TX Comptroller 50-230 2011 free printable template

Show details

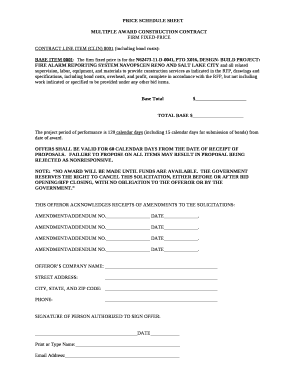

Tarrant Appraisal Review Board P. O. Box 185519 Fort Worth, Texas 76181-0519 (817) 284-8884 Moving: (Name/ mailing address) Re: Account # Daytime Phone # Tax Year Filing Deadline: January 31, Property

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign TX Comptroller 50-230

Edit your TX Comptroller 50-230 form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

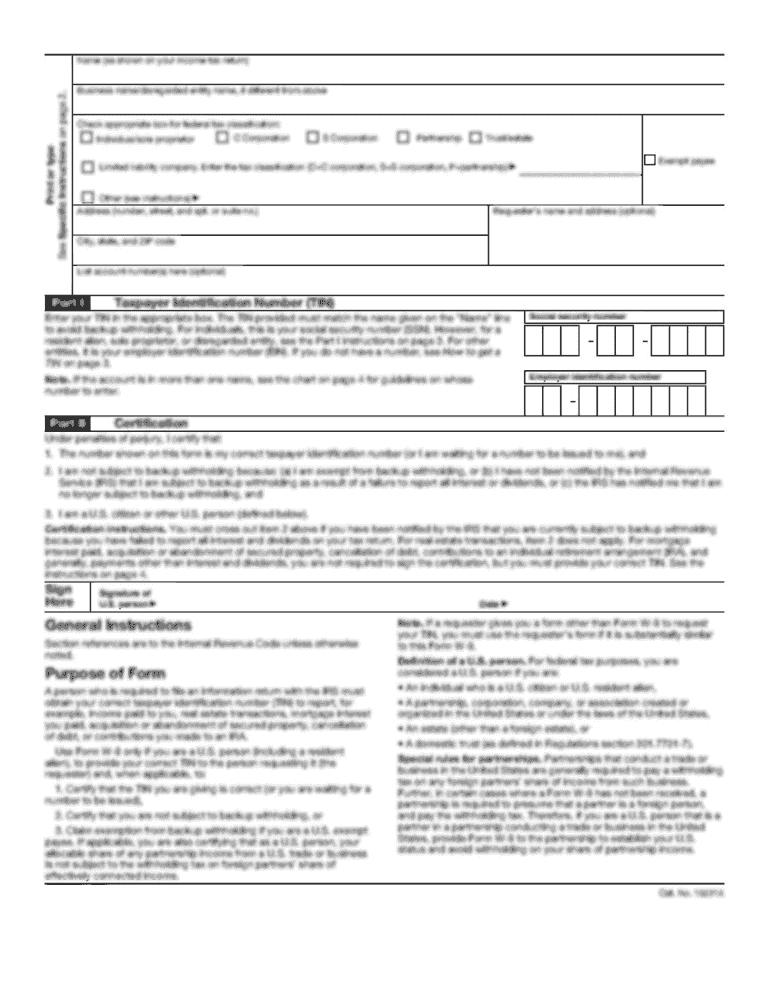

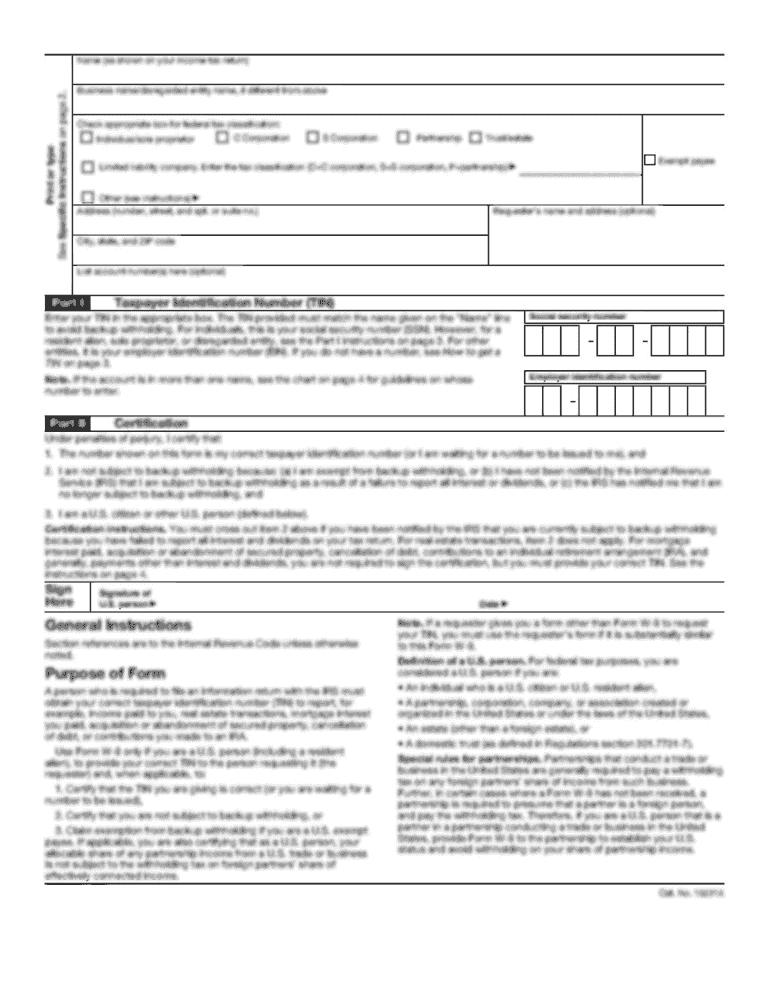

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your TX Comptroller 50-230 form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing TX Comptroller 50-230 online

In order to make advantage of the professional PDF editor, follow these steps below:

1

Log in. Click Start Free Trial and create a profile if necessary.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit TX Comptroller 50-230. Rearrange and rotate pages, add and edit text, and use additional tools. To save changes and return to your Dashboard, click Done. The Documents tab allows you to merge, divide, lock, or unlock files.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

pdfFiller makes dealing with documents a breeze. Create an account to find out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

TX Comptroller 50-230 Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out TX Comptroller 50-230

How to fill out TX Comptroller 50-230

01

Obtain the TX Comptroller Form 50-230 from the official website or local office.

02

Fill in the property owner's information, including name and address.

03

Provide details about the property, including location and type of property.

04

Indicate the type of exemption being claimed, if applicable.

05

Sign and date the form to certify the information provided.

06

Submit the completed form to the appropriate local appraisal district or office.

Who needs TX Comptroller 50-230?

01

Property owners seeking a property tax exemption in Texas.

02

Individuals or businesses that own property classified as agricultural, timber, or open space.

03

Those who qualify for specific exemptions under Texas state law.

Fill

form

: Try Risk Free

People Also Ask about

How does the over 65 exemption work in Texas?

For persons age 65 or older or disabled, Tax Code Section 11.13(c) requires school districts to provide an additional $10,000 residence homestead exemption. Tax Code Section 11.13(d) allows any taxing unit to adopt a local option residence homestead exemption. This local option exemption cannot be less than $3,000.

