Get the free Economic Injury Disaster Loan Application - gpo

Show details

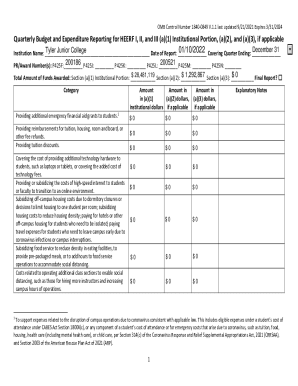

This document outlines the application process for economic injury disaster loans specifically targeting certified disadvantaged business enterprises and small businesses for short-term working capital

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign economic injury disaster loan

Edit your economic injury disaster loan form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your economic injury disaster loan form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit economic injury disaster loan online

Here are the steps you need to follow to get started with our professional PDF editor:

1

Check your account. In case you're new, it's time to start your free trial.

2

Upload a file. Select Add New on your Dashboard and upload a file from your device or import it from the cloud, online, or internal mail. Then click Edit.

3

Edit economic injury disaster loan. Add and change text, add new objects, move pages, add watermarks and page numbers, and more. Then click Done when you're done editing and go to the Documents tab to merge or split the file. If you want to lock or unlock the file, click the lock or unlock button.

4

Get your file. Select the name of your file in the docs list and choose your preferred exporting method. You can download it as a PDF, save it in another format, send it by email, or transfer it to the cloud.

It's easier to work with documents with pdfFiller than you can have believed. You can sign up for an account to see for yourself.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out economic injury disaster loan

How to fill out Economic Injury Disaster Loan Application

01

Gather necessary documents, including financial statements, tax returns, and business information.

02

Visit the U.S. Small Business Administration (SBA) website.

03

Locate the Economic Injury Disaster Loan (EIDL) application section.

04

Fill out the application form with accurate business details and financial data.

05

Specify the amount of loan needed and how it will help in recovery.

06

Review the application for completeness and accuracy.

07

Submit the application electronically or by mail as instructed.

Who needs Economic Injury Disaster Loan Application?

01

Small businesses affected by disasters, including natural disasters, economic downturns, and public health emergencies.

02

Non-profit organizations that have suffered economic injury due to a disaster.

03

Self-employed individuals and independent contractors experiencing a significant loss of income.

Fill

form

: Try Risk Free

People Also Ask about

How to apply for a FEMA disaster loan?

You may apply online at any time from the MySBA Loan Portal. To get direct help from SBA, you may apply in person at one of the centers below: FEMA Disaster Recovery Center (DRC) SBA Disaster Loan Outreach Center.

What is the most FEMA will pay out?

Aside from risky industries, there are also those that are excluded from SBA loans, no matter how good the rest of your application is. Excluded business types include life insurance companies, lobbying organizations, certain types of franchises, cannabis-based businesses, certain types of health businesses, and more.

How to apply for disaster loan?

You may apply online at any time from the MySBA Loan Portal. To get direct help from SBA, you may apply in person at one of the centers below: FEMA Disaster Recovery Center (DRC) SBA Disaster Loan Outreach Center.

Is the EIDL loan still available?

As of January 1, 2022, SBA stopped accepting applications for new COVID-19 EIDL loans or advances. As of May 6, 2022, SBA is no longer processing COVID-19 EIDL loan increase requests or requests for reconsideration of previously declined loan applications.

Is it hard to get approved for an SBA disaster loan?

You have a low credit score However, the required value typically depends on which lender you choose and may not need to be as high when applying for a Disaster Loan. Unfortunately even under these circumstances, if you don't have great credit, you will most likely not receive an SBA loan.

What is the economic injury disaster loan program?

Economic Injury Disaster Loan (EIDL) - assists with operational costs whether or not a disaster caused physical damage to a business. Home and personal property loans - helps homeowners and renters replace or repair damaged homes, cars, appliances, furniture, and clothing.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is Economic Injury Disaster Loan Application?

The Economic Injury Disaster Loan Application is a form used to apply for financial assistance from the Small Business Administration (SBA) to help businesses recover from the economic impacts of a disaster.

Who is required to file Economic Injury Disaster Loan Application?

Businesses, including sole proprietors, partnerships, and corporations that have suffered financial losses due to a declared disaster are required to file the Economic Injury Disaster Loan Application.

How to fill out Economic Injury Disaster Loan Application?

To fill out the Economic Injury Disaster Loan Application, applicants must complete the application form provided by the SBA, gather necessary documentation that shows financial losses, and submit the application online or by mail.

What is the purpose of Economic Injury Disaster Loan Application?

The purpose of the Economic Injury Disaster Loan Application is to provide financial support to businesses affected by disasters, enabling them to meet their operating expenses and recover more effectively.

What information must be reported on Economic Injury Disaster Loan Application?

Applicants must report information including business ownership details, financial statements, tax returns, and the specifics of the economic injury incurred due to the disaster.

Fill out your economic injury disaster loan online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Economic Injury Disaster Loan is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.