OR Wine Board Tax Report 2021-2025 free printable template

Show details

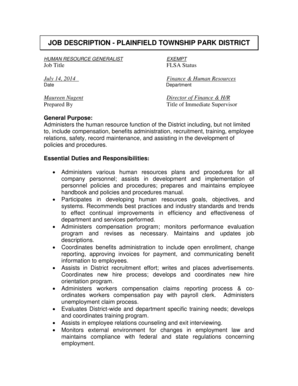

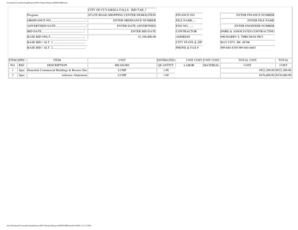

Oregon Liquor Cannabis Commission OREGON WINE BOARD TAX REPORT STATEMENT For IN STATE LICENSEES Calendar year ending 20___ check box if first year report check box if amended report check box if out

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign owb-tax-report-in-state-licenseespdf

Edit your owb-tax-report-in-state-licenseespdf form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your owb-tax-report-in-state-licenseespdf form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing owb-tax-report-in-state-licenseespdf online

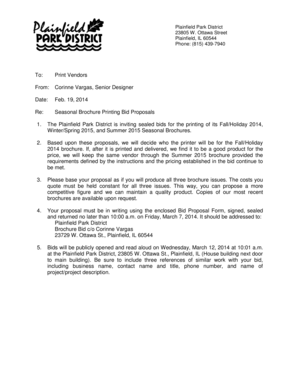

To use our professional PDF editor, follow these steps:

1

Log in to account. Click on Start Free Trial and sign up a profile if you don't have one.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit owb-tax-report-in-state-licenseespdf. Replace text, adding objects, rearranging pages, and more. Then select the Documents tab to combine, divide, lock or unlock the file.

4

Get your file. When you find your file in the docs list, click on its name and choose how you want to save it. To get the PDF, you can save it, send an email with it, or move it to the cloud.

With pdfFiller, it's always easy to work with documents. Try it!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

OR Wine Board Tax Report Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out owb-tax-report-in-state-licenseespdf

How to fill out OR Wine Board Tax Report

01

Gather all necessary sales data for the reporting period.

02

Access the OR Wine Board Tax Report form, available online or through the Board.

03

Fill in the basic information, including your winery's name, address, and reporting period.

04

Enter total wine sales, specifying types of wine sold (e.g., red, white, sparkling).

05

Include any deductions for returns or discounts offered during the reporting period.

06

Calculate the total taxable sales based on the provided guidelines.

07

Review all entries for accuracy and completeness.

08

Sign the report and date it before submission.

09

Submit the form electronically or via mail as per the instructions.

Who needs OR Wine Board Tax Report?

01

Winery owners and operators producing wine in Oregon.

02

Distributors and retailers who sell Oregon wines.

03

Licensed sellers of wine required to report sales to the Oregon Wine Board.

Fill

form

: Try Risk Free

People Also Ask about

Is liquor cheaper in Oregon or Washington?

In order to avoid these high taxes, Washingtonians have turned to their neighbors, Idaho and Oregon, where state taxes on spirits stand at $10.92 and $22.73 per gallon compared to Washington's $35.22 per gallon. For context, the national median liquor tax is $5.53 per gallon.

What does OLCC stand for?

Oregon Liquor and Cannabis Commission.

Is wine taxed in Oregon?

Oregon Wine Tax - $0.67 / gallon In Oregon, wine vendors are responsible for paying a state excise tax of $0.67 per gallon, plus Federal excise taxes, for all wine sold.

What items are taxed in Oregon?

Oregon Sales Tax Rate While Oregon does not collect a sales tax, excise taxes are levied on the sale of certain products, including alcohol, cigarettes & tobacco, and gasoline. These excise taxes are passed on to the consumer in the goods' price.

Is OLCC a government agency?

The Oregon Liquor and Cannabis Commission (OLCC), formerly known as Oregon Liquor Control Commission is a government agency of the U.S. state of Oregon.

How much is a OLCC license in Oregon?

A: Create an account through the Alcohol Service Permit Portal. Fill out the application form, upload a valid copy of your state-issued ID, driver license, or passport, and pay the fee of $23 and the $5.65 portal provider fee. The fees are non-refundable.

Does Oregon have tax on wine?

Oregon Wine Tax - $0.67 / gallon In Oregon, wine vendors are responsible for paying a state excise tax of $0.67 per gallon, plus Federal excise taxes, for all wine sold.

What is the OLCC privilege tax?

WHAT IS A PRIVILEGE TAX? Oregon assesses a tax on the privilege of making malt beverages, wine, or cider in Oregon or shipping or importing malt beverages, wine, or cider into Oregon. This is called a privilege tax.

How much is tax on alcohol in California?

✔ California's general sales tax of 6% also applies to the purchase of liquor.

How is wine taxed in the US?

The complete text of all wine tax regulations may be found at 27 CFR 24.270-. 279. The tax law is 26 U.S.C. 5041-5043.General Excise Tax Information. Still WineTax Rate per Wine Gallon16% and under alcohol by volume (0.392g CO2/100mL or less)$1.0710 more rows

What tax is charged on liquor?

