Get the free Claim for Environmental Remediation Insurance Credit - tax ny

Show details

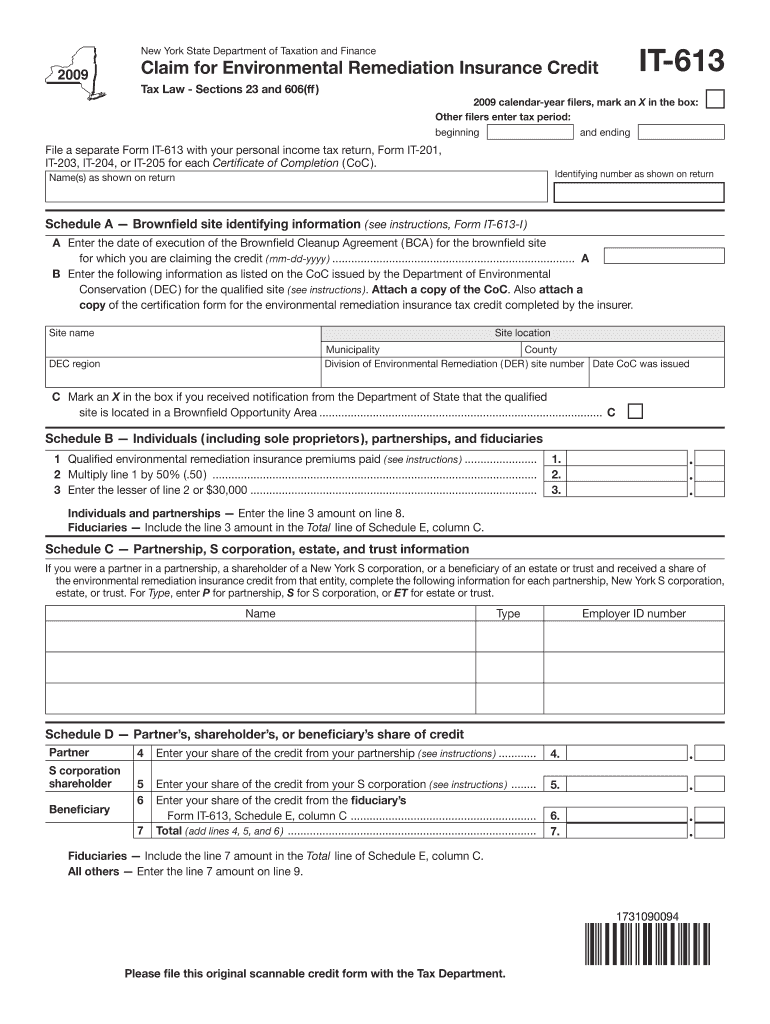

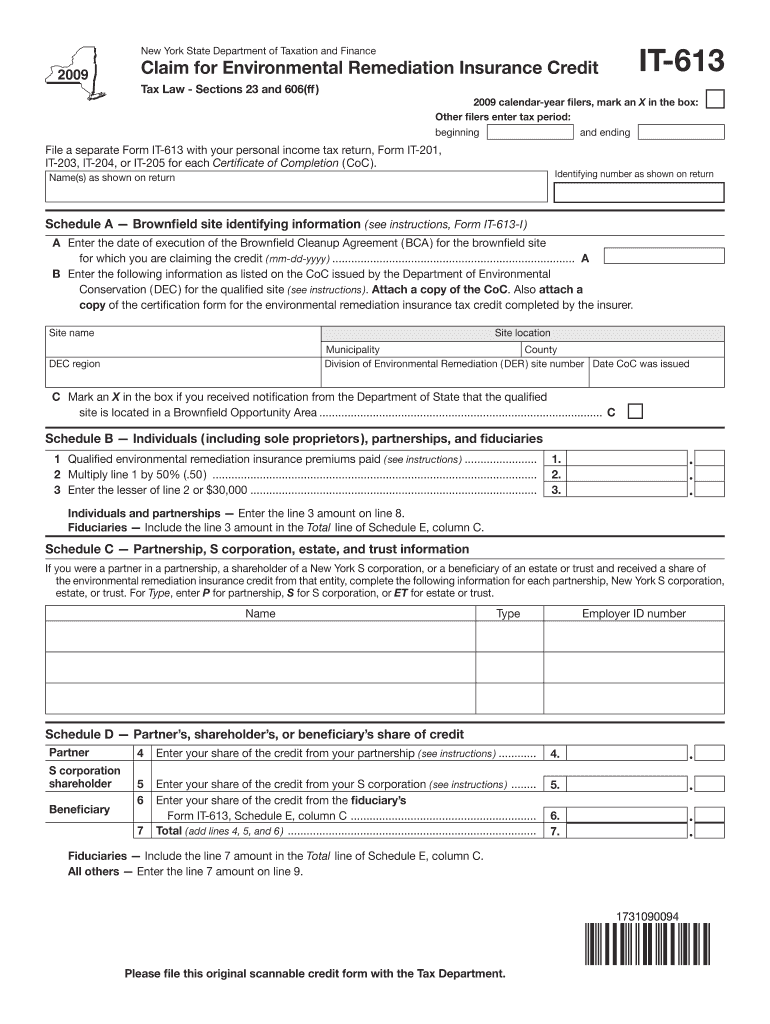

This form allows individuals, partnerships, and fiduciaries to claim an environmental remediation insurance credit provided under New York State tax law, specifically for cleanup efforts at brownfield

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign claim for environmental remediation

Edit your claim for environmental remediation form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your claim for environmental remediation form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit claim for environmental remediation online

To use our professional PDF editor, follow these steps:

1

Check your account. If you don't have a profile yet, click Start Free Trial and sign up for one.

