HI RP 19-57 2018 free printable template

Show details

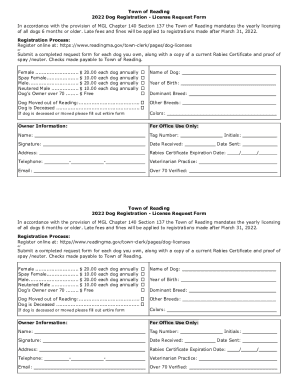

RP Form 19-57 Rev 10/2018 Dept. of Finance ISLE COUNTY OF HAWAII DEPARTMENT OF FINANCE REAL PROPERTY TAX DIVISION ZONE TAX MAP KEY / PARCEL ID SECTION PLAT PARCEL CPR East Hawaii Hilo Office Aupuni Center 101 Pauahi Street Suite 4 Hilo HI 96720 West Hawaii Kona Office 74-5044 Ane Keohokalole Hwy Building D 2nd Floor Kailua-Kona HI 96740 Phone 808 961-8354 Phone 808 323-4881 NON-DEDICATED AGRICULTURAL USE APPLICATION DEADLINE TO FILE IS DECEMBER 31ST IF APPROVED THIS WILL BE EFFECTIVE THE...

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign HI RP 19-57

Edit your HI RP 19-57 form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your HI RP 19-57 form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit HI RP 19-57 online

Follow the steps below to use a professional PDF editor:

1

Log into your account. If you don't have a profile yet, click Start Free Trial and sign up for one.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit HI RP 19-57. Replace text, adding objects, rearranging pages, and more. Then select the Documents tab to combine, divide, lock or unlock the file.

4

Save your file. Choose it from the list of records. Then, shift the pointer to the right toolbar and select one of the several exporting methods: save it in multiple formats, download it as a PDF, email it, or save it to the cloud.

The use of pdfFiller makes dealing with documents straightforward.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

HI RP 19-57 Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out HI RP 19-57

How to fill out HI RP 19-57

01

Step 1: Gather all necessary personal information such as your name, address, and contact details.

02

Step 2: Collect relevant financial information, including income sources and expenses.

03

Step 3: Carefully read the instructions provided with the HI RP 19-57 form.

04

Step 4: Fill out each section of the form accurately, ensuring all information is complete.

05

Step 5: Review your completed form for any errors or omissions.

06

Step 6: Sign and date the form as required.

07

Step 7: Submit the form to the appropriate agency or department as instructed.

Who needs HI RP 19-57?

01

Individuals applying for benefits or assistance programs that require the HI RP 19-57 form.

02

Applicants seeking to update their financial information for ongoing support.

03

People undergoing processes that require proof of income or financial status.

Fill

form

: Try Risk Free

People Also Ask about

What is the senior discount for property taxes in Hawaii?

The basic home exemption for homeowners 60 to 69 years of age is $80,000. The basic home exemption for homeowners 70 years of age or over is $100,000. In addition to the basic exemption amount, an additional exemption of 20 percent of the assessed value of the property is also applied to reduce the net taxable value.

Do you have to file home exemption every year in Hawaii?

Once filed and granted, these home and real property exemptions do not have to re-filed annually, as long as all requirements continue to be met.

What is tax exemption owner occupancy Hawaii?

HOME EXEMPTION REQUIREMENTS The real property must be owned and occupied as the owner's principal home as of the assessment date by an individual or individuals. Owner's principal home means occupancy by the owner of the home in the city for more than 270 calendar days of a calendar year.

How do I get ag exemption in Hawaii?

How can I get an agriculture use assessment? If the property is zoned agriculture and in actual agricultural use, you need to file the Agriculture Notification Memo. If the property is not zoned for agriculture, contact an Appraiser at our office at (808) 270-7297 for further details.

How do I get agricultural exemption in Idaho?

The owner must make an initial application and must show that the land was actively devoted to agriculture during the last three growing seasons and · Agriculturally produces for sale or home consumption the equivalent of 15% or more of the owners' or lessees' annual gross income or · Agriculturally produced gross

How much is home exemption in Hawaii?

Beginning with the 2020 assessment (2020-2021 tax year) the basic home exemption for homeowners under 65 will be $100,000. This means that $100,000 is deducted from the assessed value of the property and the homeowner is taxed on the balance. For homeowners 65 years and older the home exemption will be $140,000.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I execute HI RP 19-57 online?

Filling out and eSigning HI RP 19-57 is now simple. The solution allows you to change and reorganize PDF text, add fillable fields, and eSign the document. Start a free trial of pdfFiller, the best document editing solution.

Can I create an eSignature for the HI RP 19-57 in Gmail?

With pdfFiller's add-on, you may upload, type, or draw a signature in Gmail. You can eSign your HI RP 19-57 and other papers directly in your mailbox with pdfFiller. To preserve signed papers and your personal signatures, create an account.

How do I complete HI RP 19-57 on an Android device?

Use the pdfFiller mobile app to complete your HI RP 19-57 on an Android device. The application makes it possible to perform all needed document management manipulations, like adding, editing, and removing text, signing, annotating, and more. All you need is your smartphone and an internet connection.

What is HI RP 19-57?

HI RP 19-57 is a specific form or report used for certain regulatory or compliance purposes, often related to health insurance or Medicare reporting.

Who is required to file HI RP 19-57?

Entities or individuals involved in specific health insurance practices or Medicare programs may be required to file HI RP 19-57.

How to fill out HI RP 19-57?

To fill out HI RP 19-57, you need to follow the instructions provided with the form, which typically includes entering relevant data in designated fields and ensuring all necessary information is accurate.

What is the purpose of HI RP 19-57?

The purpose of HI RP 19-57 is to collect specific information related to health insurance practices for compliance, regulatory reporting, or data analysis.

What information must be reported on HI RP 19-57?

The information that must be reported on HI RP 19-57 includes data such as participant details, coverage information, and any relevant health insurance metrics.

Fill out your HI RP 19-57 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

HI RP 19-57 is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.