Ireland RP50 2006 free printable template

Show details

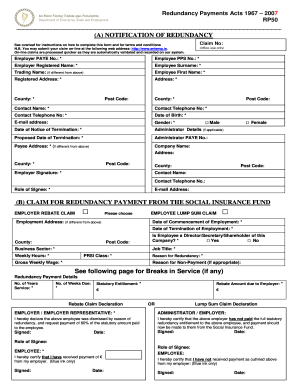

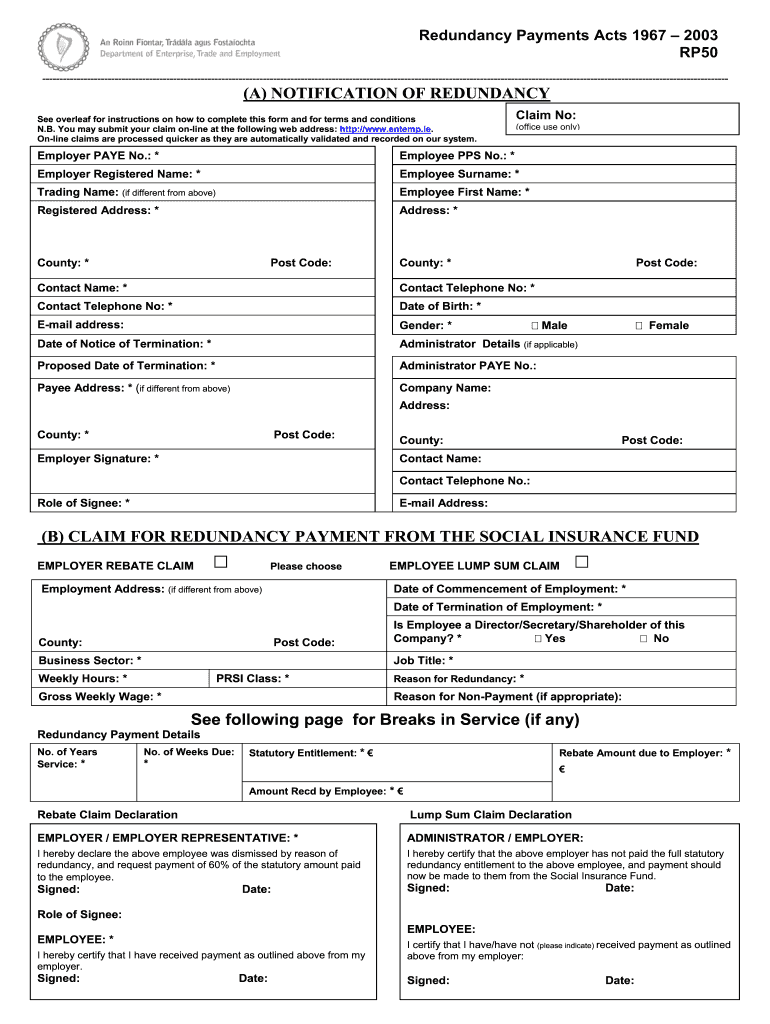

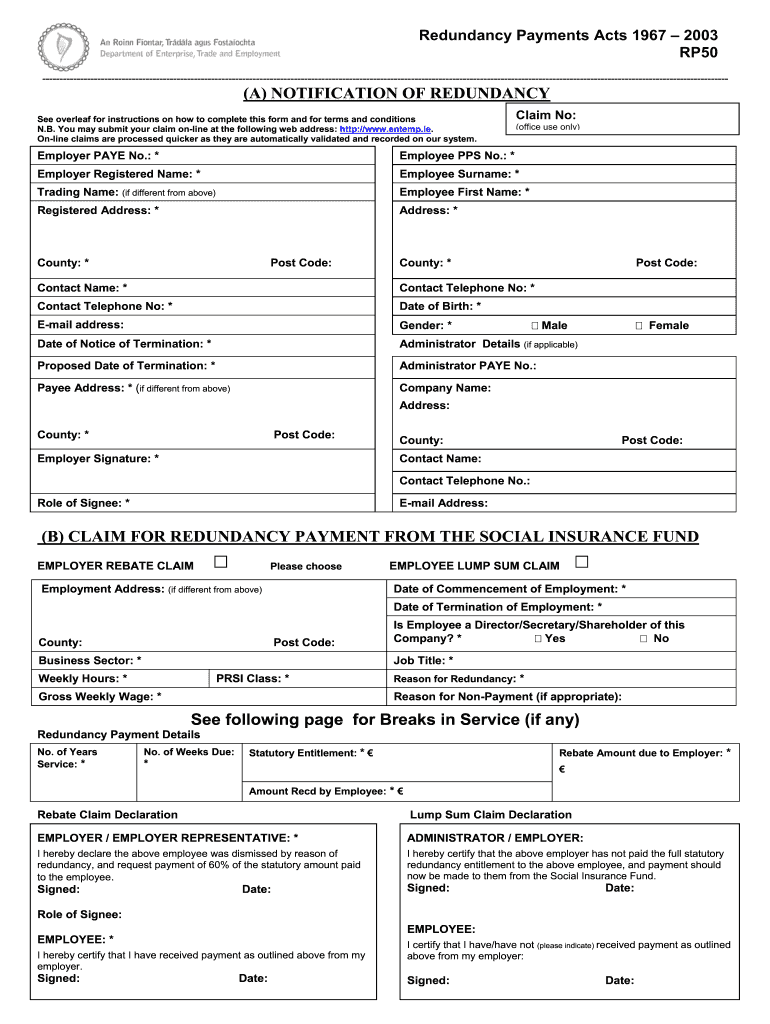

Redundancy Payments Acts 1967 2003 RP50 -------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign Ireland RP50

Edit your Ireland RP50 form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your Ireland RP50 form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing Ireland RP50 online

Use the instructions below to start using our professional PDF editor:

1

Create an account. Begin by choosing Start Free Trial and, if you are a new user, establish a profile.

