Get the free Wisconsin Partnership Recycling Surcharge - revenue wi

Show details

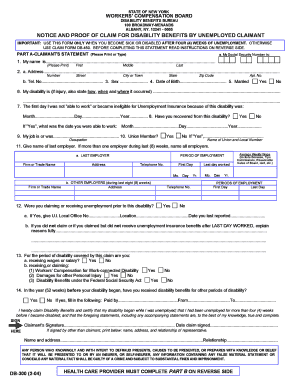

This form is used by partnerships in Wisconsin to report and compute the recycling surcharge based on their gross receipts and net business income for a given taxable year.

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign wisconsin partnership recycling surcharge

Edit your wisconsin partnership recycling surcharge form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your wisconsin partnership recycling surcharge form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing wisconsin partnership recycling surcharge online

Use the instructions below to start using our professional PDF editor:

1

Set up an account. If you are a new user, click Start Free Trial and establish a profile.

2

Upload a file. Select Add New on your Dashboard and upload a file from your device or import it from the cloud, online, or internal mail. Then click Edit.

3

Edit wisconsin partnership recycling surcharge. Text may be added and replaced, new objects can be included, pages can be rearranged, watermarks and page numbers can be added, and so on. When you're done editing, click Done and then go to the Documents tab to combine, divide, lock, or unlock the file.

4

Save your file. Select it from your list of records. Then, move your cursor to the right toolbar and choose one of the exporting options. You can save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud, among other things.

It's easier to work with documents with pdfFiller than you could have believed. Sign up for a free account to view.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out wisconsin partnership recycling surcharge

How to fill out Wisconsin Partnership Recycling Surcharge

01

Obtain the Wisconsin Partnership Recycling Surcharge form from the Wisconsin Department of Natural Resources website or your local government office.

02

Fill in the business identification information, including your business name, address, and contact details.

03

Determine your recycling surcharge amount by following the guidelines provided on the form or accompanying instructions.

04

Calculate the total amount due, including any applicable late fees if filing after the deadline.

05

Provide any additional required documentation, if necessary, such as proof of recycling efforts or waste management.

06

Sign and date the form to certify that the information provided is accurate and complete.

07

Submit the completed form and payment to the appropriate state or local agency by the specified due date.

Who needs Wisconsin Partnership Recycling Surcharge?

01

Businesses operating in Wisconsin that generate waste and are required to participate in recycling programs under state law.

02

Companies that are subject to Wisconsin's recycling surcharge due to the volume of waste they produce.

03

Any entities that have been notified by the Wisconsin Department of Natural Resources regarding the surcharge requirements.

Fill

form

: Try Risk Free

People Also Ask about

What is the tax return for Hoa in Wisconsin?

Wisconsin HOA Tax Filing Requirements Filing returns can be done using either Form 1120 or 1120–H. All corporations were generally required to file Form 1120 before the Tax Reform Act of 1976. All HOAs were treated as “for-profit” corporations.

What is the capital gains tax in Wisconsin?

Wisconsin capital gains are taxed as part of your state income, with rates varying based on your overall income and filing status. The tax rates for 2025 are:3. 3.50% for incomes up to $14,680 for single filers and up to $19,580 for married couples filing jointly.

What is the economic development surcharge in Wisconsin?

What is the economic development surcharge? The economic development surcharge applies to certain businesses that have $4 million or more of gross receipts. The minimum economic development surcharge is $25 and the maximum is $9,800. Who is subject to the economic development surcharge?

What is recycling processing surcharge?

Recycling Processing Charge ("RPC") The RPC is a recurring charge imposed on customers receiving recycling services. It is not a tax, surcharge, or fee mandated by or remitted to any governmental or regulatory agency.

What taxes does an LLC pay in Wisconsin?

As the owner of an LLC, you must pay self-employment tax and federal income tax, which are taxed as “pass-through” income. Federal taxes can be complicated, so speak to your accountant or professional tax preparer to ensure that your Wisconsin LLC is paying the correct amount.

Are fuel surcharges taxable in Wisconsin?

A retailer's charges for customer alterations, handling services, small orders, returned merchandise, restocking, split shipments, shipping, postage, crating, packing, fuel surcharges, and similar charges for services related to retail sales, are included in the sales price derived from the sale of taxable tangible

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is Wisconsin Partnership Recycling Surcharge?

The Wisconsin Partnership Recycling Surcharge is a fee charged to certain entities that generate waste in Wisconsin, used to fund recycling programs and initiatives within the state.

Who is required to file Wisconsin Partnership Recycling Surcharge?

Entities involved in waste generation that exceed the specified thresholds for waste disposal are required to file the Wisconsin Partnership Recycling Surcharge.

How to fill out Wisconsin Partnership Recycling Surcharge?

To fill out the Wisconsin Partnership Recycling Surcharge, taxpayers need to provide information regarding the amount of waste generated, calculate the surcharge based on this amount, and submit the form to the appropriate state agency.

What is the purpose of Wisconsin Partnership Recycling Surcharge?

The purpose of the Wisconsin Partnership Recycling Surcharge is to promote recycling practices, support waste reduction efforts, and fund recycling programs across the state.

What information must be reported on Wisconsin Partnership Recycling Surcharge?

Information that must be reported includes the total waste generated, the calculated surcharge, and any relevant entity identification information necessary for processing the form.

Fill out your wisconsin partnership recycling surcharge online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Wisconsin Partnership Recycling Surcharge is not the form you're looking for?Search for another form here.

Relevant keywords

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.