Ireland RP50 2007 free printable template

Show details

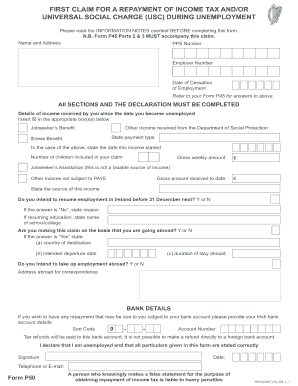

Submitted to Redundancy Payments Section at address below. If appointed an administrator may apply to the Department on behalf of the Employee on-line at Sum payment directly to the Department by completing the Redundancy Form RP50 as above. Redundancy Payments Acts 1967 2007 RP50 ------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------- A NOTIFICATION...

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign Ireland RP50

Edit your Ireland RP50 form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your Ireland RP50 form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing Ireland RP50 online

To use our professional PDF editor, follow these steps:

1

Set up an account. If you are a new user, click Start Free Trial and establish a profile.

2

Upload a file. Select Add New on your Dashboard and upload a file from your device or import it from the cloud, online, or internal mail. Then click Edit.

3

Edit Ireland RP50. Rearrange and rotate pages, add and edit text, and use additional tools. To save changes and return to your Dashboard, click Done. The Documents tab allows you to merge, divide, lock, or unlock files.

4

Save your file. Select it in the list of your records. Then, move the cursor to the right toolbar and choose one of the available exporting methods: save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud.

With pdfFiller, it's always easy to work with documents.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

Ireland RP50 Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out Ireland RP50

How to fill out Ireland RP50

01

Obtain the RP50 form from the official Irish immigration website or your local immigration office.

02

Fill in your personal details including your name, address, date of birth, and nationality.

03

Provide details of your immigration status and history in Ireland.

04

Complete the section regarding your employment or study details, if applicable.

05

Attach any required supporting documentation, such as proof of residence or identification.

06

Review the form for accuracy and completeness.

07

Submit the RP50 form to the appropriate immigration office as specified in the instructions.

Who needs Ireland RP50?

01

The RP50 form is needed by non-EEA nationals residing in Ireland who require a registration certificate or proof of residence.

02

It is typically required for those applying for long-term residency, work permits, or student visas.

Instructions and Help about Ireland RP50

Fill

form

: Try Risk Free

People Also Ask about

What is the difference between a layoff and a redundancy?

A lay-off does not involve the termination of your contract of employment, whereas a redundancy does.

What is an RP9 form?

Notice to an Employer by an Employee to Terminate Employment (Form RP6) Lay Off and Short Term Procedures (Form RP9) Claim by an Employee Against an Employer for a Lump Sum or Part of a Lump Sum (Form RP77)

What is an RP77 form?

REDUNDANCY PAYMENS ACTS, 1967 TO 2007. A claim by an employee against an employer for a lump sum or part of a lump sum. An employee who is in doubt about whether he/she has a valid claim or not can check against an informational leaflet on the qualifications – (see the footnote overleaf).

What does it mean to be temporarily laid off?

A temporary lay-off, or temporary redundancy, is a temporary scheme where the employee is ordered not to come to work, while the employer is relieved of its obligation to pay a salary. The employment relationship persists, and it is a condition that the cessation of work is temporary.

What is RP50 form?

If your employer still refuses to pay your redundancy, you can apply for your lump sum directly to the Department of Social Protection (DSP) for payment under the Redundancy Payments Scheme. You can apply by completing the following steps: Email redundancypayments@welfare.ie to request an application form (RP50).

Our user reviews speak for themselves

Read more or give pdfFiller a try to experience the benefits for yourself

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I fill out the Ireland RP50 form on my smartphone?

The pdfFiller mobile app makes it simple to design and fill out legal paperwork. Complete and sign Ireland RP50 and other papers using the app. Visit pdfFiller's website to learn more about the PDF editor's features.

How do I edit Ireland RP50 on an iOS device?

You can. Using the pdfFiller iOS app, you can edit, distribute, and sign Ireland RP50. Install it in seconds at the Apple Store. The app is free, but you must register to buy a subscription or start a free trial.

How do I complete Ireland RP50 on an iOS device?

In order to fill out documents on your iOS device, install the pdfFiller app. Create an account or log in to an existing one if you have a subscription to the service. Once the registration process is complete, upload your Ireland RP50. You now can take advantage of pdfFiller's advanced functionalities: adding fillable fields and eSigning documents, and accessing them from any device, wherever you are.

What is Ireland RP50?

Ireland RP50 is a Return of Payments made by employers to Revenue, which details the payments made to employees and other relevant payments during a specific tax period.

Who is required to file Ireland RP50?

Employers who make payments to employees and have tax deducted under the Pay As You Earn (PAYE) system are required to file the Ireland RP50.

How to fill out Ireland RP50?

To fill out Ireland RP50, employers must provide details of all payments made to employees, including gross pay, tax deducted, and any other deductions. This can typically be done through the Revenue Online Service (ROS) or on paper forms.

What is the purpose of Ireland RP50?

The purpose of Ireland RP50 is to ensure that all payments are accurately reported to the Revenue Commissioners, enabling proper tax calculations and ensuring compliance with tax obligations.

What information must be reported on Ireland RP50?

The information that must be reported on Ireland RP50 includes the employer's details, employee details, amounts paid to employees, tax deducted, and any other relevant deductions or contributions.

Fill out your Ireland RP50 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Ireland rp50 is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.