Get the free REQUEST FOR PIN

Show details

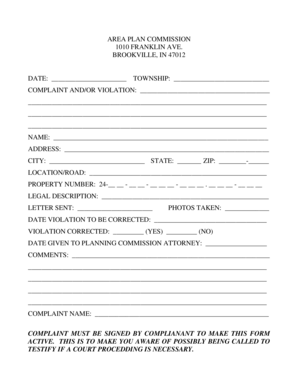

This form is designed for individuals and firms to request a PIN for accessing online applications related to CPA qualifications with the Oklahoma Accountancy Board.

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign request for pin

Edit your request for pin form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your request for pin form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit request for pin online

Follow the steps down below to benefit from the PDF editor's expertise:

1

Create an account. Begin by choosing Start Free Trial and, if you are a new user, establish a profile.

2

Upload a document. Select Add New on your Dashboard and transfer a file into the system in one of the following ways: by uploading it from your device or importing from the cloud, web, or internal mail. Then, click Start editing.

3

Edit request for pin. Rearrange and rotate pages, add and edit text, and use additional tools. To save changes and return to your Dashboard, click Done. The Documents tab allows you to merge, divide, lock, or unlock files.

4

Save your file. Select it in the list of your records. Then, move the cursor to the right toolbar and choose one of the available exporting methods: save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud.

pdfFiller makes dealing with documents a breeze. Create an account to find out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out request for pin

How to fill out REQUEST FOR PIN

01

Obtain the REQUEST FOR PIN form from the appropriate authority or website.

02

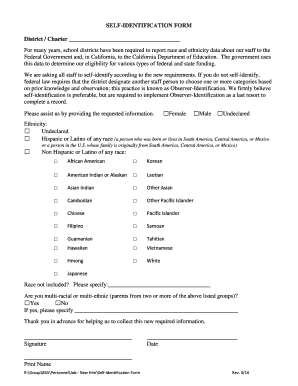

Fill in your personal information, including your name, address, and contact details.

03

Provide any necessary identification numbers, such as Social Security Number or taxpayer ID.

04

Review the form for accuracy and completeness.

05

Sign and date the form.

06

Submit the form via the specified method (mail, online, or in-person) to the designated office.

Who needs REQUEST FOR PIN?

01

Individuals who have lost their Personal Identification Number (PIN).

02

Taxpayers who need a PIN for tax return processing.

03

Participants in programs that require PIN for identification or authentication.

04

Individuals applying for certain government benefits that require a PIN.

Fill

form

: Try Risk Free

People Also Ask about

What is my ID me PIN?

An Identity Protection PIN (IP PIN) is a six-digit number that helps protect your Social Security number (SSN) or Individual Taxpayer Identification Number (ITIN) from unauthorized use on tax returns. The IRS encourages all taxpayers to sign up for an IP PIN. You must request your IP PIN directly from the IRS.

How do I recover my self-select pin?

What if I can't remember last years AGI or PIN? You may call the IRS toll free number at 1-800-829-1040 or use the link on our self select pin page to enter data to receive that information.

Can I get a pin for my Social Security number?

If you don't already have an IP PIN, you may get an IP PIN as a proactive step to protect yourself from tax-related identity theft. Anyone with an SSN or an ITIN can get an IP PIN including individuals living abroad.

Does everyone have an IRS PIN?

Most taxpayers don't need one. You can still opt into the IP PIN program, even if you aren't a victim of identity theft. An IP PIN adds another layer of security protection, giving you peace of mind when you're filing your taxes.

How to get a personal identification number?

Your Personal Identification Number (PIN) Retrieve your IP PIN online at the IRS's Get an IP PIN site; or. Call the IRS at 1-800-908-4490 to have your IP PIN mailed to you. Will take up to 21 days. Pandemic delays it longer.

Can I put a hold on my social security number?

Lock Your Social Security Number To block electronic access to your SSN, call the Social Security Administration at 800-772-1213. Once you've made your request, any automated telephone and electronic access to your Social Security file is blocked.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is REQUEST FOR PIN?

REQUEST FOR PIN is a formal request to obtain a Personal Identification Number (PIN) used for various identity verification processes.

Who is required to file REQUEST FOR PIN?

Individuals or entities needing to access secured services, such as tax filing or financial transactions, are typically required to file a REQUEST FOR PIN.

How to fill out REQUEST FOR PIN?

To fill out a REQUEST FOR PIN, provide personal identification information, including name, address, and any relevant identification numbers, and submit the form to the requesting authority.

What is the purpose of REQUEST FOR PIN?

The purpose of REQUEST FOR PIN is to secure and authenticate an individual’s identity for accessing certain services that require a PIN.

What information must be reported on REQUEST FOR PIN?

The information that must be reported on REQUEST FOR PIN includes personal identification details, contact information, and any applicable identification numbers or documentation required by the authority.

Fill out your request for pin online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Request For Pin is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.