OR Wine Board Tax Report 2011 free printable template

Show details

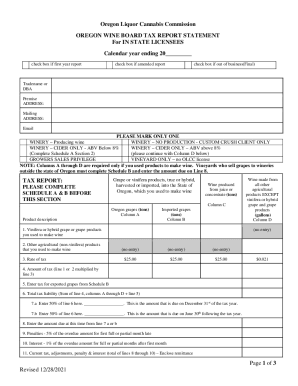

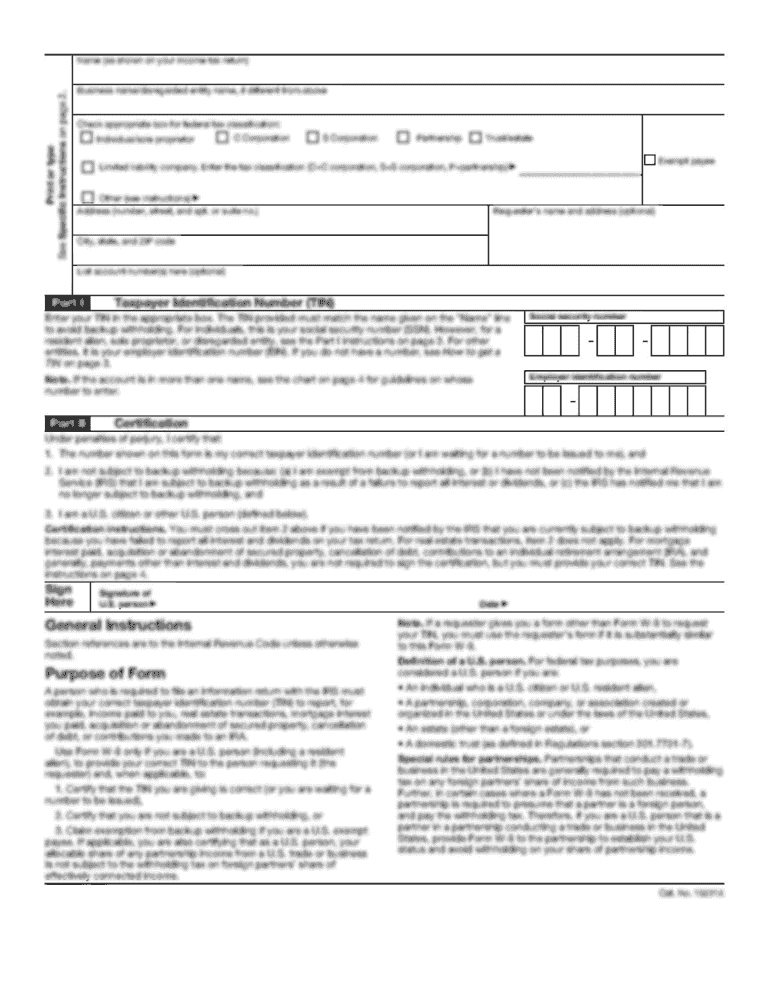

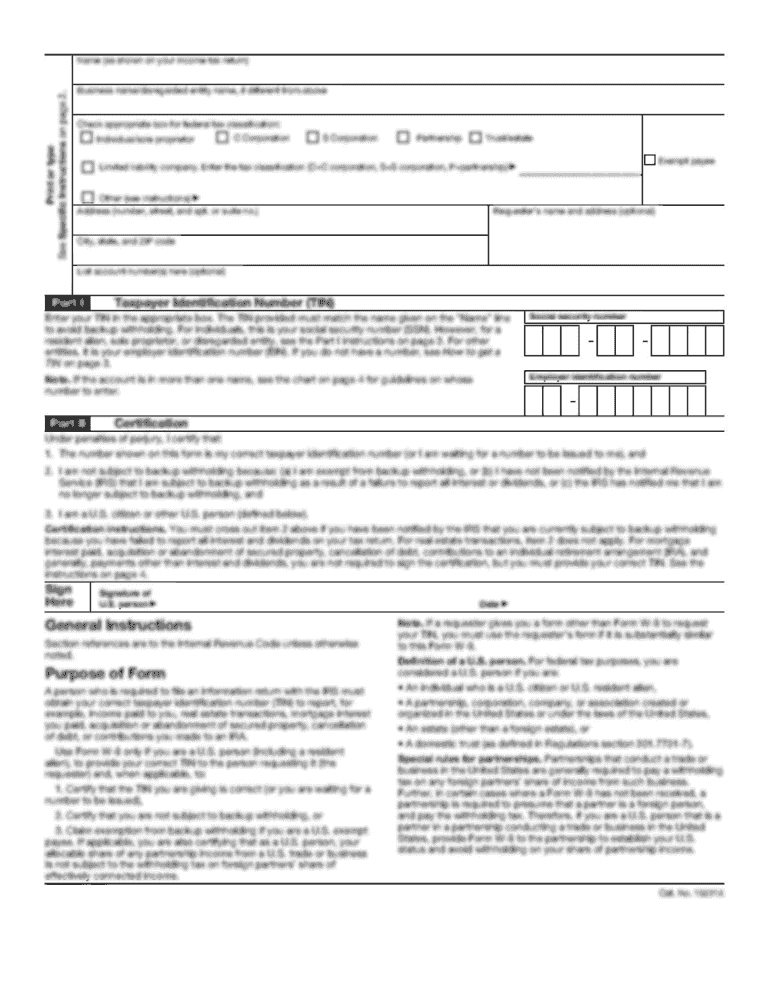

Clear Form Print Form Oregon Liquor Control Commission OREGON WINE BOARD TAX REPORT reflects tax imposed upon the sale or use of all agricultural products used in a winery for making wine. 20 Report

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign OR Wine Board Tax Report

Edit your OR Wine Board Tax Report form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your OR Wine Board Tax Report form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit OR Wine Board Tax Report online

Follow the guidelines below to use a professional PDF editor:

1

Create an account. Begin by choosing Start Free Trial and, if you are a new user, establish a profile.

2

Upload a document. Select Add New on your Dashboard and transfer a file into the system in one of the following ways: by uploading it from your device or importing from the cloud, web, or internal mail. Then, click Start editing.

3

Edit OR Wine Board Tax Report. Add and change text, add new objects, move pages, add watermarks and page numbers, and more. Then click Done when you're done editing and go to the Documents tab to merge or split the file. If you want to lock or unlock the file, click the lock or unlock button.

4

Get your file. Select the name of your file in the docs list and choose your preferred exporting method. You can download it as a PDF, save it in another format, send it by email, or transfer it to the cloud.

pdfFiller makes working with documents easier than you could ever imagine. Create an account to find out for yourself how it works!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

OR Wine Board Tax Report Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out OR Wine Board Tax Report

How to fill out OR Wine Board Tax Report

01

Gather all necessary sales data for the reporting period.

02

Calculate the total volume of wine produced and sold.

03

List all types of wine sold, including the relevant quantities and sales amounts.

04

Complete any required personal or business information in the report.

05

Accurately input the calculated figures into the designated fields.

06

Review the report for accuracy and completeness.

07

Submit the tax report by the specified deadline.

Who needs OR Wine Board Tax Report?

01

