Get the free IT-203-C - tax ny

Show details

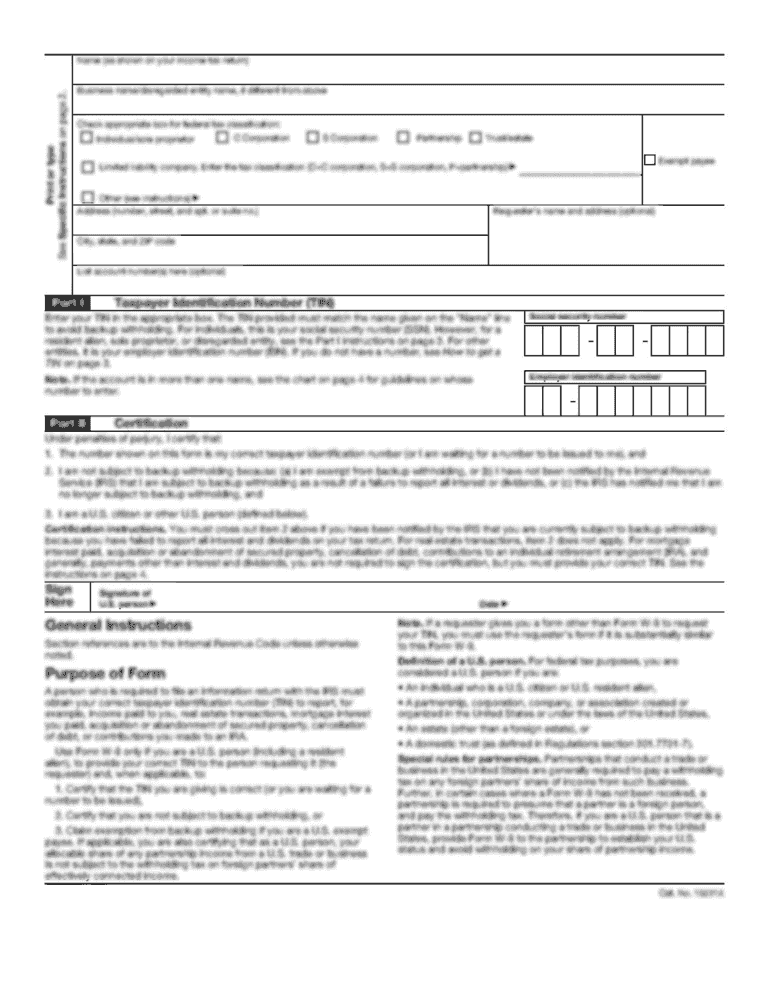

This form is used by nonresident or part-year resident married taxpayers filing a joint New York State tax return to certify that only one spouse has New York source income.

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign it-203-c - tax ny

Edit your it-203-c - tax ny form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your it-203-c - tax ny form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit it-203-c - tax ny online

To use our professional PDF editor, follow these steps:

1

Create an account. Begin by choosing Start Free Trial and, if you are a new user, establish a profile.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit it-203-c - tax ny. Rearrange and rotate pages, add and edit text, and use additional tools. To save changes and return to your Dashboard, click Done. The Documents tab allows you to merge, divide, lock, or unlock files.

4

Save your file. Select it in the list of your records. Then, move the cursor to the right toolbar and choose one of the available exporting methods: save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud.

It's easier to work with documents with pdfFiller than you could have believed. You may try it out for yourself by signing up for an account.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out it-203-c - tax ny

How to fill out IT-203-C

01

Obtain the IT-203-C form from the New York State Department of Taxation and Finance website.

02

Fill out the personal information section with your name, Social Security number, and address.

03

Indicate your filing status (e.g., single, married filing jointly, etc.).

04

Report your total income on the appropriate lines based on the instructions provided.

05

Complete the adjustments section if applicable, including deductions and credits.

06

Calculate your taxable income and apply the correct tax rates using the provided tables.

07

Review the form for accuracy and make sure all sections are completed.

08

Sign and date the form before submitting it.

Who needs IT-203-C?

01

Residents of New York who earned income while living in the state.

02

Individuals who have to file a personal income tax return for New York State.

03

Taxpayers who meet the eligibility criteria for the IT-203-C form, usually related to partial year residency.

Fill

form

: Try Risk Free

People Also Ask about

What is form IT-203 on my tax return?

NY Form IT-203 is a New York State income tax return for nonresidents and part-year residents. It is used to report income earned in New York State by individuals who are not considered to be full-year residents of the state.

Do I have to pay NYC city tax?

As a resident, you pay state tax (and city tax if a New York City or Yonkers resident) on all your income no matter where it is earned. As a nonresident, you only pay tax on New York source income, which includes earnings from work performed in New York State, and income from real property located in the state.

How to avoid NYC city tax?

Establish Residency Outside of NYC The most straightforward way to avoid NYC city tax is by ensuring you are not considered a resident of the city. NYC residents are subject to local income tax, which can range from 3.078% to 3.876%. To avoid NYC city tax, you must establish residency outside of the city.

What is NY IT-203 C?

Spouse's Certification IT-203-C. (12/24) To be filed with Form IT-203, Nonresident and Part-Year Resident Income Tax Return, by married taxpayers filing a joint return when only one spouse has New York source income (see Form IT-203 instructions and page 2 of this form for additional information).

What is the difference between IT-203 and IT 201?

If one of you was a New York State resident and the other was a nonresident or part-year resident, you must each file a separate New York return. The resident must use Form IT-201. The nonresident or part-year resident, if required to file a New York State return, must use Form IT-203.

Where to live to avoid New York City taxes?

As a New Jersey resident, you are also exempt, in most cases, from paying New York City income tax.

What is the 183 rule in New York City?

The 183-day rule is used to determine whether you are considered a resident for state income tax purposes. If you spend 183 days or more in the state during a calendar year, you will typically be deemed a resident and will be required to pay New York State income taxes on your worldwide income.

How to get tax exempt in NYC?

To claim exemption from New York State and City withholding taxes, you must certify the following conditions in writing: You must be under age 18, or over age 65, or a full-time student under age 25 and. You did not have a New York income tax liability for the previous year; and.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is IT-203-C?

IT-203-C is a New York State income tax form specifically designed for non-residents and part-year residents to calculate their income tax liability.

Who is required to file IT-203-C?

Individuals who are non-residents or part-year residents of New York State and earned income in New York during the tax year are required to file IT-203-C.

How to fill out IT-203-C?

To fill out IT-203-C, gather your income documentation, complete the personal information section, report your New York source income, compute your tax liability, and finalize the form by signing and dating it.

What is the purpose of IT-203-C?

The purpose of IT-203-C is to allow non-residents and part-year residents to report their New York income and calculate their tax owed to the state.

What information must be reported on IT-203-C?

On IT-203-C, filers must report personal details, income earned in New York, exemptions, deductions, credits, and any tax paid or refundable amounts.

Fill out your it-203-c - tax ny online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

It-203-C - Tax Ny is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.