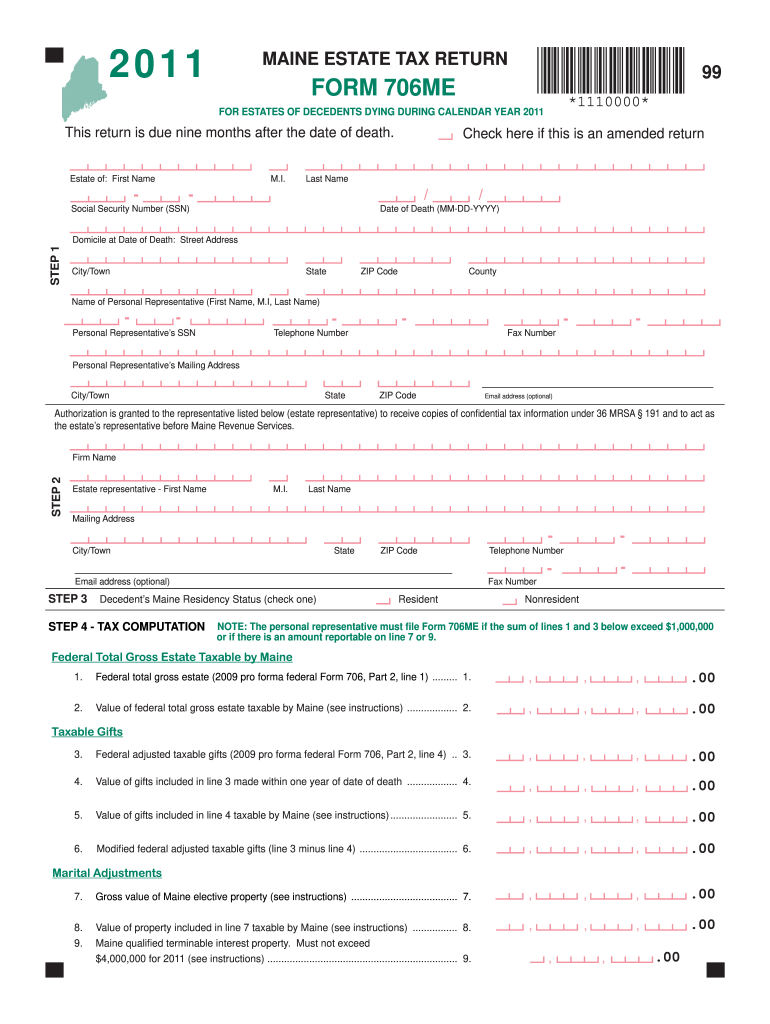

ME MRS 706ME 2011 free printable template

Get, Create, Make and Sign ME MRS 706ME

How to edit ME MRS 706ME online

Uncompromising security for your PDF editing and eSignature needs

ME MRS 706ME Form Versions

How to fill out ME MRS 706ME

How to fill out ME MRS 706ME

Who needs ME MRS 706ME?

Instructions and Help about ME MRS 706ME

Hi, hi folks 1945 Okinawa Japan the war is over there's a few the United States establishes some military bases on the island not elope they disestablished new ones, or they took over comment Japanese military bases but what a subspace established or a comma did in 1945 was in the world area now houses in London nothing well over the last 17 years the population started moving and expanding in building homes and businesses in schools recreational centers all around the circumference of the air base and if the wrong people start to say gee what's that sound kyllikki walkers it's a quick look at the recipient and belongs to those Americans that would plan to make it all this noise close it up kinematic so remain the point of contention because the populace that moved in here at airport were irritated by sounds from an airport anybody and so negotiation between United States government in the national government Japan they agreed to move that air base close it down and move it to another portion of the island which is less populated, so construction started and here's with the Liberals the leftist the Communists on the island started protesting you see, so the plane was it because it was an among a populated area as their first claim the intention was just there to begin with they want Yankees to go home the anti-American those who were protesting the base so that the governor of Okinawa is the actual article that appeared in the Dallas Morning News he issued an order rescinding the permit allowing the Americans to build that base and allies populated in it yeah he said you can't build a base oddly we don't want your base in that less populated area in other words when he canceled the permit to build that base he validated the base where it is among the pop, so the company wants the base to stay among the populace even though the populace doesn't want it there he's ignored of those constituents who are agitated by that airbase yeah it's said instead of pooping it do it less populated area you see folks it's further proof you cannot give in to liberals they complain the air base was there okay we'll close it we were to lower Larry, and then they could put they got there Vicki there, but they won't satisfy now they want that that close in the new less populated area because liberals are never satisfied they get 150 they move to the second one on to the third one on to the fourth one that's why the first time they hideous heads you to pound it down and suppress them immediately no matter how innocent it may seem they're evil in their intentions Vincent kids now let's talk about closing all the bases as these piece of people want the Philippines seven years ago remember that's your neighborhood country 922 miles to the southwest there's the Philippines and the Philippines sold the Americans Yankee go home close your bases we don't want you here so now who filled in the boy now the Americans left your good old friends the Chinese Communist started...

