MI DoT 3676 2010 free printable template

Show details

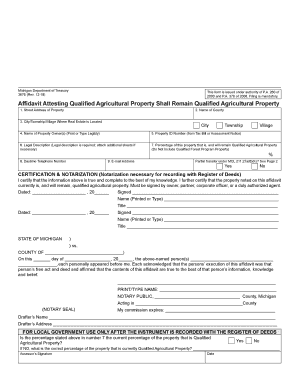

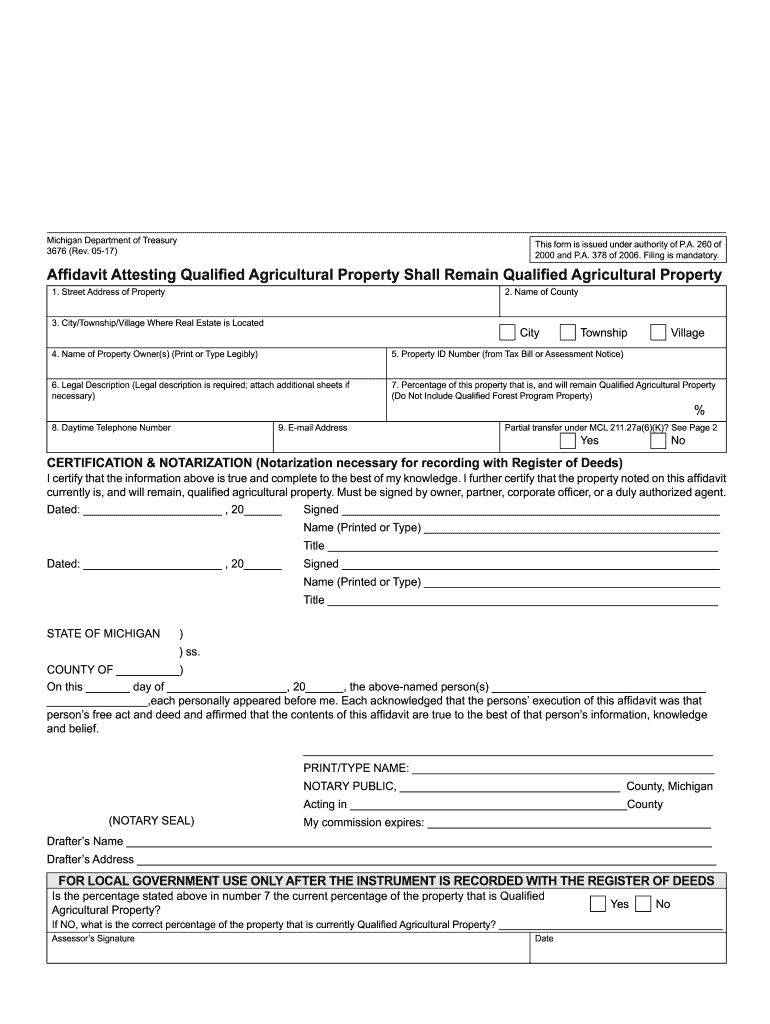

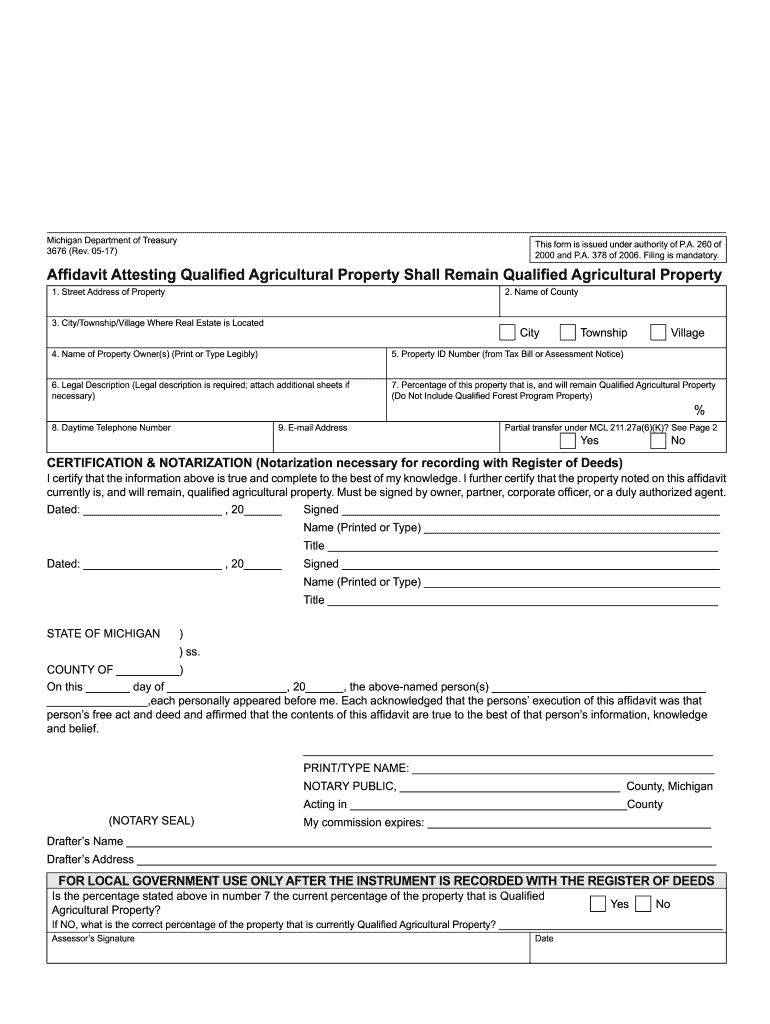

Reset Form Michigan Department of Treasury 3676 Rev. 3-10 This form is issued under authority of P. A. 260 of 2000 and P. A. 378 of 2006. Filing is mandatory. Affidavit Attesting that Qualified Agricultural Property or Qualified Forest Shall Remain Qualified Agricultural Property INSTRUCTIONS This form must be filed to claim that a transfer of property is not a statutory transfer of ownership because the property will continue to be qualified agricultural or qualified forest property. This...

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign form 3676 2010

Edit your form 3676 2010 form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your form 3676 2010 form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit form 3676 2010 online

In order to make advantage of the professional PDF editor, follow these steps:

1

Register the account. Begin by clicking Start Free Trial and create a profile if you are a new user.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit form 3676 2010. Rearrange and rotate pages, add new and changed texts, add new objects, and use other useful tools. When you're done, click Done. You can use the Documents tab to merge, split, lock, or unlock your files.

4

Get your file. Select the name of your file in the docs list and choose your preferred exporting method. You can download it as a PDF, save it in another format, send it by email, or transfer it to the cloud.

pdfFiller makes dealing with documents a breeze. Create an account to find out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

MI DoT 3676 Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out form 3676 2010

How to fill out MI DoT 3676

01

Start by downloading the MI DoT 3676 form from the Michigan Department of Transportation website.

02

Read the instructions carefully before filling out the form.