Wine producers and manufacturers operating in Oregon.

02

Businesses selling wine at retail or wholesale in Oregon.

03

Wineries and vineyards that need to report their tax obligations.

Fill

form

: Try Risk Free

People Also Ask about

Is liquor cheaper in Oregon or Washington?

In order to avoid these high taxes, Washingtonians have turned to their neighbors, Idaho and Oregon, where state taxes on spirits stand at $10.92 and $22.73 per gallon compared to Washington's $35.22 per gallon. For context, the national median liquor tax is $5.53 per gallon.

What does OLCC stand for?

Oregon Liquor and Cannabis Commission.

Is wine taxed in Oregon?

Oregon Wine Tax - $0.67 / gallon In Oregon, wine vendors are responsible for paying a state excise tax of $0.67 per gallon, plus Federal excise taxes, for all wine sold.

What items are taxed in Oregon?

Oregon Sales Tax Rate While Oregon does not collect a sales tax, excise taxes are levied on the sale of certain products, including alcohol, cigarettes & tobacco, and gasoline. These excise taxes are passed on to the consumer in the goods' price.

Is OLCC a government agency?

The Oregon Liquor and Cannabis Commission (OLCC), formerly known as Oregon Liquor Control Commission is a government agency of the U.S. state of Oregon.

How much is a OLCC license in Oregon?

A: Create an account through the Alcohol Service Permit Portal. Fill out the application form, upload a valid copy of your state-issued ID, driver license, or passport, and pay the fee of $23 and the $5.65 portal provider fee. The fees are non-refundable.

Does Oregon have tax on wine?

Oregon Wine Tax - $0.67 / gallon In Oregon, wine vendors are responsible for paying a state excise tax of $0.67 per gallon, plus Federal excise taxes, for all wine sold.

What is the OLCC privilege tax?

WHAT IS A PRIVILEGE TAX? Oregon assesses a tax on the privilege of making malt beverages, wine, or cider in Oregon or shipping or importing malt beverages, wine, or cider into Oregon. This is called a privilege tax.

How much is tax on alcohol in California?

✔ California's general sales tax of 6% also applies to the purchase of liquor.

How is wine taxed in the US?

The complete text of all wine tax regulations may be found at 27 CFR 24.270-. 279. The tax law is 26 U.S.C. 5041-5043.General Excise Tax Information. Still WineTax Rate per Wine Gallon16% and under alcohol by volume (0.392g CO2/100mL or less)$1.0710 more rows

What tax is charged on liquor?

