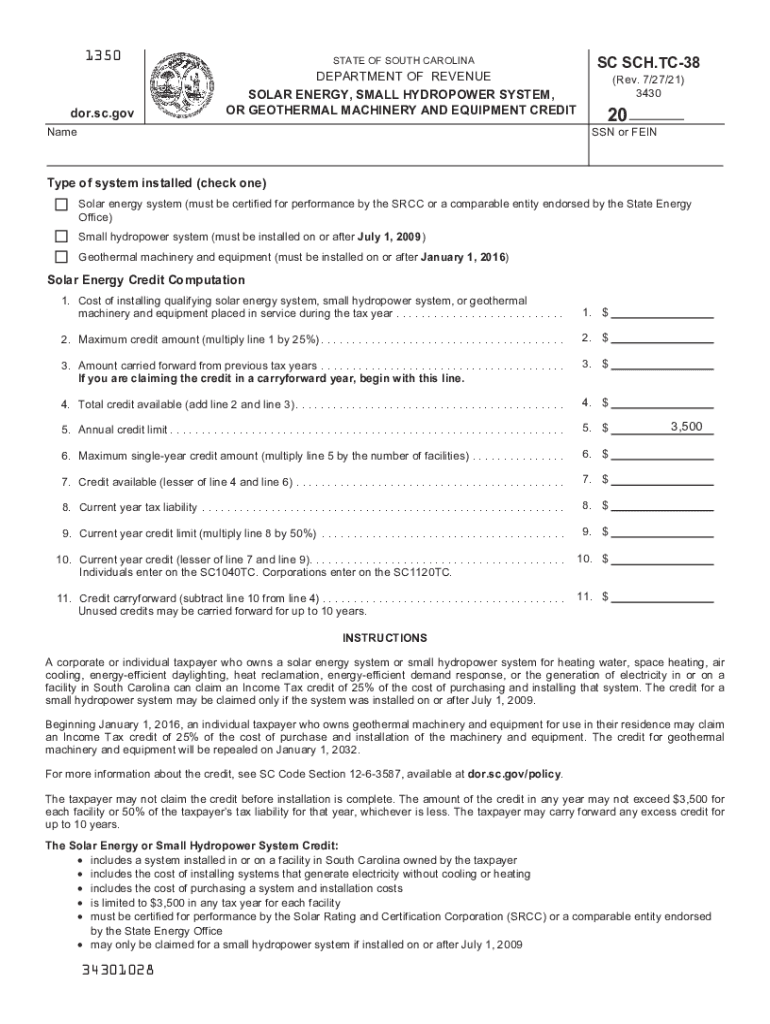

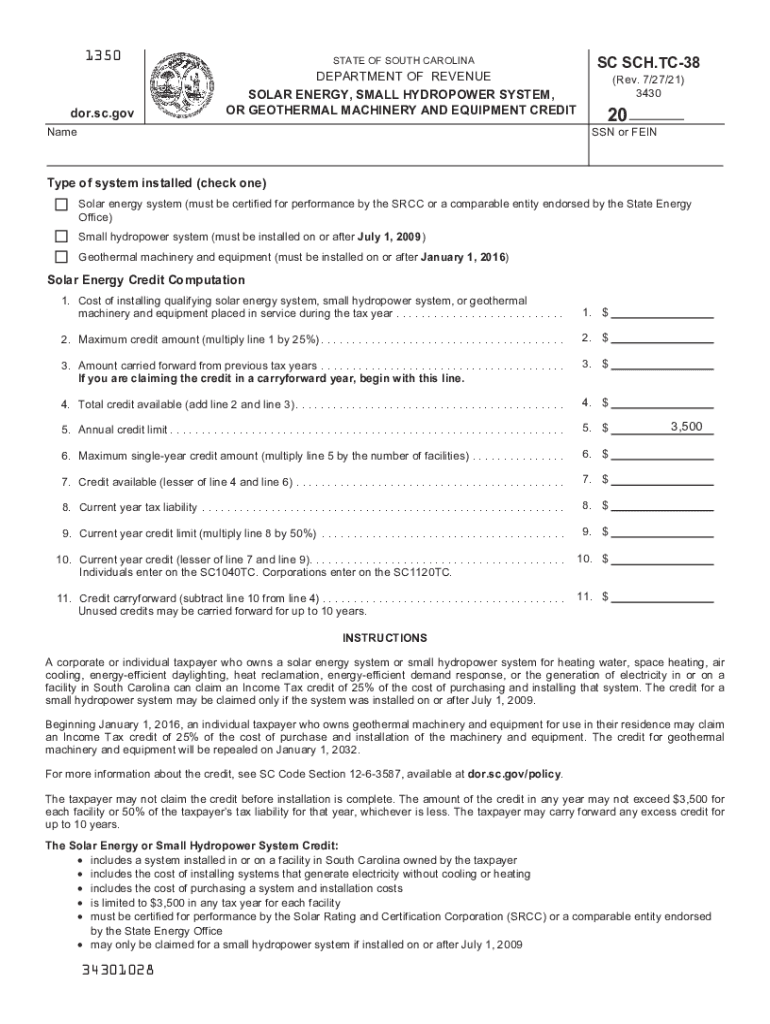

SC SC SCH. TC-38 2021 free printable template

Get, Create, Make and Sign SC SC SCH TC-38

How to edit SC SC SCH TC-38 online

Uncompromising security for your PDF editing and eSignature needs

SC SC SCH. TC-38 Form Versions

How to fill out SC SC SCH TC-38

How to fill out SC SC SCH. TC-38

Who needs SC SC SCH. TC-38?

Instructions and Help about SC SC SCH TC-38

Welcome to this month's special tax topic webinar we'll be learning about the solar energy Tax Credit which has some unique tax benefits so for anyone living in states where the Sun shines this is a great topic whether you're considering purchasing solar panels or recently installed some as always this webinar is for educational purposes and does not constitute a device we recommend all students discuss their individual tax situation with us by scheduling consultation, so I'm very excited our presenter today will be matron May has over 20 years experience in tax and finance as an enrolled agent she specializes in trader tax laws estate and trusts taxation foreign reporting and researching advanced tax topics she's one of our best tax accountants here at Nazi tax pros, and I'm super excited for you to hear from her today thank you the solar tax credit was created to encourage Americans to use solar power the Environmental Protection Agency or EPA and the Department of Energy offer tax credits for solar-powered systems, so 30 percent credit is available through the end of 2019 and after that the percentage taps down maker and then stops at the end of 2021 the credit is equal to 30 percent of your total qualified cost you can claim the residential energy efficiency property credit for solar wind and geothermal equipment in both your principal residence in a second home, but fuel cell equipment qualifies only if installed in your principal residence you can ask the Builder to make a reasonable allocation for the cost for purposes of calculating your tax credit other than the cost of the system there's no limit to the dollar amount of the credit except for fuel cells with the maximum credit of 500 for each half kilowatt of power capacity or 1000 for each kilowatt generally you can claim a tax credit on the expenses related to the new solar