03

Provide your personal information, including your name, address, and contact details.

04

Fill in the required vehicle information such as make, model, year, and VIN (Vehicle Identification Number).

05

Indicate the purpose of the form and any relevant details.

06

Review the completed form for accuracy and completeness.

07

Sign and date the form where indicated.

08

Submit the form to the appropriate Michigan Department of Transportation office, either by mail or in person.

Who needs MI DoT 3676?

01

Individuals or businesses registering a vehicle in Michigan for the first time.

02

Individuals seeking to transfer vehicle ownership or update vehicle details.

03

Those applying for a title for a vehicle in Michigan.

Instructions and Help about form 3676 2010

Fill

form

: Try Risk Free

People Also Ask about

How many acres is considered a farm in KY?

The Kentucky Revised Statute 132.010 (9, 10, 11) defines agricultural land as any tract of land, including all income producing improvements of at least 10 contiguous acres in area used for the production of livestock, livestock products, poultry, poultry products and/or the growing of tobacco and/or crops including

What qualifies you as a farmer?

You are in the business of farming if you cultivate, operate, or manage a farm for profit, either as owner or tenant. A farm includes livestock, dairy, poultry, fish, fruit, and truck farms. It also includes plantations, ranches, ranges, and orchards.

Does the IRS consider my farm a hobby?

ing to the IRS, a farmer needs to show a profit 3 out of 5 years, even if the profits are not large. Always showing a loss on your Schedule F, can alert the IRS that the operation may be a hobby and not a for-profit business. You can expect future profits in your farming activities.

What qualifies as a farm to the IRS?

A farm includes livestock, dairy, poultry, fish, fruit, and truck farms. It also includes plantations, ranches, ranges, and orchards.

Is 1 acre land enough for farming?