What is Texas personal property tax rate?

Texas Property Taxes Property taxes in Texas are the seventh-highest in the U.S., as the average effective property tax rate in the Lone Star State is 1.60%. Compare that to the national average, which currently stands at 0.99%. The typical Texas homeowner pays $3,797 annually in property taxes.

How do I get over 65 property tax exemption in Texas?

You may apply to the appraisal district the year you become age 65 or qualify for disability. If your application is approved, you will receive the exemption for the entire year in which you become age 65 or disabled and for subsequent years as long as you own a qualified residence homestead.

How much do property taxes go down when you turn 65 in Texas?

Age 65 or older and disabled exemptions: Individuals age 65 or older or disabled residence homestead owners qualify for a $10,000 residence homestead exemption for school district taxes, in addition to the $40,000 exemption for all homeowners.

How to fill out a homestead exemption form in Texas?

5:14 10:32 Texas Homestead Exemption Explained - How to Fill - YouTube YouTube Start of suggested clip End of suggested clip License. Okay so you're going to fill all that out for property owner. And number one same here ifMoreLicense. Okay so you're going to fill all that out for property owner. And number one same here if it's two owners you're gonna do the same thing for property owner number two.

How much is business personal property tax in Texas?

Business personal property accounts for 9.8 percent of the total market value of all property in the state, and 10.5 percent of all school taxable property in the state. exemption if they are in the state on a temporary basis.

How are business property taxes calculated in Texas?

The assessment ratio is 100% in Texas, meaning property tax rates are applied to the full appraised value. Property is taxed based on its current market value (what it would sell for if a buyer and seller seek the best price).

How can I avoid paying property taxes in Texas?

In short, nobody gets to avoid Texas property taxes. Some homeowners are protected against the most drastic consequences of non-payment, but payment is always expected nonetheless. So the best you can do is look for a way to make paying property taxes more manageable.

Can you be exempt from paying property taxes in Texas?

