SC SC SCH. TC-38 2007 free printable template

Show details

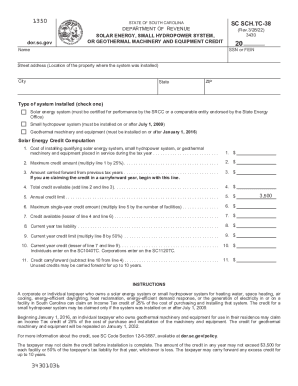

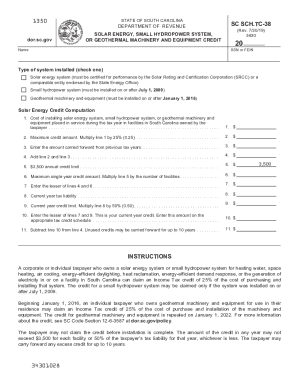

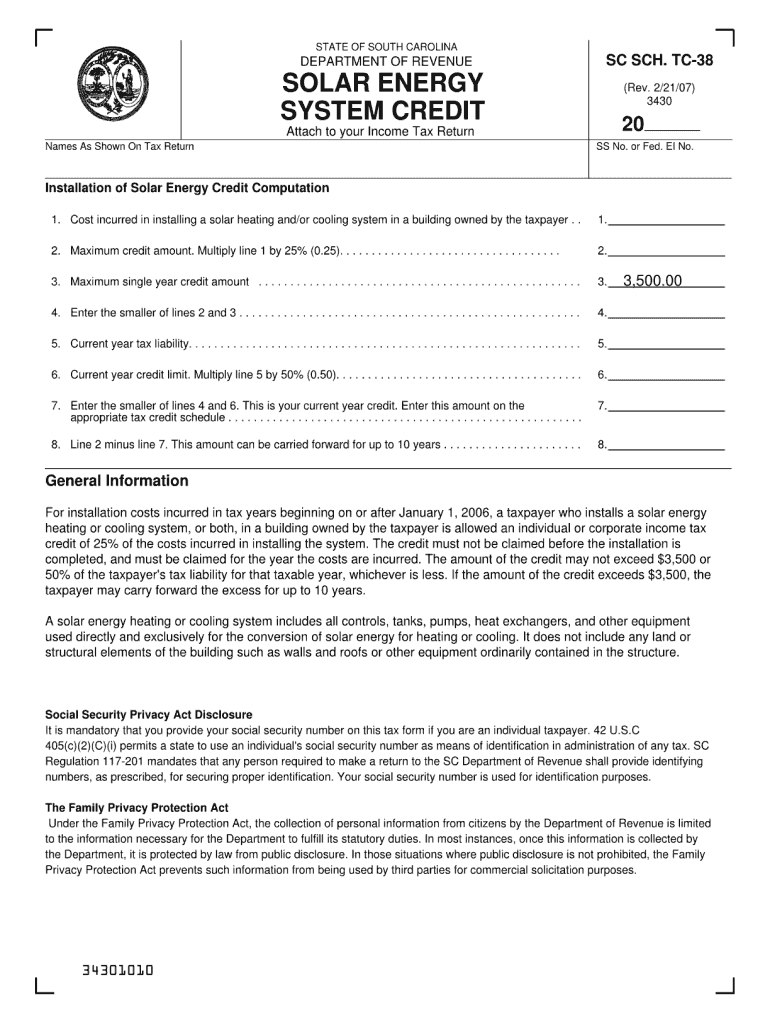

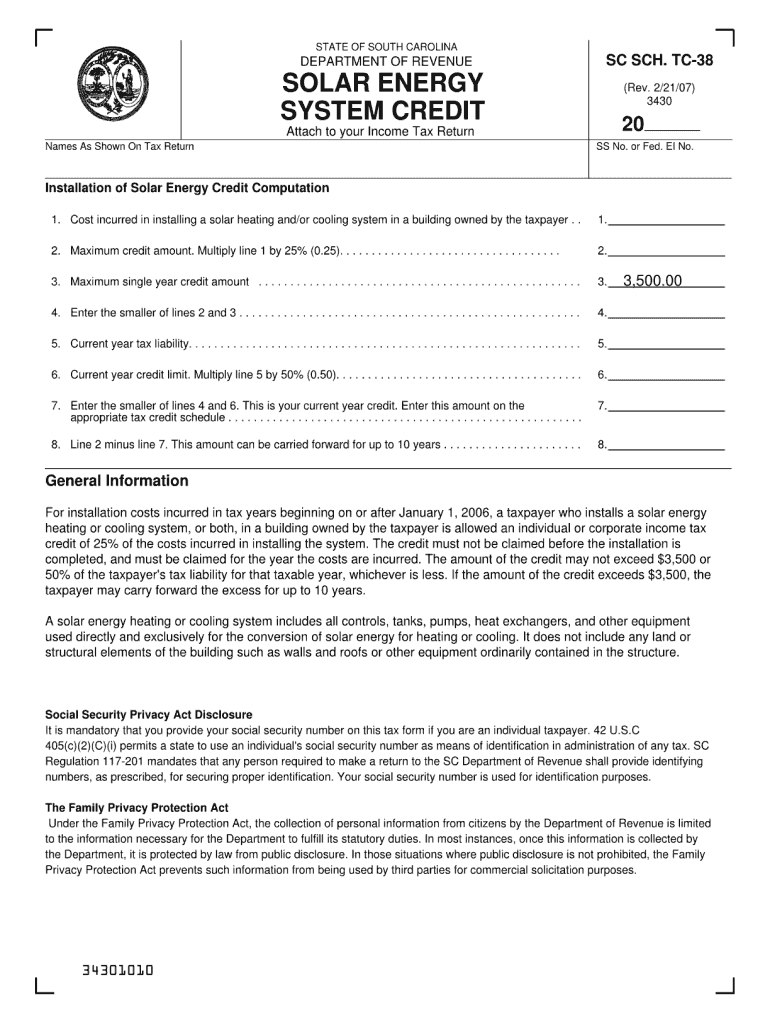

STATE OF SOUTH CAROLINA DEPARTMENT OF REVENUE SC SCH. TC-38 (Rev. 2/21/07) 3430 SOLAR ENERGY SYSTEM CREDIT Attach to your Income Tax Return Names As Shown On Tax Return 20 SS No. or Fed. EI No. Installation

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign SC SC SCH TC-38

Edit your SC SC SCH TC-38 form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your SC SC SCH TC-38 form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit SC SC SCH TC-38 online

To use our professional PDF editor, follow these steps:

1

Check your account. It's time to start your free trial.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit SC SC SCH TC-38. Text may be added and replaced, new objects can be included, pages can be rearranged, watermarks and page numbers can be added, and so on. When you're done editing, click Done and then go to the Documents tab to combine, divide, lock, or unlock the file.

4

Save your file. Select it from your list of records. Then, move your cursor to the right toolbar and choose one of the exporting options. You can save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud, among other things.

It's easier to work with documents with pdfFiller than you can have ever thought. You can sign up for an account to see for yourself.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

SC SC SCH. TC-38 Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out SC SC SCH TC-38

How to fill out SC SC SCH. TC-38

01

Obtain the SC SC SCH. TC-38 form from the relevant authority or download it from the official website.

02

Read the instructions carefully to understand the required sections and information.

03

Start with the personal information section, including full name, address, and contact details.

04

Fill in the specific fields related to your application purpose, ensuring accuracy.

05

Provide any requested documentation or identification as specified in the form.

06

Review your completed form for any errors or missing information.

07

Sign and date the form where indicated.

08

Submit the form either electronically or by mail, following any additional submission guidelines.

Who needs SC SC SCH. TC-38?

01

Individuals or entities applying for a specific service or benefit that requires the SC SC SCH. TC-38 form.

