Get the free SALE OR DONATION OF CONSERVATION EASEMENT APPLICATION FORM

Show details

This document serves as an application form for the sale or donation of a conservation easement to the Jefferson County Farmland Protection Board, detailing property and owner information.

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign sale or donation of

Edit your sale or donation of form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your sale or donation of form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit sale or donation of online

To use the services of a skilled PDF editor, follow these steps:

1

Log in. Click Start Free Trial and create a profile if necessary.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit sale or donation of. Add and change text, add new objects, move pages, add watermarks and page numbers, and more. Then click Done when you're done editing and go to the Documents tab to merge or split the file. If you want to lock or unlock the file, click the lock or unlock button.

4

Save your file. Choose it from the list of records. Then, shift the pointer to the right toolbar and select one of the several exporting methods: save it in multiple formats, download it as a PDF, email it, or save it to the cloud.

pdfFiller makes dealing with documents a breeze. Create an account to find out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out sale or donation of

How to fill out SALE OR DONATION OF CONSERVATION EASEMENT APPLICATION FORM

01

Obtain a copy of the SALE OR DONATION OF CONSERVATION EASEMENT APPLICATION FORM from the appropriate agency or website.

02

Read the instructions carefully to understand the requirements and necessary information.

03

Fill out the applicant's information section, including name, address, and contact details.

04

Provide details about the property involved, including its location, size, and current use.

05

Explain the purpose of the conservation easement and how it contributes to land conservation.

06

Attach any required supporting documents, such as maps, property deeds, or previous environmental assessments.

07

Review the application thoroughly to ensure all sections are completed accurately.

08

Sign and date the application form as required.

09

Submit the completed form along with any attachments to the designated authority.

Who needs SALE OR DONATION OF CONSERVATION EASEMENT APPLICATION FORM?

01

Property owners looking to conserve land while retaining ownership,

02

Non-profit organizations or conservation groups seeking to protect natural resources,

03

Individuals or entities interested in making a charitable donation of land or rights for conservation purposes.

Fill

form

: Try Risk Free

People Also Ask about

How is the sale of a conservation easement taxed?

It reduces the value of the estate to be taxed. A conservation easement lowers the property value — and, correspondingly, estate taxes. In some cases, a conservation easement may drop the value of the estate below the threshold for estate taxes altogether.

What are the downsides of a conservation easement?

Drawbacks Of Conservation Easements Most conservation easements are permanent and bind all future landowners (including heirs). Conservation easement holders and farmers may not always share a common vision. Conservation easements can reduce the property's overall value, making the land worth less for future sales.

How is the sale of an easement taxed?

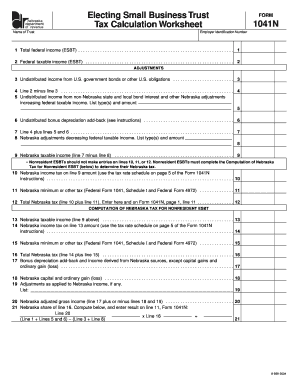

If it is impossible or impractical to separate the basis of the part of the property on which the easement is granted, the basis of the whole property is reduced by the amount received. Any amount received that is more than the basis to be reduced is a taxable gain. The transaction is reported as a sale of property.

Are easements subject to property tax?

Tax considerations for permanent easements Permanent easements are perpetual or don't have a specified end date. Permanent easements often remove all your rights to the property except for the title itself, so they are treated as property sales for tax purposes.

Is money from a conservation easement taxable?

A conservation easement lowers the property value — and, correspondingly, estate taxes. In some cases, a conservation easement may drop the value of the estate below the threshold for estate taxes altogether. Heirs can exclude 40% of the value of land under conservation easement from estate taxes.

How much do conservation easements pay?

Most easement programs pay the landowner for the rights that are being purchased, often at the appraised fair market value. Depending on the land value, development pressures, and values at risk, this payment can be substantial, often thousands of dollars per acre.

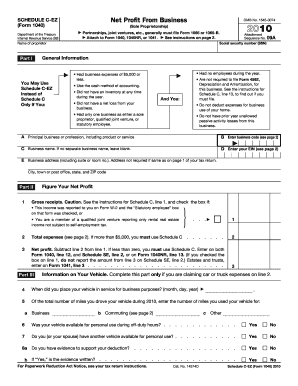

What is the IRS form for conservation easement?

Form 8283 Evaluation for Conservation Easement Donations IRS Form 8283 is required for all non-cash contributions valued at greater than $500. While the land trust's signature on Form 8283 does not represent agreement with the claimed value, the IRS has asked that land trusts use common sense in Form 8283 compliance.

How to calculate conservation easement tax deduction?

The value of the donated easement for purposes of claiming a federal income tax deduction is calculated as the difference between the fair value of the eased property before the easement is granted minus the value of the eased property after the easement is granted.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is SALE OR DONATION OF CONSERVATION EASEMENT APPLICATION FORM?

The SALE OR DONATION OF CONSERVATION EASEMENT APPLICATION FORM is a document used to request the sale or donation of a conservation easement, which is a legal agreement that protects a property’s conservation values while allowing limited use.

Who is required to file SALE OR DONATION OF CONSERVATION EASEMENT APPLICATION FORM?

Property owners who wish to sell or donate their conservation easement are required to file this form.

How to fill out SALE OR DONATION OF CONSERVATION EASEMENT APPLICATION FORM?

To fill out the form, property owners must provide personal information, details about the property, the nature of the easement, and any supporting documents, such as surveys or appraisals.

What is the purpose of SALE OR DONATION OF CONSERVATION EASEMENT APPLICATION FORM?

The purpose of the form is to formalize the request for the sale or donation of a conservation easement and to ensure that all necessary information is collected for review and approval.

What information must be reported on SALE OR DONATION OF CONSERVATION EASEMENT APPLICATION FORM?

The information that must be reported includes the property owner’s details, property address, description of the conservation easement, any current encumbrances, and intended uses of the property post-easement.

Fill out your sale or donation of online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Sale Or Donation Of is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.