To qualify for the general residence homestead exemption an individual must have an ownership interest in the property and use the property as the individual's principal residence. An applicant is required to state that he or she does not claim an exemption on another residence homestead in or outside of Texas.

Does Texas have a business personal property tax?

Business Personal Property tax is an ad valorem tax on the tangible personal property that is used for the production of income. The State of Texas has jurisdiction to tax personal property if the property is: Located in the state for longer than a temporary period.

Who qualifies for property tax exemption in Texas?

To qualify, a home must meet the definition of a residence homestead: The home's owner must be an individual (for example: not a corporation or other business entity) and use the home as his or her principal residence on Jan. 1 of the tax year. An age 65 or older or disabled exemption is effective as of Jan.

How do I get a homestead exemption in Texas?

To qualify for the general residence homestead exemption an individual must have an ownership interest in the property and use the property as the individual's principal residence. An applicant is required to state that he or she does not claim an exemption on another residence homestead in or outside of Texas.

How do I waive property taxes in Texas?

What Property Tax Exemptions Are Available in Texas? General Residence Homestead. Age 65 or Older or Disabled. Manufactured and Cooperative Housing. Uninhabitable or Unstable Residence. Temporary Exemption for Disaster Damage.

How do I fill out the homestead exemption form Texas 2022?

How do I apply for a homestead exemption? You must apply with your county appraisal district to apply for a homestead exemption. Applying is free and only needs to be filed once. The application can be found on your appraisal district website or using Texas Comptroller Form 50-114.

How much does a homestead exemption save you on taxes in Texas?

As of May 22, 2022, the Texas residential homestead exemption entitles the homeowner to a $40,000 reduction in value for school tax purposes. Counties, cities, and special taxing districts may offer homestead exemptions up to 20% of the total value. Most counties in North Texas do offer this 20% reduction.

How much is property tax for commercial property in Texas?

That's because appraisers get more aggressive about assessing value in hot real estate markets—as cities boom, so do commercial property tax rates. In Texas cities—which are going through a rise in property value—commercial real estate tax rates are somewhat higher than the national average, at 1.83% rather than 1.08%.

What city in Texas does not pay property taxes?

The City of Stafford holds the unique distinction of being the largest city in Texas to abolish city property taxes. This includes both commercial and residential properties. In addition to a lack of city property taxes, the State of Texas has no state property taxes.

Do you get a property tax break at age 65 in Texas?

For many senior homeowners, rising property taxes can be a threat to their financial stability, even though their mortgages may be paid off. The Texas Tax Code, Section 33.06, allows taxpayers 65 years of age or older to defer their property taxes until their estates are settled after death.

What documents do I need to file homestead exemption in Texas?

Attach a copy of property owner's driver's license or state-issued personal identification certificate. The address listed on the driver's license or state-issued personal identification certificate must correspond to the property address for which the exemption is requested.

Our user reviews speak for themselves

Read more or give pdfFiller a try to experience the benefits for yourself

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I make changes in TX Comptroller 50-230?

With pdfFiller, you may not only alter the content but also rearrange the pages. Upload your TX Comptroller 50-230 and modify it with a few clicks. The editor lets you add photos, sticky notes, text boxes, and more to PDFs.

How do I edit TX Comptroller 50-230 in Chrome?

Install the pdfFiller Google Chrome Extension in your web browser to begin editing TX Comptroller 50-230 and other documents right from a Google search page. When you examine your documents in Chrome, you may make changes to them. With pdfFiller, you can create fillable documents and update existing PDFs from any internet-connected device.

Can I sign the TX Comptroller 50-230 electronically in Chrome?

Yes. With pdfFiller for Chrome, you can eSign documents and utilize the PDF editor all in one spot. Create a legally enforceable eSignature by sketching, typing, or uploading a handwritten signature image. You may eSign your TX Comptroller 50-230 in seconds.

What is TX Comptroller 50-230?

TX Comptroller 50-230 is a form used in Texas for reporting certain business information to the Texas Comptroller of Public Accounts.

Who is required to file TX Comptroller 50-230?

Businesses that are subject to franchise or other business taxes in Texas are typically required to file TX Comptroller 50-230.

How to fill out TX Comptroller 50-230?

To fill out TX Comptroller 50-230, you need to provide details such as your business name, address, and any relevant financial information that pertains to your business operations.

What is the purpose of TX Comptroller 50-230?

The purpose of TX Comptroller 50-230 is to collect vital business information for tax assessment and compliance purposes.

What information must be reported on TX Comptroller 50-230?

Information that must be reported on TX Comptroller 50-230 includes business identification details, financial data, and any other pertinent information required by the Texas Comptroller.

Fill out your TX Comptroller 50-230 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

TX Comptroller 50-230 is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.