One acre isn't likely large enough to accomplish all of those things and be completely self-sustaining, but it is large enough to be sustainable and practical.

What qualifies as a farm in Arkansas?

A farm is “any place from which $1,000 or more of agricultural products were produced and sold, or normally would have been sold, during the year.” Government payments are included in sales.

What qualifies as a farm in Michigan?

A farm is eligible if one of the following is true: “Agricultural use” means the production of plants and animals useful to humans, use in a federal acreage set-aside program, or a federal conservation program. Agricultural use does not include the management and harvesting of a woodlot.

What is a PA 260?

PA 260 protects the taxable value on farmland from rising to the State Equalized Value (SEV) when farm property is transferred, so long as the land remains an agricultural use.

Do farmers pay taxes in Michigan?

Most common agricultural input expenses are exempt from Michigan Sales Tax.

What is the difference between a farm and a hobby farm?

So, for clarification, a hobby farm is a smallholding or small farm whose maintenance is without expectation of being a primary source of income. A commercial farm is a type of farming in which both crops and livestock are for business use only. It is a modernized method of agriculture undertaken on a large scale.

How many acres do you need for a tax deduction?

Specifically, farmers are able to take 20 to 75 percent off their property tax bill if they agree not to develop their land for ten years and do so with at least 100 acres.

How do I become a tax exempt farm in Michigan?

To claim exemption, a purchaser must provide the supplier with one of the following: Michigan Sales and Use Tax Certificate of Exemption (Form 3372) Multistate Tax Commission's Uniform Sales and Use Tax Certificate. Streamlined Sales and Use Tax Agreement Certificate or the same information in another format.

How many acres do you need to be considered a farm in Michigan?

A farm is eligible if one of the following is true: Farm has been designated as a specialty farm by MDARD, is a minimum of 15 acres, and has a gross annual income exceeding $2,000/yr.

How do I qualify for farm tax exemption in Michigan?

To be eligible for the qualified agricultural property exemption, a structure must be a related building and must be located on a parcel that is classified agricultural or that is devoted primarily to agricultural use.

How many acres do you need for a farm?

9. A homestead is typically smaller than a ranch or farm. ing to the USDA, the average size of a farm is 444 acres. A homestead tends to be quite a bit smaller since it usually only needs to produce enough to support a family.

How many animals do you need for an ag exemption in Florida?

A minimum of six adult goats/sheep shall be required and granted on a three animal per acre ratio in most cases (herd of fifteen for five acres). A minimum of five calves is required. 4. If property is leased, the lease must be in effect as of January 1st.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I get form 3676 2010?

With pdfFiller, an all-in-one online tool for professional document management, it's easy to fill out documents. Over 25 million fillable forms are available on our website, and you can find the form 3676 2010 in a matter of seconds. Open it right away and start making it your own with help from advanced editing tools.

Can I create an electronic signature for the form 3676 2010 in Chrome?

Yes. By adding the solution to your Chrome browser, you can use pdfFiller to eSign documents and enjoy all of the features of the PDF editor in one place. Use the extension to create a legally-binding eSignature by drawing it, typing it, or uploading a picture of your handwritten signature. Whatever you choose, you will be able to eSign your form 3676 2010 in seconds.

How can I edit form 3676 2010 on a smartphone?

You can easily do so with pdfFiller's apps for iOS and Android devices, which can be found at the Apple Store and the Google Play Store, respectively. You can use them to fill out PDFs. We have a website where you can get the app, but you can also get it there. When you install the app, log in, and start editing form 3676 2010, you can start right away.

What is MI DoT 3676?

MI DoT 3676 is a form related to the Michigan Department of Transportation used for reporting various transportation-related data.

Who is required to file MI DoT 3676?

Individuals or organizations involved in transportation activities in Michigan, such as contractors and service providers, are required to file MI DoT 3676.

How to fill out MI DoT 3676?

To fill out MI DoT 3676, follow the instructions provided in the form, entering the required information accurately and completely, and submit it to the Michigan Department of Transportation.

What is the purpose of MI DoT 3676?

The purpose of MI DoT 3676 is to collect data relevant to transportation operations, funding, and compliance with state regulations.

What information must be reported on MI DoT 3676?

MI DoT 3676 requires reporting information such as transportation service details, contractor information, project descriptions, and relevant financial figures.

Fill out your form 3676 2010 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Form 3676 2010 is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.