Get the free Conversion of a Corporation to a Partnership or Limited Partnership - sos sc

Show details

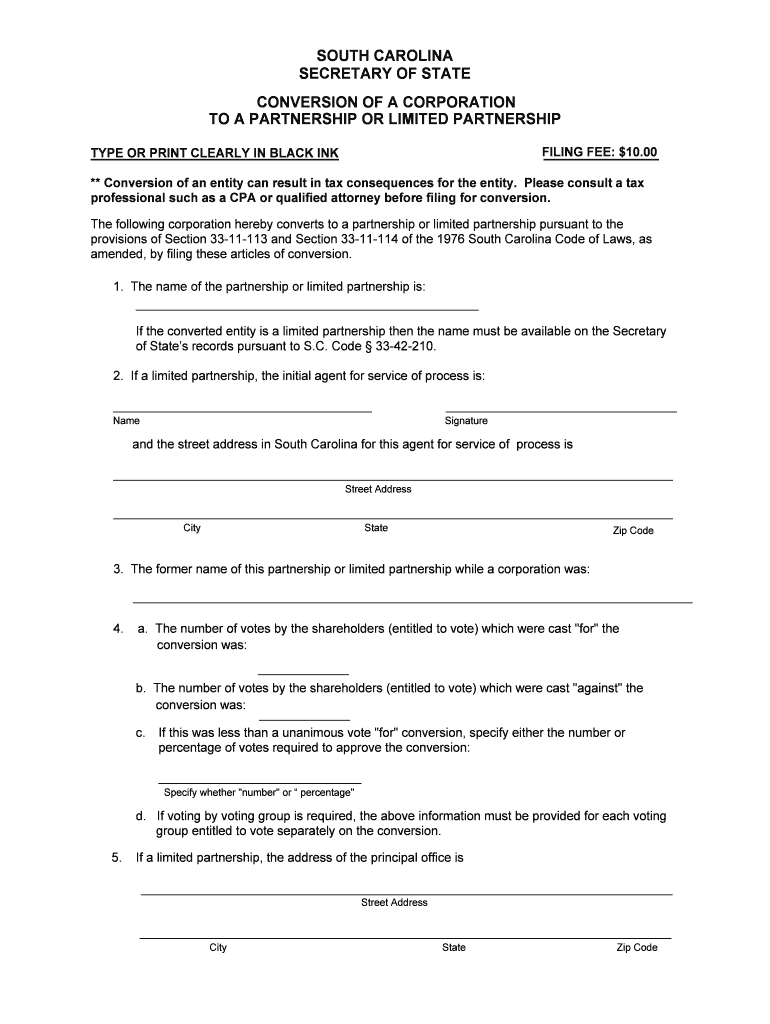

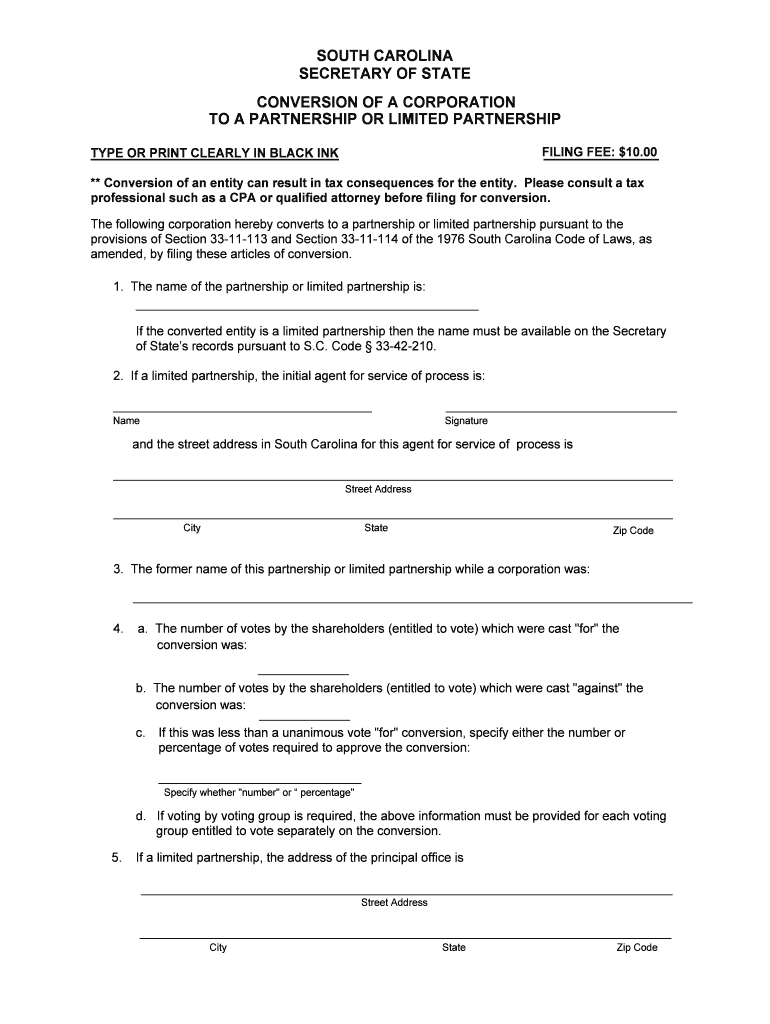

This form is used for the conversion of a corporation to a partnership or limited partnership in South Carolina, including necessary details about the entity and its partners.

