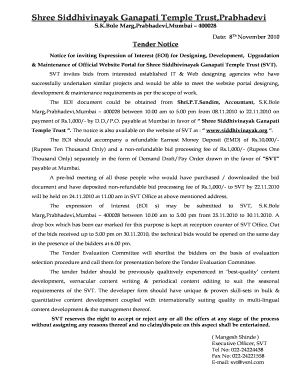

Get the free Employer Transit Pass Credit 2010

Show details

This document allows employers in Minnesota to calculate and claim a credit for providing transit passes to their employees. It includes specific instructions on eligibility, the calculation process,

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign employer transit pass credit

Edit your employer transit pass credit form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your employer transit pass credit form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing employer transit pass credit online

Follow the steps down below to take advantage of the professional PDF editor:

1

Log in. Click Start Free Trial and create a profile if necessary.

2

Upload a document. Select Add New on your Dashboard and transfer a file into the system in one of the following ways: by uploading it from your device or importing from the cloud, web, or internal mail. Then, click Start editing.

3

Edit employer transit pass credit. Rearrange and rotate pages, add new and changed texts, add new objects, and use other useful tools. When you're done, click Done. You can use the Documents tab to merge, split, lock, or unlock your files.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

With pdfFiller, it's always easy to work with documents.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out employer transit pass credit

How to fill out Employer Transit Pass Credit 2010

01

Gather necessary documents: Collect employee information and transit pass purchase details.

02

Obtain the correct form: Download or request the Employer Transit Pass Credit 2010 form from the tax authority's website.

03

Fill out the employer information: Enter your business name, address, and tax identification number on the form.

04

List employee details: Include each employee's name, social security number, and the amount of transit passes purchased on their behalf.

05

Calculate the credit: Determine the total amount of the Employer Transit Pass Credit based on the eligible transit passes purchased.

06

Sign and date the form: Ensure the form is signed by an authorized person in the company.

07

Submit the form: Send the completed form to the appropriate tax authority by the established deadline.

Who needs Employer Transit Pass Credit 2010?

01

Employers who provide transit passes to their employees can apply for the Employer Transit Pass Credit for the year 2010.

02

Businesses looking to reduce their tax liability through transit incentive programs.

03

Companies aiming to support their employees' commuting needs by offering transit passes.

Fill

form

: Try Risk Free

People Also Ask about

What is the transit improvement tax in Minnesota?

The new 0.75% sales tax collected in the seven metro counties means that regional transit finally has the kind of revenue needed to upgrade service and compete with regions around the world.

What is the new tax credit in Minnesota?

Minnesota currently has a child tax credit that allows taxpayers a credit equal to $1,750 per child, up to age 17. But that credit would increase by $400 for each child born during the taxable year under HF2254, a bill sponsored by Rep.

What is the employer transit pass credit in Minnesota?

The credit is equal to 30% of the difference between the price you pay for the passes and the price you charge employees. It is not refundable and can only be applied to your current tax liability. Enclose this schedule when you file your Minnesota return.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is Employer Transit Pass Credit 2010?

The Employer Transit Pass Credit 2010 is a tax credit provided to employers who provide transit passes to their employees. This credit was designed to encourage the use of public transportation and reduce traffic congestion.

Who is required to file Employer Transit Pass Credit 2010?

Employers who provide transit passes to their employees and wish to claim the tax credit are required to file the Employer Transit Pass Credit 2010. This applies to businesses that meet the eligibility criteria set forth by the tax regulations.

How to fill out Employer Transit Pass Credit 2010?

To fill out the Employer Transit Pass Credit 2010 form, employers need to provide information regarding the number of transit passes distributed, the total cost incurred, and other relevant details as specified in the instructions for the form.

What is the purpose of Employer Transit Pass Credit 2010?

The purpose of the Employer Transit Pass Credit 2010 is to incentivize employers to provide their employees with transit passes, thereby promoting the use of public transportation and contributing to environmental sustainability efforts by reducing vehicular traffic.

What information must be reported on Employer Transit Pass Credit 2010?

The information that must be reported on the Employer Transit Pass Credit 2010 includes the total number of transit passes issued, the total amount spent on these passes, and any other relevant details indicating compliance with the eligibility criteria for the credit.

Fill out your employer transit pass credit online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Employer Transit Pass Credit is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.