Get the free County Equalization Complaint - judiciary state nj

Show details

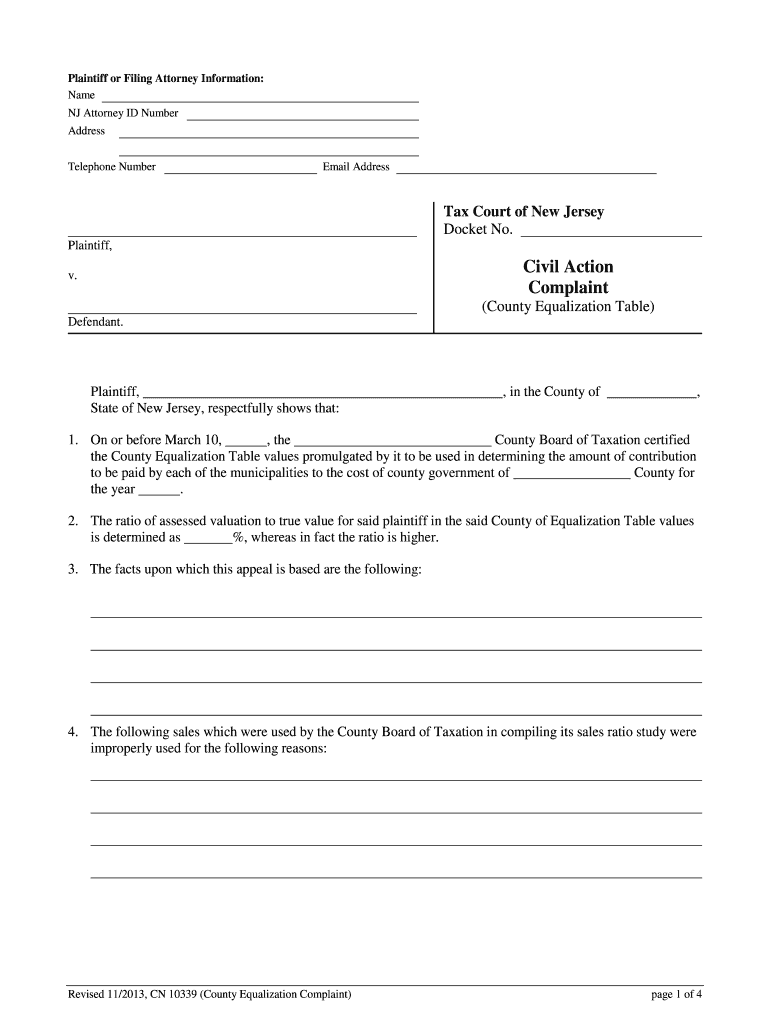

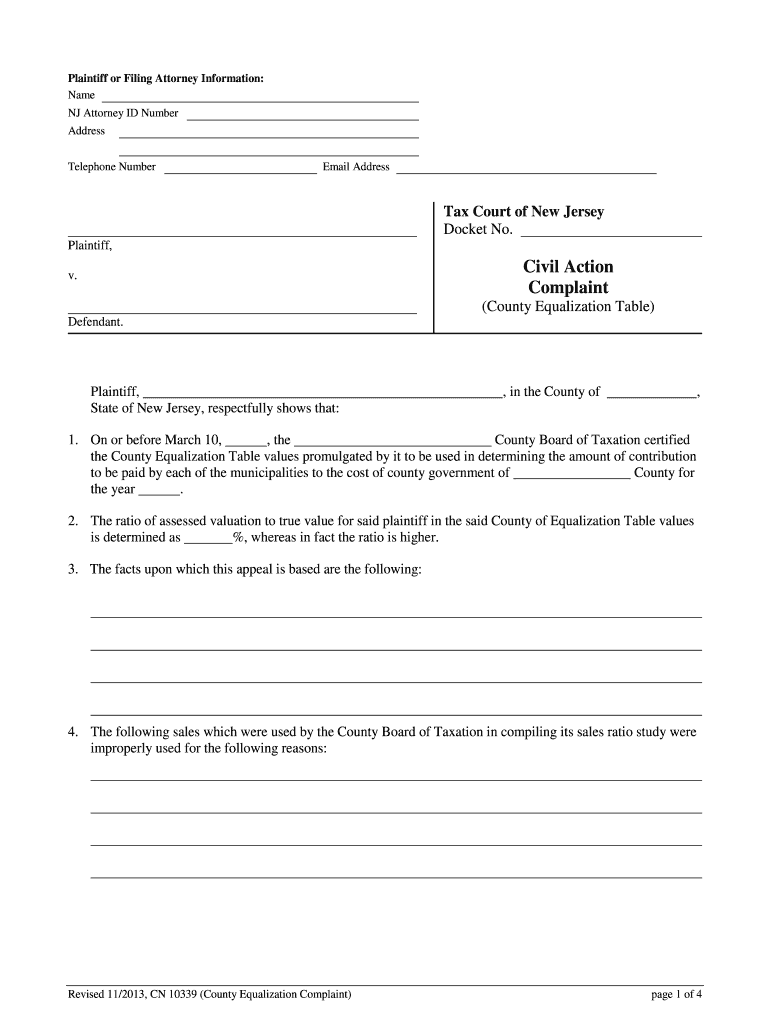

This document is used to file a complaint in the Tax Court of New Jersey, concerning the County Equalization Table values for taxation purposes.

