Get the free Changes to Workers’ Compensation Division audits - wcd oregon

Show details

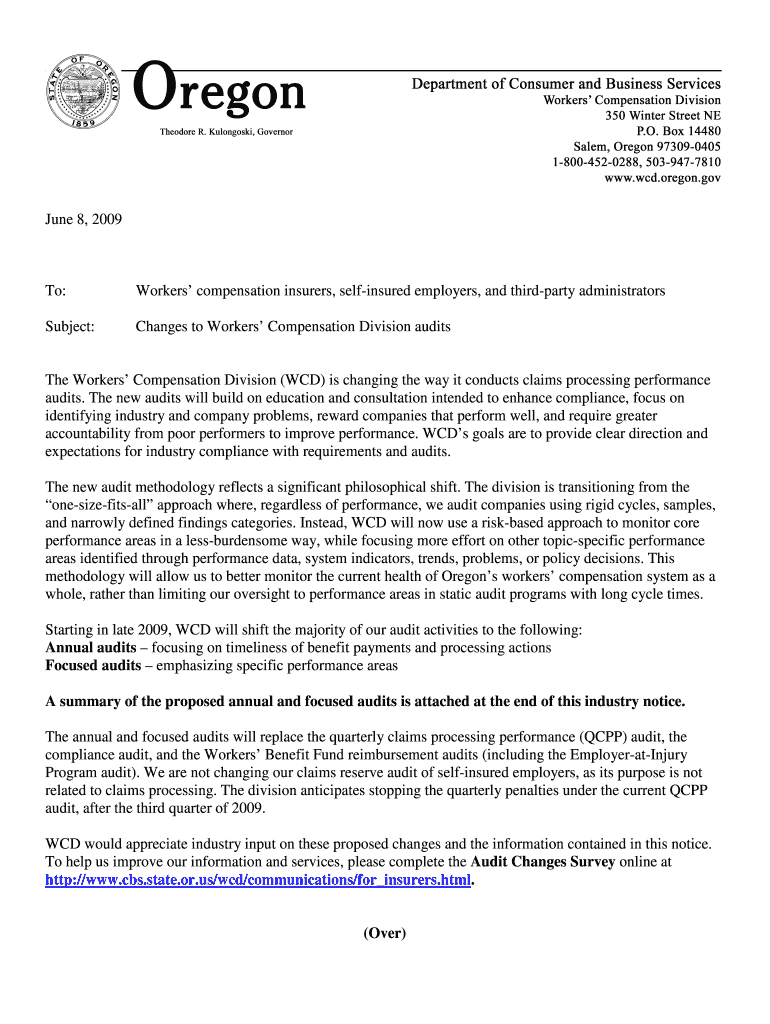

This document outlines changes to the Workers’ Compensation Division's approach to conducting claims processing performance audits, including a shift to a risk-based methodology and new focus on

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign changes to workers compensation

Edit your changes to workers compensation form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your changes to workers compensation form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing changes to workers compensation online

To use the services of a skilled PDF editor, follow these steps:

1

Log into your account. In case you're new, it's time to start your free trial.

2

Simply add a document. Select Add New from your Dashboard and import a file into the system by uploading it from your device or importing it via the cloud, online, or internal mail. Then click Begin editing.

3

Edit changes to workers compensation. Add and replace text, insert new objects, rearrange pages, add watermarks and page numbers, and more. Click Done when you are finished editing and go to the Documents tab to merge, split, lock or unlock the file.

4

Save your file. Select it from your records list. Then, click the right toolbar and select one of the various exporting options: save in numerous formats, download as PDF, email, or cloud.

With pdfFiller, it's always easy to work with documents. Check it out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

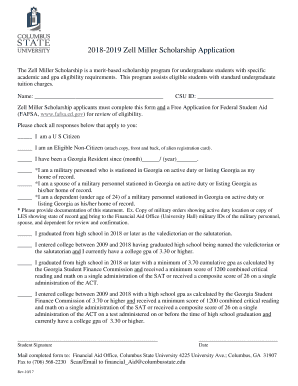

How to fill out changes to workers compensation

How to fill out Changes to Workers’ Compensation Division audits

01

Gather relevant documentation regarding the audit period.