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign conversion of a corporation

Edit your conversion of a corporation form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your conversion of a corporation form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit conversion of a corporation online

To use the professional PDF editor, follow these steps:

1

Log in. Click Start Free Trial and create a profile if necessary.

2

Upload a document. Select Add New on your Dashboard and transfer a file into the system in one of the following ways: by uploading it from your device or importing from the cloud, web, or internal mail. Then, click Start editing.

3

Edit conversion of a corporation. Rearrange and rotate pages, add new and changed texts, add new objects, and use other useful tools. When you're done, click Done. You can use the Documents tab to merge, split, lock, or unlock your files.

4

Save your file. Select it from your list of records. Then, move your cursor to the right toolbar and choose one of the exporting options. You can save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud, among other things.

It's easier to work with documents with pdfFiller than you can have ever thought. You can sign up for an account to see for yourself.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out conversion of a corporation

How to fill out Conversion of a Corporation to a Partnership or Limited Partnership

01

Review current corporate structure and reasons for conversion.

02

Consult with a legal professional to understand implications.

03

Prepare a plan for the conversion, including partnership terms.

04

Obtain board approval for the conversion from the corporation.

05

Draft and file the necessary documents with your state’s Secretary of State.

06

Notify stakeholders, including shareholders and employees, about the conversion.

07

Update tax status and notify the IRS of the change.

08

Open new bank accounts under the partnership or limited partnership name.

09

Transfer assets and liabilities from the corporation to the partnership.

10

Maintain records of the conversion and ensure compliance with state laws.

Who needs Conversion of a Corporation to a Partnership or Limited Partnership?

01

Business owners seeking to benefit from partnership taxation.

02

Corporations facing high tax liability who want a more flexible structure.

03

Businesses looking to include new partners or investors.

04

Entrepreneurs wanting to limit personal liability while maintaining business control.

Fill

form

: Try Risk Free

People Also Ask about

What is the 5 year rule for C corporations?

Making an S election is a non-taxable event, but the change does create a built-in gains period of five years. During that period, if the corporation recognizes gains on assets held at the time of election, it pays corporate tax on the built-in gain at the time of conversion.

What are the tax consequences of converting C corporation to LLC?

If a corporation elects to be classified as a partnership, the corporation will be deemed to have distributed all its assets and liabilities to its shareholders in liquidation, and the shareholders are deemed to contribute all the distributed assets and liabilities immediately thereafter to a newly formed partnership.

Why would a company go from Inc. to LLC?

Converting a C Corporation to an LLC is considered a taxable liquidation event under IRS rules. This means that all corporate assets are deemed sold at fair market value, triggering potential capital gains taxes. Additionally, shareholders are taxed when they receive distributions from the liquidated corporation.

Can you convert a corporation into a partnership?

An existing corporation transfers substantially all of its business into a partnership and liquidates the corporation. Existing shareholders exchange their shares for units in the partnership. An existing corporation places assets into a limited partnership and distributes the partnership units to the shareholders.

Why would a corporation switch to an LLC?

There are lots of reasons you might change a corporation into an LLC: easier management, fewer corporate requirements, flexible taxation, pass-through taxation, and more.

Is converting an S Corp to an LLC a taxable event?

The merger is without tax consequences, because it's a merger of two entities, Old S and LLC, that are disregarded for tax purposes. Furthermore, all of the assets, liabilities, contracts, and legal relationships of Old S transfer to LLC and in most circumstances no third party consents are required.

What happens to taxes when you convert from C Corp to LLC?

Converting a C Corporation to an LLC is considered a taxable liquidation event under IRS rules. This means that all corporate assets are deemed sold at fair market value, triggering potential capital gains taxes. Additionally, shareholders are taxed when they receive distributions from the liquidated corporation.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is Conversion of a Corporation to a Partnership or Limited Partnership?

Conversion of a Corporation to a Partnership or Limited Partnership refers to the legal process whereby a corporation changes its business structure to become a partnership or a limited partnership, allowing it to take advantage of different tax treatments and operational flexibility.

Who is required to file Conversion of a Corporation to a Partnership or Limited Partnership?

Typically, the corporation's board of directors or a designated person must file for conversion. This can include owners or shareholders who wish to change the business structure for legal and financial benefits.

How to fill out Conversion of a Corporation to a Partnership or Limited Partnership?

To fill out the conversion form, one must provide the corporation's details, the new partnership's structure, names of partners, business purpose, and other relevant information as required by the state in which the conversion is filed.

What is the purpose of Conversion of a Corporation to a Partnership or Limited Partnership?

The purpose of conversion is to provide a more flexible management structure, potential tax advantages, and ease of profit distribution among partners, allowing the business to adapt to changing needs.

What information must be reported on Conversion of a Corporation to a Partnership or Limited Partnership?

Information typically required includes the corporation's name and ID, the name of the new partnership, details of the partners, business address, business purpose, and confirmation of compliance with state laws.

Fill out your conversion of a corporation online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Conversion Of A Corporation is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.