Get the free pdffiller

Show details

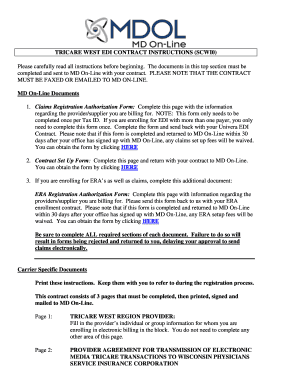

VRT TOR Transfer of Residence from within the EU Application and Declaration for Relief from Vehicle Registration Tax VRT A separate form should be completed for each vehicle involved Revenue information leaflet Transfer of Residence should be read before completing this application. In order to qualify for relief documentary evidence as detailed on this form and relevant to your personal circumstances must be provided with your application. 1 Pe...

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign tor1 form

Edit your tor1 form example pdf form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your tor1 form pdf download form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit tor1 form pdf online

In order to make advantage of the professional PDF editor, follow these steps:

1

Register the account. Begin by clicking Start Free Trial and create a profile if you are a new user.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit tor1 form. Rearrange and rotate pages, add and edit text, and use additional tools. To save changes and return to your Dashboard, click Done. The Documents tab allows you to merge, divide, lock, or unlock files.

4

Get your file. When you find your file in the docs list, click on its name and choose how you want to save it. To get the PDF, you can save it, send an email with it, or move it to the cloud.

pdfFiller makes working with documents easier than you could ever imagine. Register for an account and see for yourself!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out tor1 form example

How to fill out tor Ireland:

01

Visit the official website of tor Ireland.

02

Create an account by providing necessary personal and contact information.

03

Fill out the required details such as your name, address, nationality, and purpose of visit to Ireland.

04

Upload any supporting documents that may be required, such as letters of invitation, hotel reservations, or travel itineraries.

05

Review all the information filled in and make sure everything is accurate and up to date.

06

Pay the required fee for processing the tor application.

07

Submit the application and wait for a response from tor Ireland regarding the status of your application.

Who needs tor Ireland:

01

Individuals who intend to travel to Ireland for tourism or leisure purposes.

02

Business professionals or entrepreneurs who are planning to visit Ireland for meetings, conferences, or exploring business opportunities.

03

Students who wish to pursue their education in Ireland.

04

Individuals seeking medical treatment or attending medical conferences in Ireland.

05

Those participating in cultural or sports events in Ireland.

06

Individuals visiting family or friends living in Ireland.

07

People seeking asylum or refuge in Ireland due to political or social reasons.

Please note that the specific requirements and eligibility criteria may vary depending on the individual's nationality and the purpose of their visit to Ireland. It is advisable to check the official tor Ireland website for detailed information and guidelines.

Fill

form

: Try Risk Free

People Also Ask about

Do I need to complete a Tor?

Prior approval for importing goods You must get approval from HMRC before claiming the relief. You must complete a ToR1 form and provide details of goods being imported and evidence to support your claim.

What is the Tor number for UK?

Once you have sent the application to customs, you should get an automated response to say it has been received, if you do not receive the automated email within 24 hours of sending, please call the TOR helpline – 0300 322 7064 (option 4), to check and confirm they have received your application.

How long do you need to own a car to avoid VRT?

The vehicle must: be your personal property. have been in your possession and used by you for at least six months before transfer of residence. Any possession and use in the State, even during times when you were living abroad, does not count.

What happens if you don't pay VRT?

If you have imported a vehicle, you must pay VRT and receive the vehicle's registration certificate showing that you have paid VRT. Any delay in registering your vehicle or paying Vehicle Registration Tax will make you liable to substantial penalties – including forfeiture of your vehicle and prosecution.

How do I submit a Tor form?

If you are moving from within the EU, you must submit your application to the National VRT Service via MyEnquiries, where possible. If you are not able to access Revenue's online resources, please contact the designated Revenue office. You must register the vehicle within 30 days of bringing it into the State.

Do I need to pay VRT?

If you have imported a vehicle, you must pay VRT and get the vehicle's registration certificate showing that you have paid VRT. If you delay in registering your vehicle or paying Vehicle Registration Tax you have to pay a penalty. Your vehicle could be also be seized.

How do I fill out a Tor?

Customer Guide:How to Make a TOR Application & FAQS An email address and phone number - this is important so HMRC can contact you with any questions. A list of all the items you are bringing with you (this can be your removal company survey inventory our your insurance form list). A picture of your passport photo page.

How do I prove a non UK address for Tor?

Proof of non-UK address bank statement. utility bill. mortgage or rental agreement.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send pdffiller form to be eSigned by others?

When your pdffiller form is finished, send it to recipients securely and gather eSignatures with pdfFiller. You may email, text, fax, mail, or notarize a PDF straight from your account. Create an account today to test it.

How do I edit pdffiller form in Chrome?

Install the pdfFiller Chrome Extension to modify, fill out, and eSign your pdffiller form, which you can access right from a Google search page. Fillable documents without leaving Chrome on any internet-connected device.

How do I fill out pdffiller form on an Android device?

Use the pdfFiller mobile app to complete your pdffiller form on an Android device. The application makes it possible to perform all needed document management manipulations, like adding, editing, and removing text, signing, annotating, and more. All you need is your smartphone and an internet connection.

What is tor1 form example?

The TOR1 form is a specific form used for reporting certain information to tax authorities, often related to income earned by individuals or entities.

Who is required to file tor1 form example?

Individuals or entities that meet specific income thresholds or have certain types of income must file the TOR1 form as required by tax regulations.

How to fill out tor1 form example?

To fill out the TOR1 form, gather all necessary financial information, complete each section accurately, and ensure you provide details such as income sources and any applicable deductions before submitting it to the appropriate tax authority.

What is the purpose of tor1 form example?

The purpose of the TOR1 form is to report income and financial information to tax authorities, ensuring compliance with tax laws and aiding in the assessment of tax liabilities.

What information must be reported on tor1 form example?

The TOR1 form typically requires reporting information such as total income, types of income received, deductions claimed, and any taxes already withheld or paid.

Fill out your pdffiller form online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Pdffiller Form is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.