02

Organizations needing to report information related to the particular category addressed by the form.

03

Anyone mandated by regulation to complete the SC SC SCH. TC-38 for compliance purposes.

Fill

form

: Try Risk Free

People Also Ask about

What is the EITC credit for 2023 in South Carolina?

Eligible tax filers in South Carolina can currently claim a nonrefundable state EITC, with a credit worth 125% of the federal credit beginning in tax year 2023.

What is the new EITC for 2023?

Earned income tax credit 2023 The earned income tax credit is adjusted to account for inflation each year. For the 2023 tax year (taxes filed in 2024), the earned income tax credit will run from $600 to $7,430, depending on filing status and number of children.

What IRS form do I need for solar tax credit?

Use Form 5695 to figure and take your residential energy credits.

What is the SC Motor Fuel Income Tax credit?

The amount of the credit is based on the smaller of the increase in South Carolina motor fuel user fee you paid during 2022 or the preventative maintenance costs incurred in South Carolina during 2022. Each taxpayer can claim this credit for up to two vehicles registered in South Carolina.

How do I claim my SC solar tax credit?

Federal Solar Tax Credit for South Carolina Residents You can qualify for this credit as a homeowner if you purchase your PV system fully with cash or through a solar loan. You claim the credit when you file your federal taxes for the year.

How to file SC solar tax credit?

To claim the South Carolina tax credit for solar, you must file Form SC1040TC as part of your state tax return. The corresponding code is 038 SOLAR ENERGY OR SMALL HYDROPOWER SYSTEM CREDIT: For installing a solar energy system or small hydropower system in a South Carolina facility (TC-38).

What is the drip trickle irrigation credit for SC?

The credit is for 25% of expenses made in a tax year. File a separate SCH TC-1 for each measure. Claim the credit only one time for each of the three measures. The credit is limited to a maximum of $2,500 in a tax year.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Where do I find SC SC SCH TC-38?

It's simple using pdfFiller, an online document management tool. Use our huge online form collection (over 25M fillable forms) to quickly discover the SC SC SCH TC-38. Open it immediately and start altering it with sophisticated capabilities.

How do I complete SC SC SCH TC-38 on an iOS device?

In order to fill out documents on your iOS device, install the pdfFiller app. Create an account or log in to an existing one if you have a subscription to the service. Once the registration process is complete, upload your SC SC SCH TC-38. You now can take advantage of pdfFiller's advanced functionalities: adding fillable fields and eSigning documents, and accessing them from any device, wherever you are.

How do I edit SC SC SCH TC-38 on an Android device?

With the pdfFiller mobile app for Android, you may make modifications to PDF files such as SC SC SCH TC-38. Documents may be edited, signed, and sent directly from your mobile device. Install the app and you'll be able to manage your documents from anywhere.

What is SC SC SCH. TC-38?

SC SC SCH. TC-38 is a form used for reporting certain tax information related to specific entities or transactions. It is part of the state tax filing system.

Who is required to file SC SC SCH. TC-38?

Entities or individuals who meet specific criteria set by the state tax authority are required to file SC SC SCH. TC-38, typically those engaged in transactions that require reporting under state tax regulations.

How to fill out SC SC SCH. TC-38?

To fill out SC SC SCH. TC-38, you need to provide required details such as entity information, transaction specifics, and any other relevant tax information as outlined in the form instructions.

What is the purpose of SC SC SCH. TC-38?

The purpose of SC SC SCH. TC-38 is to ensure compliance with state tax laws by reporting necessary information regarding certain transactions or entities, allowing tax authorities to assess tax obligations accurately.

What information must be reported on SC SC SCH. TC-38?

The information that must be reported on SC SC SCH. TC-38 includes entity names, addresses, taxpayer identification numbers, details of the transactions, and other specific information required by the state tax authority.

Fill out your SC SC SCH TC-38 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

SC SC SCH TC-38 is not the form you're looking for?Search for another form here.

Relevant keywords

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.