ME MRS 706ME 2008 free printable template

Show details

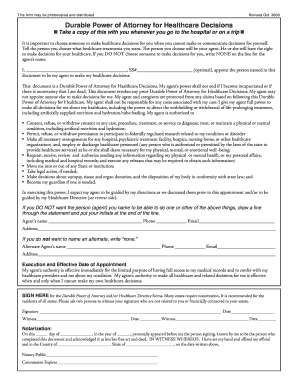

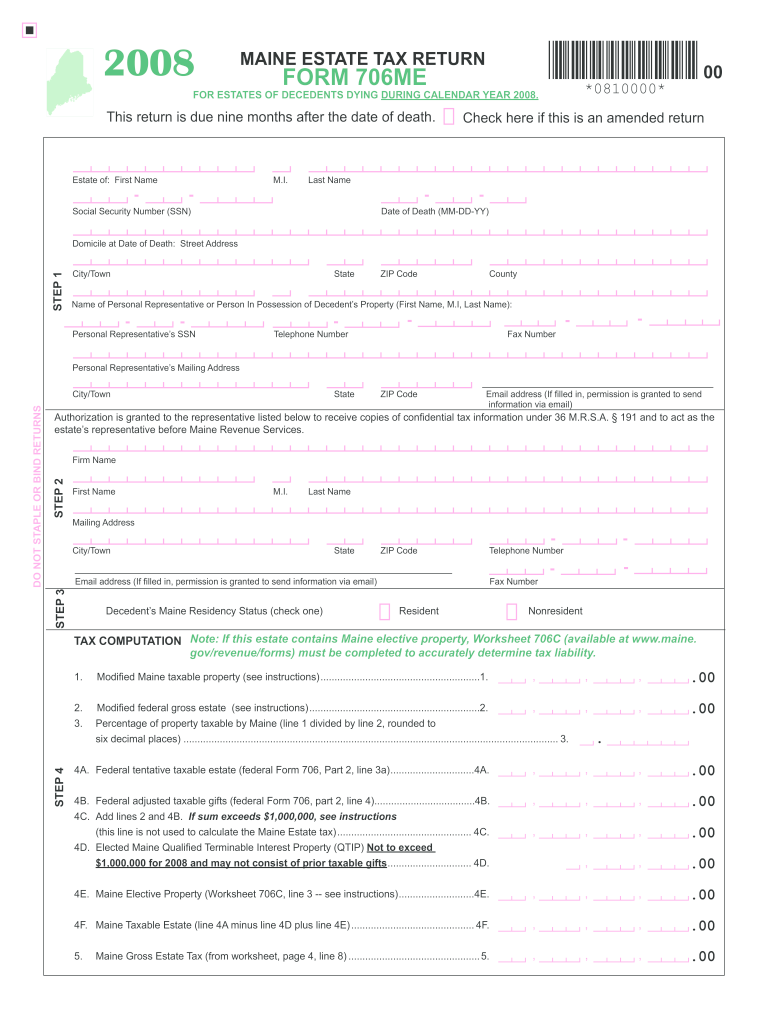

2008 Estate of:Filename MAINE ESTATE TAX RETURN FOR ESTATES OF DECEDENTS DYING DURING CALENDAR YEAR 2008. FORM 706ME *0810000 00 Thisreturnisdueninemonthsafterthedateofdeath. Checkhereifthisisanamendedreturn

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign ME MRS 706ME

Edit your ME MRS 706ME form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your ME MRS 706ME form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit ME MRS 706ME online

Here are the steps you need to follow to get started with our professional PDF editor:

1

Log into your account. In case you're new, it's time to start your free trial.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit ME MRS 706ME. Add and change text, add new objects, move pages, add watermarks and page numbers, and more. Then click Done when you're done editing and go to the Documents tab to merge or split the file. If you want to lock or unlock the file, click the lock or unlock button.

4

Get your file. When you find your file in the docs list, click on its name and choose how you want to save it. To get the PDF, you can save it, send an email with it, or move it to the cloud.

pdfFiller makes dealing with documents a breeze. Create an account to find out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

ME MRS 706ME Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out ME MRS 706ME

How to fill out ME MRS 706ME

01

Begin by gathering all necessary personal and financial documents.

