HI RP 19-57 2011 free printable template

Show details

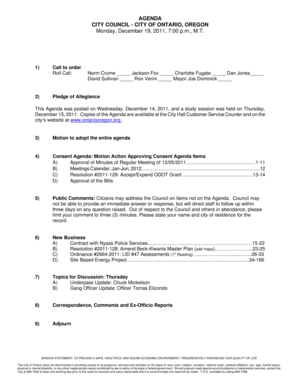

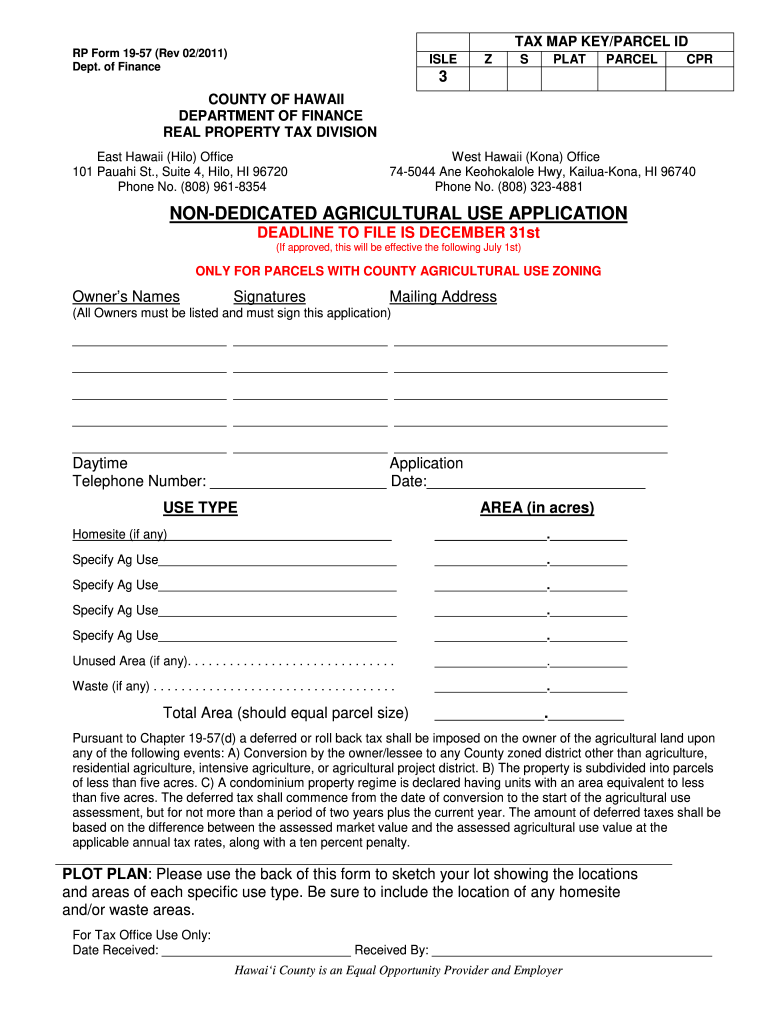

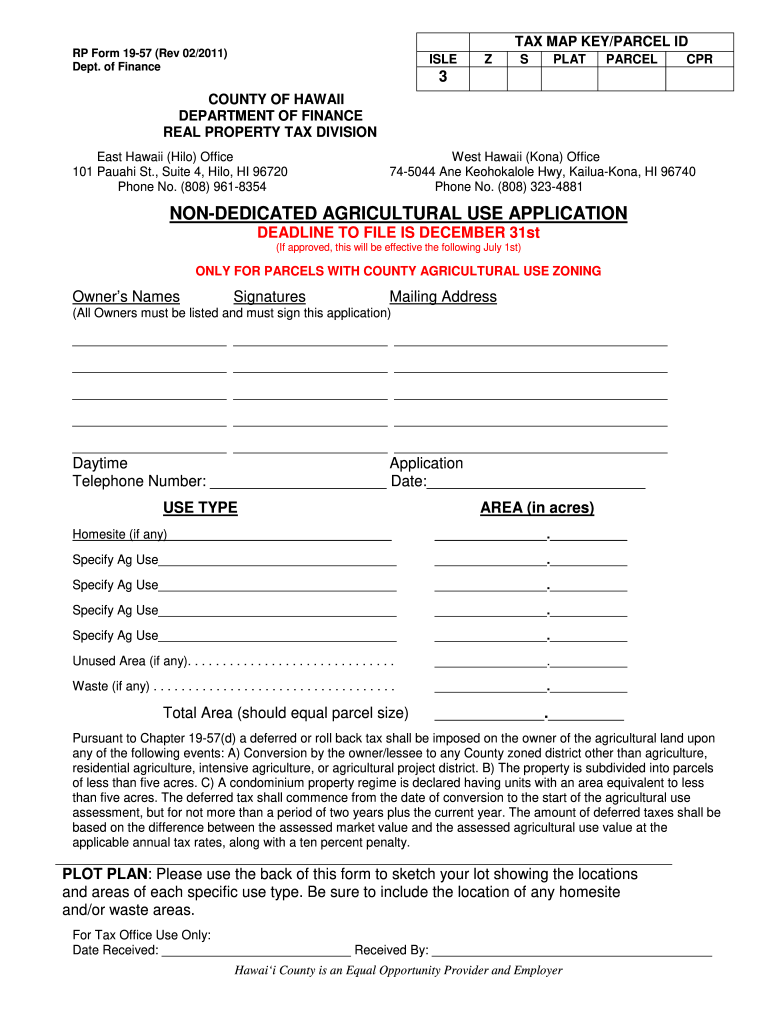

RP Form 19-57 (Rev 02/2011). Dept. of Finance. COUNTY OF HAWAII. DEPARTMENT OF FINANCE. REAL PROPERTY TAX DIVISION. East Hawaii (Hilo) ...