The tax rate on these varies between 18 and 28%. It impacts the producers of liquor who have to bear the taxes. Again, if the producers increase the prices, it will likely affect their sales and turnover. Before the GST Act was established, transport costs and freight involved a 15% service tax.

Is it cheaper to buy liquor in Oregon or Washington?

In order to avoid these high taxes, Washingtonians have turned to their neighbors, Idaho and Oregon, where state taxes on spirits stand at $10.92 and $22.73 per gallon compared to Washington's $35.22 per gallon. For context, the national median liquor tax is $5.53 per gallon.

Where did OLCC originate?

The Oregon Liquor Control Commission (OLCC) regulates the sale, distribution, and use of alcoholic beverages in order to protect Oregon's public health, safety and community livability. The OLCC was created in 1933 by a special session of the Oregon Legislature following the end of national Prohibition.

Does Oregon have alcohol tax?

The ten states with the highest alcohol tax per gallon of spirits are: Washington - $33.22. Oregon - $21.95. Virginia - $19.89.

Do you pay tax on liquor in Oregon?

Oregon: Alcohol Excise Taxes In addition to (or instead of) traditional sales taxes, alcoholic beverages like wine, beer, and liquor are subject to excise taxes on both the Oregon and Federal levels. Excise taxes on alcohol are implemented by every state, as are excises on cigarettes and motor fuels like gasoline.

In which state is alcohol the cheapest?

Goa. Goa, a party paradise, has the cheapest liquor in the entire country. From cheap international whiskeys to abundant international and domestic beer brands, Goa has cheap booze which also makes it one of the most visited states.

Is beer taxed in Oregon?

In Oregon, businesses that distribute, import or produce beer, cider or wine are required to pay privilege tax, as set forth in Oregon Revised Statute 473.

Is alcohol more expensive in Washington?

Washington state by far has the highest excise tax rate on distilled spirits ($35.31 per gallon), followed by Oregon ($21.95), Virginia ($19.89), Alabama ($19.11) and Utah ($15.92), the Tax Foundation found. Distilled spirits are taxed the least in Wyoming and New Hampshire—less than $1 per gallon.

Who has the highest tax on alcohol?

Washington has the highest spirits tax in the United States at $33.22 per gallon.Alcohol Tax by State Washington - $33.22. Oregon - $21.95. Virginia - $19.89. Alabama - $19.11. Utah - $15.92. North Carolina - $14.58. Kansas - $13.03. Alaska - $12.80.

Who came up with OLCC?

1933 just days after the national repeal of prohibition. Oregon's governor, Julius Meier appointed Dr. William S. Knox and a special committee to study Oregon's options with regard to regulation of alcoholic beverages.

What is OLCC certified?

Oregon OLCC Permit Course. This online course is approved by the Oregon Liquor and Cannabis Commission (OLCC) for individuals that need to obtain an OLCC Permit to serve alcohol at liquor-licensed businesses. Craft Serving is the newest Alcohol Server Education provider in Oregon!

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I edit OR Wine Board Tax Report from Google Drive?

You can quickly improve your document management and form preparation by integrating pdfFiller with Google Docs so that you can create, edit and sign documents directly from your Google Drive. The add-on enables you to transform your OR Wine Board Tax Report into a dynamic fillable form that you can manage and eSign from any internet-connected device.

How do I edit OR Wine Board Tax Report on an iOS device?

Create, edit, and share OR Wine Board Tax Report from your iOS smartphone with the pdfFiller mobile app. Installing it from the Apple Store takes only a few seconds. You may take advantage of a free trial and select a subscription that meets your needs.

How do I edit OR Wine Board Tax Report on an Android device?

You can edit, sign, and distribute OR Wine Board Tax Report on your mobile device from anywhere using the pdfFiller mobile app for Android; all you need is an internet connection. Download the app and begin streamlining your document workflow from anywhere.

What is OR Wine Board Tax Report?

The OR Wine Board Tax Report is a mandatory report filed by vineyards and wineries in Oregon to disclose their production, sales, and tax obligations related to wine production and sales.

Who is required to file OR Wine Board Tax Report?

All wineries and vineyards operating in Oregon that produce wine are required to file the OR Wine Board Tax Report.

How to fill out OR Wine Board Tax Report?

To fill out the OR Wine Board Tax Report, gather the necessary production and sales information, complete the designated sections on the form, and submit it electronically or by mail as per the guidelines provided by the Oregon Wine Board.

What is the purpose of OR Wine Board Tax Report?

The purpose of the OR Wine Board Tax Report is to ensure compliance with state tax regulations, provide data on the wine industry in Oregon, and facilitate funding for wine-related activities and programs.

What information must be reported on OR Wine Board Tax Report?

The OR Wine Board Tax Report requires reporting information such as total wine production, sales data, excise tax calculations, and any applicable fees or credits.

Fill out your OR Wine Board Tax Report online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

OR Wine Board Tax Report is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.