The tax rate on these varies between 18 and 28%. It impacts the producers of liquor who have to bear the taxes. Again, if the producers increase the prices, it will likely affect their sales and turnover. Before the GST Act was established, transport costs and freight involved a 15% service tax.

Is it cheaper to buy liquor in Oregon or Washington?

In order to avoid these high taxes, Washingtonians have turned to their neighbors, Idaho and Oregon, where state taxes on spirits stand at $10.92 and $22.73 per gallon compared to Washington's $35.22 per gallon. For context, the national median liquor tax is $5.53 per gallon.

Where did OLCC originate?

The Oregon Liquor Control Commission (OLCC) regulates the sale, distribution, and use of alcoholic beverages in order to protect Oregon's public health, safety and community livability. The OLCC was created in 1933 by a special session of the Oregon Legislature following the end of national Prohibition.

Does Oregon have alcohol tax?

The ten states with the highest alcohol tax per gallon of spirits are: Washington - $33.22. Oregon - $21.95. Virginia - $19.89.

Do you pay tax on liquor in Oregon?

Oregon: Alcohol Excise Taxes In addition to (or instead of) traditional sales taxes, alcoholic beverages like wine, beer, and liquor are subject to excise taxes on both the Oregon and Federal levels. Excise taxes on alcohol are implemented by every state, as are excises on cigarettes and motor fuels like gasoline.

In which state is alcohol the cheapest?

Goa. Goa, a party paradise, has the cheapest liquor in the entire country. From cheap international whiskeys to abundant international and domestic beer brands, Goa has cheap booze which also makes it one of the most visited states.

Is beer taxed in Oregon?

In Oregon, businesses that distribute, import or produce beer, cider or wine are required to pay privilege tax, as set forth in Oregon Revised Statute 473.

Is alcohol more expensive in Washington?

Washington state by far has the highest excise tax rate on distilled spirits ($35.31 per gallon), followed by Oregon ($21.95), Virginia ($19.89), Alabama ($19.11) and Utah ($15.92), the Tax Foundation found. Distilled spirits are taxed the least in Wyoming and New Hampshire—less than $1 per gallon.

Who has the highest tax on alcohol?

Washington has the highest spirits tax in the United States at $33.22 per gallon.Alcohol Tax by State Washington - $33.22. Oregon - $21.95. Virginia - $19.89. Alabama - $19.11. Utah - $15.92. North Carolina - $14.58. Kansas - $13.03. Alaska - $12.80.

Who came up with OLCC?

1933 just days after the national repeal of prohibition. Oregon's governor, Julius Meier appointed Dr. William S. Knox and a special committee to study Oregon's options with regard to regulation of alcoholic beverages.

What is OLCC certified?

Oregon OLCC Permit Course. This online course is approved by the Oregon Liquor and Cannabis Commission (OLCC) for individuals that need to obtain an OLCC Permit to serve alcohol at liquor-licensed businesses. Craft Serving is the newest Alcohol Server Education provider in Oregon!

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Can I create an electronic signature for the owb-tax-report-in-state-licenseespdf in Chrome?

You certainly can. You get not just a feature-rich PDF editor and fillable form builder with pdfFiller, but also a robust e-signature solution that you can add right to your Chrome browser. You may use our addon to produce a legally enforceable eSignature by typing, sketching, or photographing your signature with your webcam. Choose your preferred method and eSign your owb-tax-report-in-state-licenseespdf in minutes.

Can I edit owb-tax-report-in-state-licenseespdf on an iOS device?

Use the pdfFiller app for iOS to make, edit, and share owb-tax-report-in-state-licenseespdf from your phone. Apple's store will have it up and running in no time. It's possible to get a free trial and choose a subscription plan that fits your needs.

Can I edit owb-tax-report-in-state-licenseespdf on an Android device?

With the pdfFiller Android app, you can edit, sign, and share owb-tax-report-in-state-licenseespdf on your mobile device from any place. All you need is an internet connection to do this. Keep your documents in order from anywhere with the help of the app!

What is OR Wine Board Tax Report?

The OR Wine Board Tax Report is a document required by the Oregon Wine Board for reporting sales and production of wine within the state of Oregon. It helps in tracking the production and sales activities of wineries.

Who is required to file OR Wine Board Tax Report?

All wineries producing wine in Oregon, regardless of size or volume, are required to file the OR Wine Board Tax Report to comply with state regulations.

How to fill out OR Wine Board Tax Report?

To fill out the OR Wine Board Tax Report, wineries must gather data on wine production, sales, and applicable tax information. Accurate figures should be entered into the report form, and any required supplementary documentation must be attached before submission.

What is the purpose of OR Wine Board Tax Report?

The purpose of the OR Wine Board Tax Report is to ensure compliance with state tax regulations, to collect data on the wine industry in Oregon, and to provide the Oregon Wine Board with necessary information to support and promote the industry's growth.

What information must be reported on OR Wine Board Tax Report?

The OR Wine Board Tax Report requires information such as total wine production, sales data (both in-state and out-of-state), taxes owed, and other relevant financial and operational metrics related to the winery's activities.

Fill out your owb-tax-report-in-state-licenseespdf online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Owb-Tax-Report-In-State-Licenseespdf is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.