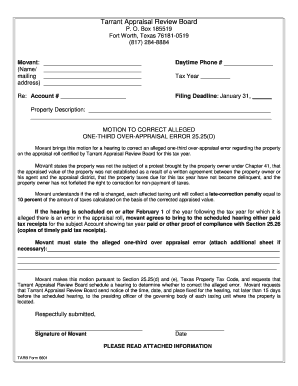

TX Comptroller 50-230 2012 free printable template

Get, Create, Make and Sign TX Comptroller 50-230

How to edit TX Comptroller 50-230 online

Uncompromising security for your PDF editing and eSignature needs

TX Comptroller 50-230 Form Versions

How to fill out TX Comptroller 50-230

How to fill out TX Comptroller 50-230

Who needs TX Comptroller 50-230?

Instructions and Help about TX Comptroller 50-230

Music open up a browser and search for Texas and LLC for inhalation you will see a lot of flings initial view of them are mostly going to be advertisements which are targeted towards people who retrying to form LLC you can ignore them and click the first link and click the first link which says SOS dot state of Texas taught us you're done×39’t have to collect the language says from 25 it is basically going to take you to the PDF document, and we are going to file purely online, and we are going to do iron SOS direct I will click on this link once I click this link here it is quickie is telling you what all things you need to do to form your LLC as you can see there this here can I find my certificate of formation online yes Texas gives that benefit, so you can see certificate of formation can be found file online through SOS Charge 24 hours day and seven days for me, I am going to click on this leg Music every search as you can see here every search as $1 we have to do a search to check uniqueness of the name which behave selected I have already done so for mining I am going to hit entertain×39’s important information that it wants to get your attention towards is that you need to have the, or you need Mohave a tub and winds up higher when SEP 7 2013 6 once I'm going to hit the summit and is going to ask me my credit card details before I can proceed Music I will say my payment method is going to be credit card I'm going to hit continued will enter my credit card details and once I enter my credit card details and hit continue we are going to me, it ingoing to take me to the next page wherein will ask me all the information pertaining to the LLC Music I have entered my credit card detail sand it has given me a session ID forever session that we would get from Sol star if there is a unique session ID chips tracking IN×39’m going to keep a note of this session on a session Adult says that all credit card payments are subject to two point eight percent of total fees or so I think I've saved my session ID now IN×39’m going to click on business organizations here it×39’s giving me all the options what all I can do from a visit this website I am going to click on domestic limited liability company LLC going to click on file document and the document which I can file as certificate of formation I'going to choose that IN×39’m going to hit continue but cancer filing at any pointing time and since I'm not a professional like doctor or CPA found something like that going to hit a limited liability company, and I'm going to choose name of my company and name of my company Issachar ALC I won't be searched for uniqueness of this name so IN×39’m going Tobit continue now this is asking me on the information about the registered agent and office of the company a registered agent as it says has to be of different and corporation or LLC or any other company or a person it cannot be the same company so IN×39’m going to enter my detail sand we'll do hit next now it...

People Also Ask about

What is a one fourth over appraisal error?

Are property taxes based on purchase price or assessed value in Texas?

How can I reduce my property taxes in Texas?

How do you successfully protest property taxes in Texas?

How much property tax can you write off in Texas?

At what age do you stop paying property taxes in Texas?

Who is exempt from property taxes in Texas?

Our user reviews speak for themselves

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I modify my TX Comptroller 50-230 in Gmail?

How do I complete TX Comptroller 50-230 online?

How do I edit TX Comptroller 50-230 in Chrome?

What is TX Comptroller 50-230?

Who is required to file TX Comptroller 50-230?

How to fill out TX Comptroller 50-230?

What is the purpose of TX Comptroller 50-230?

What information must be reported on TX Comptroller 50-230?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.