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign HI RP 19-57

Edit your HI RP 19-57 form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your HI RP 19-57 form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit HI RP 19-57 online

To use the professional PDF editor, follow these steps:

1

Create an account. Begin by choosing Start Free Trial and, if you are a new user, establish a profile.

2

Upload a file. Select Add New on your Dashboard and upload a file from your device or import it from the cloud, online, or internal mail. Then click Edit.

3

Edit HI RP 19-57. Add and replace text, insert new objects, rearrange pages, add watermarks and page numbers, and more. Click Done when you are finished editing and go to the Documents tab to merge, split, lock or unlock the file.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

HI RP 19-57 Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out HI RP 19-57

How to fill out HI RP 19-57

01

Obtain the HI RP 19-57 form from the designated source.

02

Read the instructions carefully to understand the requirements.

03

Fill in your personal information in the designated fields.

04

Provide any necessary supporting documentation as specified.

05

Review the form for completeness and accuracy.

06

Sign and date the form at the designated area.

07

Submit the completed form as instructed, either online or via mail.

Who needs HI RP 19-57?

01

Individuals who are seeking assistance or benefits related to health insurance.

02

Residents who need to report changes in their health coverage.

03

Those applying for a specific program that mandates the use of HI RP 19-57.

Fill

form

: Try Risk Free

People Also Ask about

What is the senior discount for property taxes in Hawaii?

The basic home exemption for homeowners 60 to 69 years of age is $80,000. The basic home exemption for homeowners 70 years of age or over is $100,000. In addition to the basic exemption amount, an additional exemption of 20 percent of the assessed value of the property is also applied to reduce the net taxable value.

Do you have to file home exemption every year in Hawaii?

Once filed and granted, these home and real property exemptions do not have to re-filed annually, as long as all requirements continue to be met.

What is tax exemption owner occupancy Hawaii?

HOME EXEMPTION REQUIREMENTS The real property must be owned and occupied as the owner's principal home as of the assessment date by an individual or individuals. Owner's principal home means occupancy by the owner of the home in the city for more than 270 calendar days of a calendar year.

How do I get ag exemption in Hawaii?

How can I get an agriculture use assessment? If the property is zoned agriculture and in actual agricultural use, you need to file the Agriculture Notification Memo. If the property is not zoned for agriculture, contact an Appraiser at our office at (808) 270-7297 for further details.

How do I get agricultural exemption in Idaho?

The owner must make an initial application and must show that the land was actively devoted to agriculture during the last three growing seasons and · Agriculturally produces for sale or home consumption the equivalent of 15% or more of the owners' or lessees' annual gross income or · Agriculturally produced gross

How much is home exemption in Hawaii?

Beginning with the 2020 assessment (2020-2021 tax year) the basic home exemption for homeowners under 65 will be $100,000. This means that $100,000 is deducted from the assessed value of the property and the homeowner is taxed on the balance. For homeowners 65 years and older the home exemption will be $140,000.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I make changes in HI RP 19-57?

The editing procedure is simple with pdfFiller. Open your HI RP 19-57 in the editor, which is quite user-friendly. You may use it to blackout, redact, write, and erase text, add photos, draw arrows and lines, set sticky notes and text boxes, and much more.

How do I fill out the HI RP 19-57 form on my smartphone?

You can easily create and fill out legal forms with the help of the pdfFiller mobile app. Complete and sign HI RP 19-57 and other documents on your mobile device using the application. Visit pdfFiller’s webpage to learn more about the functionalities of the PDF editor.

How do I fill out HI RP 19-57 on an Android device?

Use the pdfFiller Android app to finish your HI RP 19-57 and other documents on your Android phone. The app has all the features you need to manage your documents, like editing content, eSigning, annotating, sharing files, and more. At any time, as long as there is an internet connection.

What is HI RP 19-57?

HI RP 19-57 is a specific reporting form used for compliance with certain regulations, typically in the context of health insurance or healthcare-related data.

Who is required to file HI RP 19-57?

Organizations and individuals involved in health insurance that meet specific criteria are required to file HI RP 19-57.

How to fill out HI RP 19-57?

To fill out HI RP 19-57, complete the form by providing the necessary information as specified in the instructions, ensuring accuracy and completeness.

What is the purpose of HI RP 19-57?

The purpose of HI RP 19-57 is to collect data for regulatory compliance, financial analysis, or public health assessments within the health insurance sector.

What information must be reported on HI RP 19-57?

The information that must be reported on HI RP 19-57 typically includes details about health insurance coverage, claims, premiums, and enrolled individuals.

Fill out your HI RP 19-57 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

HI RP 19-57 is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.