PV system that already came installed in the house for the year in which you move into the house assuming the Builder did not claim the tax credit the tax credit is a dollar-for-dollar reduction in the amount of income tax you would otherwise Oh their news portion gets carried forward you cannot claim a credit for installing solar power at rental property you own the exception is if you live in the house for part of the year and use it as a rental when you are away you'll have to reduce the credit for a vacation home rental or otherwise to reflect the time you are not there if you live there for three months a year for instance you can only claim 25 of the credit if the system costs 10000 the 30 credit would be 3000, and you could claim a quarter of that or 750 expenses that qualify for the credit include first solar PV or photovoltaic or PV cells used to power an attic fan but not the fan itself second contractor labor cost for on-site preparation assembly or original installation including permitting fees inspection cost and developer fees third balance of system equipment including writing inverters and mounting...

People Also Ask about

What states are doing the Child Tax Credit for 2022?

What is SC earned income credit?

Are we getting Child Tax Credit 2022?

Does South Carolina have a child tax credit?

How much is the two wage earner credit South Carolina?

How much is the South Carolina solar tax credit?

How to claim South Carolina solar tax credit?

Does South Carolina have a rent credit?

What is TC 38?

How do I claim back solar tax credit?

What is the SC new jobs credit?

What is the South Carolina Parental credit?

How does the South Carolina solar tax credit work?

What is SC parental refundable credit?

Who is eligible for the $300 Child Tax Credit?

How do I claim solar tax credit in SC?

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I make edits in SC SC SCH TC-38 without leaving Chrome?

How do I fill out SC SC SCH TC-38 using my mobile device?

How do I edit SC SC SCH TC-38 on an iOS device?

What is SC SC SCH. TC-38?

Who is required to file SC SC SCH. TC-38?

How to fill out SC SC SCH. TC-38?

What is the purpose of SC SC SCH. TC-38?

What information must be reported on SC SC SCH. TC-38?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.