People Also Ask about

Do you pay taxes on inheritance in Maine?

Do I have to put my inheritance on my taxes?

What is the Maine estate tax exemption?

Is Maine estate tax exemption portable?

Do I need to file a Maine estate tax return?

How much inheritance is tax free for Maine?

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I make edits in ME MRS 706ME without leaving Chrome?

How can I edit ME MRS 706ME on a smartphone?

How do I fill out ME MRS 706ME on an Android device?

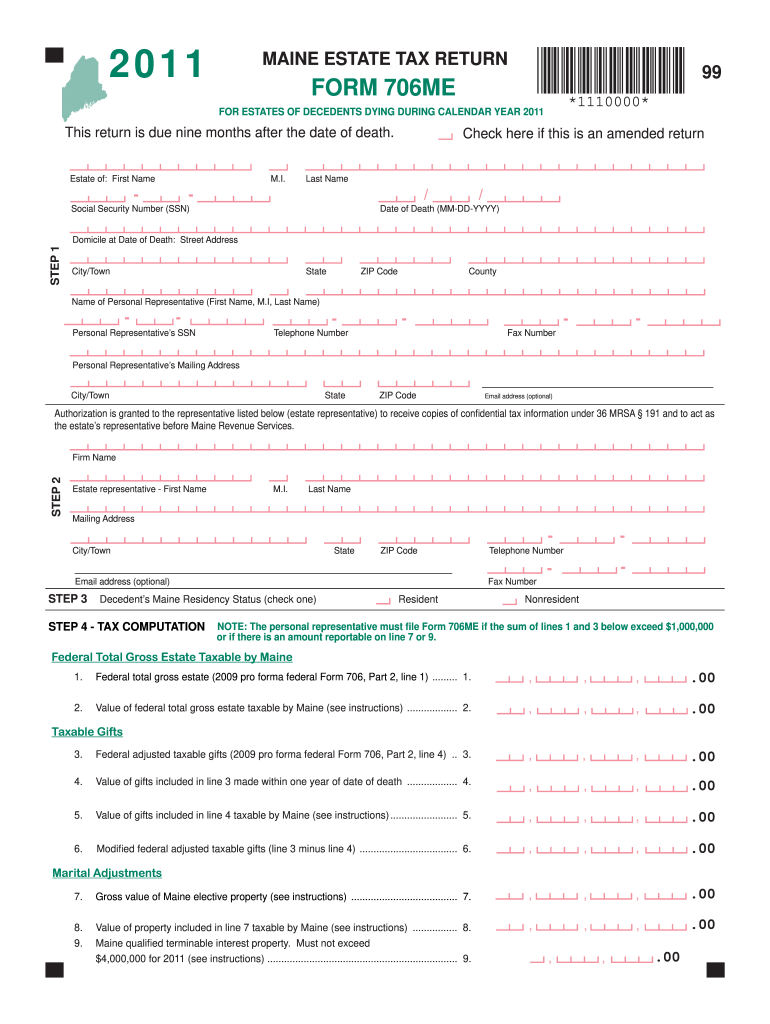

What is ME MRS 706ME?

Who is required to file ME MRS 706ME?

How to fill out ME MRS 706ME?

What is the purpose of ME MRS 706ME?

What information must be reported on ME MRS 706ME?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.