2

Upload a file. Select Add New on your Dashboard and upload a file from your device or import it from the cloud, online, or internal mail. Then click Edit.

3

Edit Ireland RP50. Replace text, adding objects, rearranging pages, and more. Then select the Documents tab to combine, divide, lock or unlock the file.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

pdfFiller makes dealing with documents a breeze. Create an account to find out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

Ireland RP50 Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out Ireland RP50

How to fill out Ireland RP50

01

Obtain the RP50 form, which is available on the official Irish Revenue website.

02

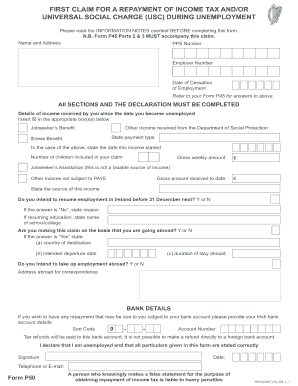

Fill out the personal details section, including your name, address, and PPS number.

03

Indicate the tax year for which you are submitting the RP50.

04

Provide information regarding your income, including any employment or self-employment income.

05

List any tax credits and reliefs you are claiming.

06

Review the completed form for accuracy.

07

Submit the RP50 form to the appropriate tax office as instructed.

Who needs Ireland RP50?

01

Individuals who need to claim tax credits, reliefs, or adjust their tax liabilities for a specific tax year in Ireland.

Instructions and Help about Ireland RP50

Fill

form

: Try Risk Free

People Also Ask about

Can I negotiate my redundancy package?

If you know what you want to achieve from your redundancy then you may be able to negotiate the settlement yourself but I often find that clients prefer to have a professional negotiator do the work for them. Sometimes you may want to get legal advice before negotiating directly.

What happens if I take voluntary redundancy?

Find out whether you'll be covered if you take voluntary redundancy. If you opt for redundancy rather than have it forced on you, insurance companies usually won't pay out. That means you'll need to continue to meet your repayments each month. That's a big expense if you haven't got any money coming in.

Is it worth taking voluntary redundancy?

Opting for voluntary redundancy can benefit both the employer and employee. It allows them to end their professional relationship on a note of goodwill and gives the employee more time to prepare financially for losing their job.

What is the reason for redundancy termination?

If an employee has been given notice of termination by reason of redundancy the employer has a duty to search for suitable alternative employment until the end of the affected employee's notice period. Any offer of alternative employment must be made before the end of the employment under the previous contract.

What happens if I ask for voluntary redundancy?

Find out whether you'll be covered if you take voluntary redundancy. If you opt for redundancy rather than have it forced on you, insurance companies usually won't pay out. That means you'll need to continue to meet your repayments each month. That's a big expense if you haven't got any money coming in.

What is an RP50 form?

If your employer still refuses to pay your redundancy, you can apply for your lump sum directly to the Department of Social Protection (DSP) for payment under the Redundancy Payments Scheme. You can apply by completing the following steps: Email redundancypayments@welfare.ie to request an application form (RP50).

Our user reviews speak for themselves

Read more or give pdfFiller a try to experience the benefits for yourself

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I manage my Ireland RP50 directly from Gmail?

pdfFiller’s add-on for Gmail enables you to create, edit, fill out and eSign your Ireland RP50 and any other documents you receive right in your inbox. Visit Google Workspace Marketplace and install pdfFiller for Gmail. Get rid of time-consuming steps and manage your documents and eSignatures effortlessly.

How do I fill out the Ireland RP50 form on my smartphone?

You can easily create and fill out legal forms with the help of the pdfFiller mobile app. Complete and sign Ireland RP50 and other documents on your mobile device using the application. Visit pdfFiller’s webpage to learn more about the functionalities of the PDF editor.

How do I edit Ireland RP50 on an Android device?

Yes, you can. With the pdfFiller mobile app for Android, you can edit, sign, and share Ireland RP50 on your mobile device from any location; only an internet connection is needed. Get the app and start to streamline your document workflow from anywhere.

What is Ireland RP50?

Ireland RP50 is a form used for reporting certain income and tax information to the Revenue Commissioners in Ireland, typically relating to benefits provided to employees.

Who is required to file Ireland RP50?

Employers in Ireland who provide certain benefits, allowances, or payments to employees are required to file the Ireland RP50 form.

How to fill out Ireland RP50?

To fill out Ireland RP50, employers need to gather the necessary details about the benefits or payments provided, complete the form accurately, and submit it to the Revenue Commissioners by the specified deadline.

What is the purpose of Ireland RP50?

The purpose of Ireland RP50 is to ensure that the Revenue Commissioners receive accurate information regarding benefits and payments made to employees, which helps in the assessment of tax obligations.

What information must be reported on Ireland RP50?

The information that must be reported on Ireland RP50 includes the type and value of benefits provided, the reasons for these benefits, and any relevant details about the employees receiving them.

Fill out your Ireland RP50 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Ireland rp50 is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.