Get the free Oregon Corporate Tax Returns 2001

Show details

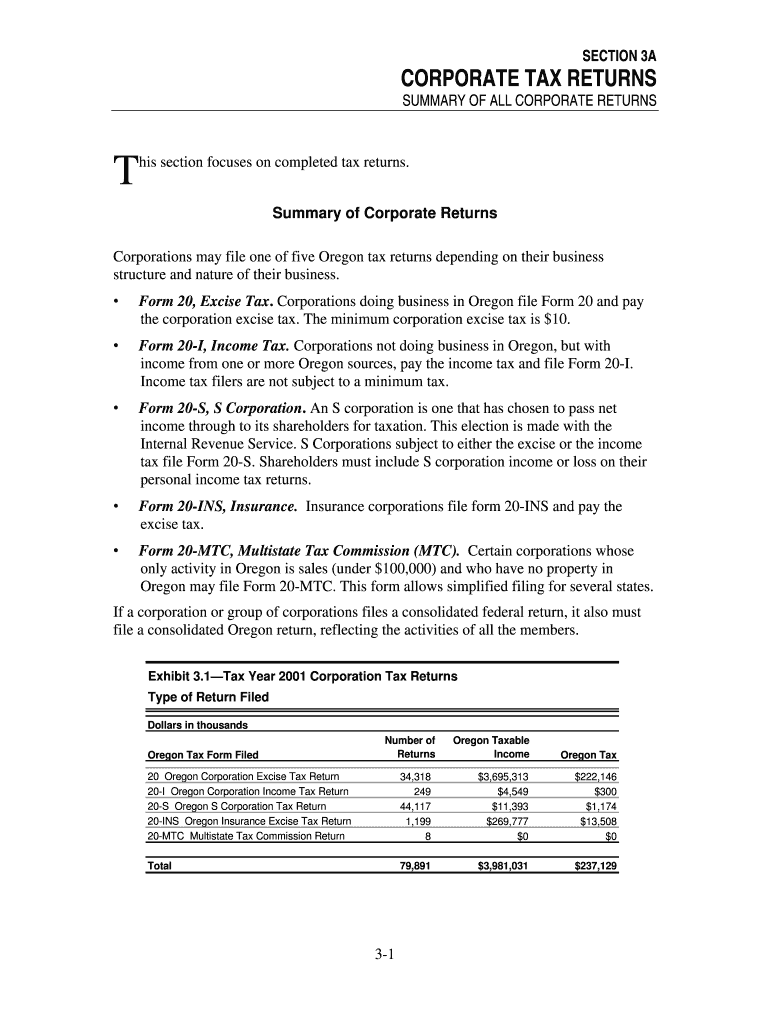

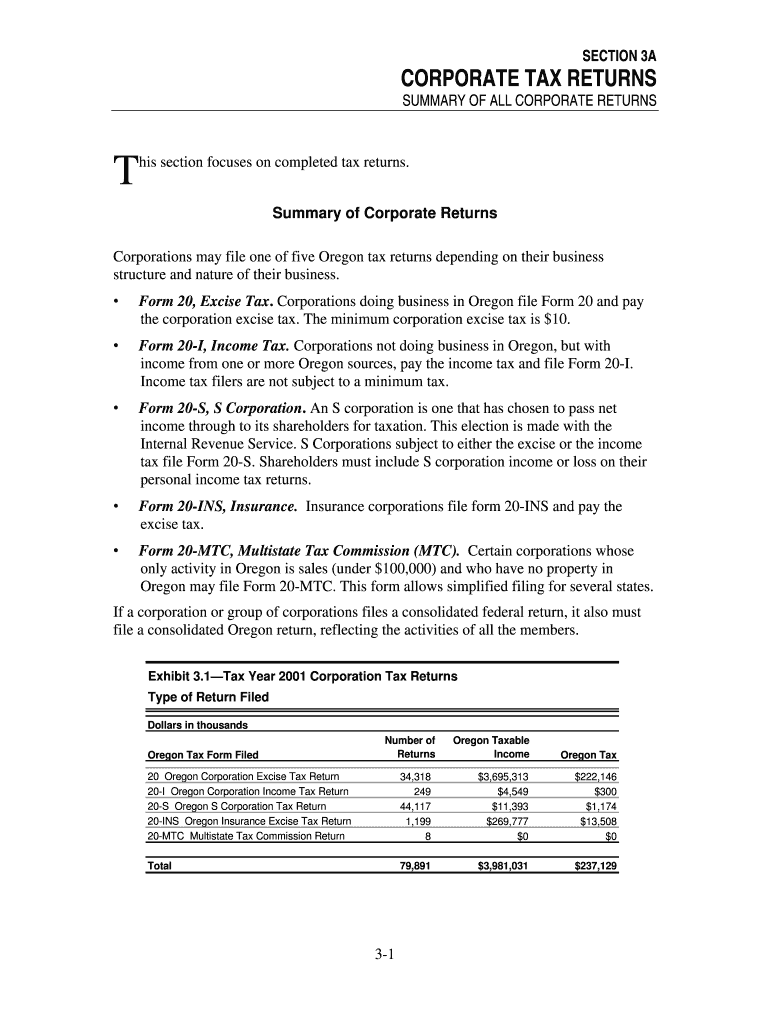

This document summarizes the various types of corporate tax returns filed in Oregon for the year 2001, detailing the requirements and statistics on different tax forms, including excise taxes, income

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign oregon corporate tax returns

Edit your oregon corporate tax returns form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your oregon corporate tax returns form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit oregon corporate tax returns online

Here are the steps you need to follow to get started with our professional PDF editor:

1

Log into your account. It's time to start your free trial.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit oregon corporate tax returns. Replace text, adding objects, rearranging pages, and more. Then select the Documents tab to combine, divide, lock or unlock the file.

