit program for certain residential properties.

Who is required to file NY TC 403 HA?

Property owners or entities claiming tax credits under the New York City tax incentive programs are required to file NY TC 403 HA.

How to fill out NY TC 403 HA?

To fill out NY TC 403 HA, follow the instructions provided on the form, ensuring all required fields are completed accurately, including details about the property and the tax credit claim.

What is the purpose of NY TC 403 HA?

The purpose of NY TC 403 HA is to formalize and document claims for tax credits within the framework of New York City's housing tax incentive programs.

What information must be reported on NY TC 403 HA?

The information that must be reported on NY TC 403 HA includes the property address, owner's information, type of tax credit being claimed, and relevant financial details related to the property.

Fill out your NY TC 403 HA online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

NY TC 403 HA is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.