2

Upload a file. Select Add New on your Dashboard and upload a file from your device or import it from the cloud, online, or internal mail. Then click Edit.

3

Edit claim for environmental remediation. Rearrange and rotate pages, add and edit text, and use additional tools. To save changes and return to your Dashboard, click Done. The Documents tab allows you to merge, divide, lock, or unlock files.

4

Save your file. Choose it from the list of records. Then, shift the pointer to the right toolbar and select one of the several exporting methods: save it in multiple formats, download it as a PDF, email it, or save it to the cloud.

It's easier to work with documents with pdfFiller than you can have believed. You can sign up for an account to see for yourself.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out claim for environmental remediation

How to fill out Claim for Environmental Remediation Insurance Credit

01

Gather required documentation: Collect all relevant information regarding the environmental remediation activities.

02

Obtain the correct form: Download or request the Claim for Environmental Remediation Insurance Credit form from the relevant authority's website.

03

Fill out the form: Complete all sections of the form, accurately providing information about the remediation project and associated costs.

04

Provide supporting documents: Attach all necessary documentation such as invoices, contracts, and any other evidence of remediation activities.

05

Review the claim: Go through the completed form and supporting documents to ensure accuracy and completeness.

06

Submit the claim: Send the completed form and documentation to the designated agency or department for processing.

Who needs Claim for Environmental Remediation Insurance Credit?

01

Businesses or property owners who have incurred costs related to environmental remediation efforts.

02

Individuals or entities seeking tax credits for insurance costs associated with environmental remediation.

03

Organizations involved in projects that require cleanup of contaminated sites.

Fill

form

: Try Risk Free

People Also Ask about

What are 5 examples of environmental?

Air, water, climate, soil, natural vegetation and landforms are all environmental factors. By definition, the environmental factors affect everyday living, and play a key role in bringing health differences across the geographic areas.

What are some examples of environmental remediation?

25 Types of Environmental Remediation #1. Activated Carbon-Based Technology. #2. Bioreactors. #3. Biowall. #4. Bioremediation – Cometabolic. #5. Electrokinetic-Enhanced Remediation. #6. Environmental Dredging. #7. Environmental Fracturing. #8. Excavation and Off-Site Disposal.

Can I write off mold remediation on my taxes?

Mold removal or remediation qualifies as a deductible expense from your income for federal taxes because the Internal Revenue Service considers it an essential repair required to maintain the value of your home. There's a distinction between repair and renovation.

What are the 3 types of remediation that occur?

ing to IBISWorld, roughly 87,172 people in the U.S. work in the Remediation and Environmental Cleanup Services industry. Although each site remediation firm undertakes varying projects, they all converge into three main types of site remediation: soil, water, and sediment.

Are environmental remediation costs deductible?

ing to basic accounting information, in most cases, environmental remediation costs can be deducted as ordinary and reasonable business expenses. However, not all of these remediation costs are expensed. In some cases, environmental cleanup costs are capitalized and then depreciated over a number of years.

What are 3 examples of how bioremediation has been used to help the environment?

Examples of Bioremediation Crime Scene and Biohazard Cleanup. In crime scene and trauma cleanup, bioremediation involves safely decontaminating areas exposed to bloodborne pathogens, body fluids, and other biological hazards. Oil Spill Cleanup. Cost Effective Cleaning Efforts. Soil Decontamination. Wastewater Treatment.

Are environmental fees tax deductible?

Environmental cleanup costs can be deducted or capitalized based on property value impact and compliance, and documentation is crucial. Environmental cleanup costs are a reality for many real estate owners, operators, and investors.

What is an example of environmental remediation?

Environmental remediation refers to reducing radiation exposure, for example, from contaminated soil, groundwater or surface water. The purpose is more than just eliminating radiation sources; it is about protecting people and the environment against potential harmful effects from exposure to ionizing radiation.

What are some examples of environmental remediation?

25 Types of Environmental Remediation #1. Activated Carbon-Based Technology. #2. Bioreactors. #3. Biowall. #4. Bioremediation – Cometabolic. #5. Electrokinetic-Enhanced Remediation. #6. Environmental Dredging. #7. Environmental Fracturing. #8. Excavation and Off-Site Disposal.

Is mold remediation considered a capital improvement?

The cost of the mold removal is considered an expense, as it is viewed as a repair expense. However, the mold removal is a capitalized expense when you buy a building with mold and then remove the mold to get the building ready for rental or use in your business.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is Claim for Environmental Remediation Insurance Credit?

The Claim for Environmental Remediation Insurance Credit is a provision that allows taxpayers to seek a tax credit for expenses related to environmental remediation insurance, which covers the costs associated with cleaning up contaminated sites.

Who is required to file Claim for Environmental Remediation Insurance Credit?

Taxpayers who have incurred costs for environmental remediation insurance and are seeking to claim a credit against their state or federal taxes are required to file this claim.

How to fill out Claim for Environmental Remediation Insurance Credit?

To fill out the Claim for Environmental Remediation Insurance Credit, taxpayers must complete the appropriate form, providing details about the incurred costs, the insurance policy, and any related environmental remediation activities.

What is the purpose of Claim for Environmental Remediation Insurance Credit?

The purpose of the Claim for Environmental Remediation Insurance Credit is to incentivize taxpayers to invest in environmental cleanup activities by providing a financial credit that can offset taxes owed.

What information must be reported on Claim for Environmental Remediation Insurance Credit?

The information that must be reported includes the amount spent on environmental remediation insurance, details of the insurance policy, identification of the contaminated site, and documentation supporting the remediation efforts.

Fill out your claim for environmental remediation online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Claim For Environmental Remediation is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.