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign county equalization complaint

Edit your county equalization complaint form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your county equalization complaint form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit county equalization complaint online

Follow the steps down below to take advantage of the professional PDF editor:

1

Check your account. In case you're new, it's time to start your free trial.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit county equalization complaint. Add and change text, add new objects, move pages, add watermarks and page numbers, and more. Then click Done when you're done editing and go to the Documents tab to merge or split the file. If you want to lock or unlock the file, click the lock or unlock button.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

Dealing with documents is always simple with pdfFiller.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out county equalization complaint

How to fill out County Equalization Complaint

01

Obtain the County Equalization Complaint form from your local county assessor's office or website.

02

Review the instructions provided with the form to understand the requirements.

03

Fill out your personal information, including your name, address, and property details.

04

Provide the reason for your complaint, citing specific issues related to property valuation.

05

Attach any supporting documentation that substantiates your claim, such as tax assessments or comparable property information.

06

Sign and date the complaint form to certify that the information is accurate.

07

Submit the completed form to the appropriate county office by the specified deadline.

Who needs County Equalization Complaint?

01

Property owners who believe their property has been incorrectly assessed for tax purposes.

02

Individuals who want to contest their property tax valuation to potentially reduce their tax liability.

Fill

form

: Try Risk Free

People Also Ask about

What does the County Board of Equalization do?

The BOE has a critical role in California's property tax system. The BOE is responsible for assessing property owned or used by railroads and privately-held public utilities and for ensuring statewide uniformity in the assessment of properties by the 58 County Assessors.

Should I challenge my property tax assessment?

Yes. Always fight your property tax assessment no matter what, for as long as it results in a tax bill greater than $0.

How do I challenge a property tax assessment in California?

You must file an Assessment Appeal Application, form BOE-305-AH, obtained from the clerk of the board of the county where your property is located.

How to successfully appeal a property tax assessment?

Six Steps to Appeal Your Property Tax Bill Step 1: Know the rules. Step 2: Check for the property tax breaks you deserve. Step 3: Go set the record straight. Step 4: Check the comparables. Step 5: Gather evidence and build your case. Step 6: Consider a professional appraiser.

Can you contest property taxes in California?

If a taxpayer disagrees with the value established for a property, they should discuss the issue with the Assessor's staff in the county where the property is located. If an agreement cannot be reached, then taxpayers have a right to appeal the value under certain circumstances and limitations.

What is the remedy of a property owner who disagrees with the assessment value of his property as issued by the local assessor?

Property owners have the right to file a formal appeal with the Assessment Appeals Board, which acts as an impartial third party in disputes between the property owner and Assessor.

What is the best evidence to protest property taxes?

The best type of documents is usually estimates for repairs from contractors and photographs of physical problems. All documentation should be signed and attested. This means you must furnish "documented" evidence of your property's needs.

What is the remedy of a property owner who disagrees with the assessment value of his property as issued by the local assessor?

Property owners have the right to file a formal appeal with the Assessment Appeals Board, which acts as an impartial third party in disputes between the property owner and Assessor.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is County Equalization Complaint?

A County Equalization Complaint is a formal request filed by taxpayers to contest the assessed value of their property set by the local tax authority. It aims to ensure that property assessments are fair and equitable.

Who is required to file County Equalization Complaint?

Any property owner who believes their property has been overvalued or assessed incorrectly is required to file a County Equalization Complaint.

How to fill out County Equalization Complaint?

To fill out a County Equalization Complaint, the property owner needs to obtain the complaint form from the county assessor's office, provide required personal and property information, state the grounds for the complaint, and submit it before the deadline.

What is the purpose of County Equalization Complaint?

The purpose of the County Equalization Complaint is to correct discrepancies in property assessments to ensure that all taxpayers are treated fairly and that property taxes are based on accurate property values.

What information must be reported on County Equalization Complaint?

Information that must be reported on a County Equalization Complaint includes the property owner’s name, address, property address, assessment value of the property, reasons for the complaint, and any supporting evidence or documentation.

Fill out your county equalization complaint online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

County Equalization Complaint is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.