02

Start filling out the personal information section at the top of the form, including your name, address, and social security number.

03

Move to the income section and report all sources of income, ensuring you provide accurate figures.

04

Complete the expenses section by detailing your monthly expenses, such as housing costs, utilities, and any outstanding debts.

05

Check the eligibility requirements listed on the form to ensure you meet them.

06

Review all provided information for accuracy and completeness before submitting.

07

Submit the completed form to the appropriate agency or organization as directed.

Who needs ME MRS 706ME?

01

Individuals seeking financial assistance or benefits.

02

Residents applying for government programs related to health, housing, or financial aid.

03

Families or individuals facing economic hardship and needing support.

Fill

form

: Try Risk Free

People Also Ask about

How can I avoid paying taxes after selling my house?

Home sales can be tax free as long as the condition of the sale meets certain criteria: The seller must have owned the home and used it as their principal residence for two out of the last five years (up to the date of closing). The two years do not have to be consecutive to qualify.

What is the estate tax exemption in Maine 2023?

Maine Estate Tax Exemption The estate tax threshold for Maine is $6.01 million in 2022 and $6.41 million in 2023. If your estate is worth less than that, Maine won't charge estate tax on it.

Do I have to pay taxes when I sell my house in Maine?

Note: Federally taxable gains on the sale of Maine real property are taxable by Maine, even if the total consideration is less than $100,000.

What is the capital gains tax on inherited property in Maine?

Capital Gains Tax: Capital gains tax is imposed when you sell the house, not while inheriting it. The IRS (Internal Revenue Service) authority levies the tax on a stepped-up basis. Maine imposes the standard capital gains tax at a rate of 7.15%.

Is Maine exempt from capital gains tax?

Maine does not have a special capital gains tax rate and, due to the state's federal conformity tie-in provision, generally follows federal law concerning the following: the partial exclusion for sale of small business stock (IRC Sec. 1202);

Can you avoid the Maine state tax when you sell your home?

Some individuals may be eligible for an exemption or reduction of the required REW payment. To apply for an exemption or reduction, use Form REW-5. This form must be submitted at least 5 business days prior to the closing. Forms not received timely may be denied an exemption or reduction.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I manage my ME MRS 706ME directly from Gmail?

Using pdfFiller's Gmail add-on, you can edit, fill out, and sign your ME MRS 706ME and other papers directly in your email. You may get it through Google Workspace Marketplace. Make better use of your time by handling your papers and eSignatures.

How can I send ME MRS 706ME for eSignature?

ME MRS 706ME is ready when you're ready to send it out. With pdfFiller, you can send it out securely and get signatures in just a few clicks. PDFs can be sent to you by email, text message, fax, USPS mail, or notarized on your account. You can do this right from your account. Become a member right now and try it out for yourself!

How do I make changes in ME MRS 706ME?

pdfFiller not only allows you to edit the content of your files but fully rearrange them by changing the number and sequence of pages. Upload your ME MRS 706ME to the editor and make any required adjustments in a couple of clicks. The editor enables you to blackout, type, and erase text in PDFs, add images, sticky notes and text boxes, and much more.

What is ME MRS 706ME?

ME MRS 706ME is the Maine Estate Tax Return form required for reporting estate tax liabilities in the state of Maine.

Who is required to file ME MRS 706ME?

Fiduciaries of estates that exceed a certain value threshold at the time of the decedent's death are required to file ME MRS 706ME.

How to fill out ME MRS 706ME?

ME MRS 706ME can be filled out by providing information on the decedent's assets, liabilities, and deductions, along with necessary identification details in accordance with the form's instructions.

What is the purpose of ME MRS 706ME?

The purpose of ME MRS 706ME is to calculate and report the estate tax owed to the state of Maine based on the net value of the estate.

What information must be reported on ME MRS 706ME?

ME MRS 706ME requires the reporting of the decedent's full name, date of death, details of the estate's assets, liabilities, deductions, and the computation of the estate tax due.

Fill out your ME MRS 706ME online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

ME MRS 706me is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.