02

Review the specific audit requirements provided by the Workers’ Compensation Division.

03

Complete the audit forms by accurately entering all necessary information.

04

Attach any required supporting documents, such as payroll records and insurance details.

05

Double-check all entries for accuracy and completeness.

06

Submit the completed audit forms and documents to the appropriate Workers’ Compensation Division office by the deadline.

Who needs Changes to Workers’ Compensation Division audits?

01

Employers who provide workers' compensation insurance to their employees.

02

Insurance companies that issue workers' compensation policies.

03

Businesses undergoing a compliance review mandated by state regulations.

Fill

form

: Try Risk Free

People Also Ask about

What should be included in a workers compensation progress report?

At each doctor's visit, an injured worker should request a copy of the physician progress report (PPR) that shows notes about the worker's injury, diagnosis, treatments, physical limitations, improvements, and work status.

How far back can a workers' comp audit go?

Here's how far back an insurance company can go to audit you: August 2021 - August 2022: Workers' comp insurance policy period. August 2022 - August 2023: You can be audited in any state. August 2023 - August 2024: You can be audited in any state except California.

What happens if I don't do a workers' comp audit?

In addition, failure to cooperate with the audit may result in a cancellation of workers' compensation coverage. Audit non-compliance will disqualify an employer from obtaining coverage from any insurance company until the outstanding audit is completed.

What is included in a workers compensation audit?

Your auditor will want to see your company's cash flow, expenses, cash disbursements, and general ledger. Tax reports. Include employee W-2s and 1099s for all employees and independent contractors plus Form 941, Form 944, and other federal tax return forms for your company.

Why is my workers' comp claim being investigated?

While most workers' comp claims are straightforward, certain situations raise red flags that prompt insurers or employers to investigate: Suspicion of a fraudulent claim – Obvious signs like altered medical records, inconsistencies, or suspicious timing of an alleged injury justify an investigation.

What is a DWC 7 form?

Workers' Compensation Claim Form (DWC-7) Form DWC-7 is a notice to provide injured workers with rights, benefits and contact information. DOWNLOAD DWC-7 FORM.

What does a workers' comp audit consist of?

A workers' compensation premium audit is the process that determines how much the compensation has changed by the end of the year so that the final premium paid can be made proportionate to the actual compensation amount.

Are bonuses included in a work comp audit?

During an audit, your insurance company will review your payroll records to make sure the premiums you've paid match the payroll your employees have received. Payroll included in a workers' compensation audit includes wages, salaries, bonuses, commissions, and other types of employee compensation.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is Changes to Workers’ Compensation Division audits?

Changes to Workers’ Compensation Division audits refer to modifications or updates in the auditing processes related to workers' compensation claims and management, ensuring compliance with regulations and proper reporting.

Who is required to file Changes to Workers’ Compensation Division audits?

Employers and insurance providers involved in workers' compensation are typically required to file Changes to Workers’ Compensation Division audits to ensure that their practices meet regulatory standards.

How to fill out Changes to Workers’ Compensation Division audits?

To fill out Changes to Workers’ Compensation Division audits, entities must accurately complete the designated audit forms, providing all necessary information regarding their workers' compensation claims and processes, ensuring data accuracy and compliance.

What is the purpose of Changes to Workers’ Compensation Division audits?

The purpose of Changes to Workers’ Compensation Division audits is to ensure accountability, verify compliance with workers' compensation laws, and analyze the effectiveness of claims management practices.

What information must be reported on Changes to Workers’ Compensation Division audits?

The information that must be reported on Changes to Workers’ Compensation Division audits typically includes claim details, payment records, coverage policies, and any discrepancies or adjustments made during the audit period.

Fill out your changes to workers compensation online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Changes To Workers Compensation is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.