Get the free Contractors Surety Application Questionnaire

Show details

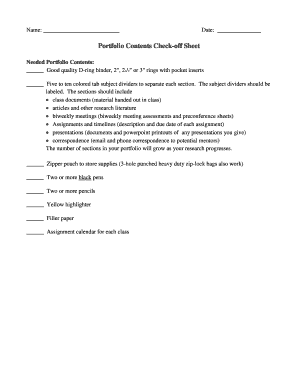

This document serves as a comprehensive guide for contractors seeking surety bonds and insurance services. It includes a checklist of required documentation, a bonding submission guide, a bid/final

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign contractors surety application questionnaire

Edit your contractors surety application questionnaire form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your contractors surety application questionnaire form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing contractors surety application questionnaire online

Follow the guidelines below to benefit from a competent PDF editor:

1

Log in to account. Click Start Free Trial and sign up a profile if you don't have one yet.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit contractors surety application questionnaire. Add and change text, add new objects, move pages, add watermarks and page numbers, and more. Then click Done when you're done editing and go to the Documents tab to merge or split the file. If you want to lock or unlock the file, click the lock or unlock button.

4

Save your file. Select it from your records list. Then, click the right toolbar and select one of the various exporting options: save in numerous formats, download as PDF, email, or cloud.

With pdfFiller, it's always easy to work with documents. Check it out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out contractors surety application questionnaire

How to fill out Contractors Surety Application Questionnaire

01

Read the introduction and instructions carefully.

02

Gather all necessary documentation and information, including company details and financial statements.

03

Start filling out the company information section with accurate details about the contractor.

04

Provide a list of completed projects along with references for each project.

05

Detail the financial status by including balance sheets, income statements, and cash flow projections.

06

Address any legal or bond-related issues by disclosing relevant information.

07

Complete the section regarding owner and key personnel backgrounds.

08

Review the application for accuracy and completeness before submission.

Who needs Contractors Surety Application Questionnaire?

01

Contractors seeking to obtain surety bonds.

02

Construction companies applying for project financing that requires surety.

03

General contractors and subcontractors looking to establish credibility with clients.

04

Business owners needing insurance for upcoming construction projects.

Fill

form

: Try Risk Free

People Also Ask about

What are the 3 C's of contract law?

Today, we're diving into the core components that make up a legally binding contract, often referred to as the 3 C's: Capacity, Consent, and Consideration. Understanding these key elements can help you navigate legal agreements with confidence and clarity.

What are the 3 C's of insurance?

The 3 C's of credit—character, capacity, and collateral—are a widely-used framework for evaluating potential borrowers' creditworthiness.

What are the 3 C's of underwriting?

Surety underwriting is a meticulous process that evaluates the risk associated with providing a guarantee for the performance of a contractual obligation, a surety bond. The foundation of the evaluation are the three fundamental pillars known as the 3 C's of surety: character, capacity, and capital.

How to fill out a surety bond application?

How to Fill Out a Surety Bond Form Bond Number. The bond number is the unique identification number assigned to your bond. Bond Premium. This is the cost of your bond, typically calculated as a percentage of your bond coverage. Principal Name. Surety Name. State of Incorporation. Obligee Name. Bond Amount. Bond Obligation.

How much does a $20,000 surety bond cost?

A $20,000 surety bond can cost as little as $150 for applicants with a good credit score, or go as high as $2,000 for applicants with poor credit. As shown in the chart above, the premium for applicants with good credit can be anywhere between 0.75% and 3% of the bond amount.

What are the 3 C's of surety?

A number of these factors fall under what the Surety industry calls “The Three C's”; Character, Capacity, and Capital. All three of these are important to the underwriting process. The principal needs to exhibit the Character, Capacity, and Capital to qualify for surety credit.

How much does a $1,000,000 surety bond cost?

Surety bond premiums are calculated as a small percentage of the bond amount. $1,000,000 surety bonds typically cost 0.5–10% of the bond amount, or $5,000–$100,000. Highly qualified applicants with strong credit might pay just $5,000 to $1,000 while an individual with poor credit will receive a higher rate.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is Contractors Surety Application Questionnaire?

The Contractors Surety Application Questionnaire is a form used by contractors to provide detailed information about their business, financial standing, and experience to surety companies to obtain surety bonds.

Who is required to file Contractors Surety Application Questionnaire?

Contractors seeking surety bonds for their projects are required to file the Contractors Surety Application Questionnaire.

How to fill out Contractors Surety Application Questionnaire?

To fill out the Contractors Surety Application Questionnaire, contractors should provide accurate information regarding their business structure, financial data, relevant project history, and any additional documentation requested by the surety company.

What is the purpose of Contractors Surety Application Questionnaire?

The purpose of the Contractors Surety Application Questionnaire is to assess the risk involved in granting surety bonds to contractors by evaluating their qualifications and capacity to complete projects.

What information must be reported on Contractors Surety Application Questionnaire?

The information that must be reported includes the contractor’s business profile, financial statements, project experience, references, and additional relevant details as required by the surety provider.

Fill out your contractors surety application questionnaire online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Contractors Surety Application Questionnaire is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.