4

Save your file. Choose it from the list of records. Then, shift the pointer to the right toolbar and select one of the several exporting methods: save it in multiple formats, download it as a PDF, email it, or save it to the cloud.

pdfFiller makes working with documents easier than you could ever imagine. Register for an account and see for yourself!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out oregon corporate tax returns

How to fill out Oregon Corporate Tax Returns 2001

01

Gather all necessary financial documents, including income statements, balance sheets, and records of deductions.

02

Obtain the Oregon Corporate Tax Return form for the year 2001.

03

Fill out the top portion of the form with your corporate name, address, and federal employer identification number (EIN).

04

Report total income in the appropriate section based on your financial records.

05

Calculate allowable deductions and enter them in the corresponding fields.

06

Determine the corporate tax liability using the rates applicable for the year 2001.

07

Complete any additional required schedules related to specific deductions or credits.

08

Review all entries for accuracy and completeness.

09

Sign and date the form, ensuring that it is authorized by an officer of the corporation.

10

Submit the completed tax return by the due date, either electronically or via mail.

Who needs Oregon Corporate Tax Returns 2001?

01

Any corporation that conducts business in Oregon or earns income from Oregon sources and has tax obligations for the year 2001.

Fill

form

: Try Risk Free

People Also Ask about

What is the 200 day rule in Oregon?

If an individual is not a domiciliary, they may be a resident if the individual maintains a permanent place of abode in Oregon and spends more than 200 days of a taxable year in Oregon unless the individual can prove they are in Oregon for a temporary or transitory purpose.

How to avoid capital gains tax in Oregon?

By statute, an individual is a resident of Oregon under two scenarios. A. An individual who is domiciled in Oregon, unless he a) does not have a permanent place of abode in Oregon; b) maintains a permanent place of abode in a place other than Oregon, and c) spends less than 31 days of a taxable year in Oregon.

What is the statute of limitations on Oregon state tax returns?

Generally, the statute of limitations is three years from the date the return is filed or the due date of the return, whichever is later.

How many days can you live in Oregon without paying taxes?

If an individual is not a domiciliary, they may be a resident if the individual maintains a permanent place of abode in Oregon and spends more than 200 days of a taxable year in Oregon unless the individual can prove they are in Oregon for a temporary or transitory purpose. ORS § 316.027(B).

What are the corporate income tax requirements in Oregon?

Tax Rates and Minimum Tax Oregon's Corporate Income and Excise taxes have a two-tiered structure, applying a 6.6% rate to taxable income up to $1 million, and a 7.6% rate to taxable income above $1 million; the threshold is not indexed for inflation.

What is the 6 month rule in Oregon?

0:38 3:53 And receive a charitable income tax deduction of about 10% of the assets. Current value this canMoreAnd receive a charitable income tax deduction of about 10% of the assets. Current value this can significantly reduce your taxable capital gains.

When did the Oregon corporate activity tax start?

The Corporate Activity Tax (CAT) is an annual tax, established in 2019, and applicable to tax years beginning on or after January 1, 2020. The CAT is imposed on taxpayers for the privilege of doing business in Oregon. The CAT is not a transactional tax, such as a retail sales tax, nor is it an income tax.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is Oregon Corporate Tax Returns 2001?

Oregon Corporate Tax Returns 2001 refers to the specific tax filing requirements and forms that corporations operating in Oregon needed to submit for the tax year 2001. The return is used to report the corporation's income, deductions, and tax liability to the state.

Who is required to file Oregon Corporate Tax Returns 2001?

Corporations doing business in Oregon, including C corporations and S corporations doing business or derived income from Oregon sources, are required to file the Oregon Corporate Tax Returns for the year 2001.

How to fill out Oregon Corporate Tax Returns 2001?

To fill out the Oregon Corporate Tax Returns 2001, corporations must complete the appropriate forms, typically including the Oregon Corporation Excise Tax Return (Form 20) or any applicable schedules, ensuring that all income, deductions, and credits are accurately reported according to state guidelines.

What is the purpose of Oregon Corporate Tax Returns 2001?

The purpose of Oregon Corporate Tax Returns 2001 is to assess the amount of taxes owed by corporations based on their taxable income, ensuring compliance with state tax laws and regulations.

What information must be reported on Oregon Corporate Tax Returns 2001?

The information that must be reported on the Oregon Corporate Tax Returns 2001 includes the corporation's total income, deductions, credits claimed, taxable income, and any other relevant financial information as required by the Oregon Department of Revenue.

Fill out your oregon corporate tax returns online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Oregon Corporate Tax Returns is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.