OH DTE 23 2005 free printable template

Show details

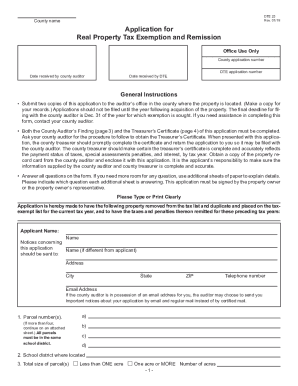

County name DUE 23 Rev. 4/05 Application for Real Property Tax Exemption and Remission Office Use Only County application number DUE application number Date received by county auditor Date received

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign OH DTE 23

Edit your OH DTE 23 form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your OH DTE 23 form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit OH DTE 23 online

Follow the steps below to use a professional PDF editor:

1

Sign into your account. In case you're new, it's time to start your free trial.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit OH DTE 23. Text may be added and replaced, new objects can be included, pages can be rearranged, watermarks and page numbers can be added, and so on. When you're done editing, click Done and then go to the Documents tab to combine, divide, lock, or unlock the file.

4

Get your file. When you find your file in the docs list, click on its name and choose how you want to save it. To get the PDF, you can save it, send an email with it, or move it to the cloud.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

OH DTE 23 Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out OH DTE 23

How to fill out OH DTE 23

01

Obtain the Ohio DTE 23 form from the official website or your local tax office.

02

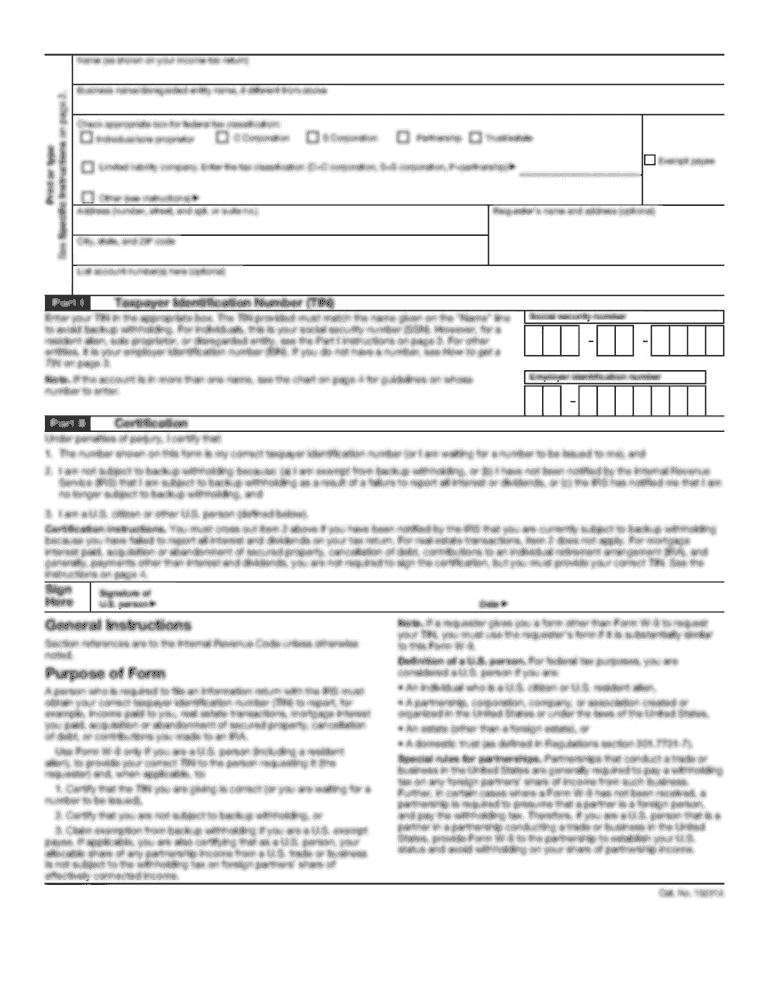

Fill in your personal information in the designated fields, including your name, address, and social security number.

03

Enter your estate's information, including the estate name and date of death.

04

Provide a detailed description of the real estate property, including its address and parcel number.

05

Indicate the fair market value of the property at the time of death.

06

Review the instructions for any additional requirements or documentation needed to accompany the form.

07

Sign and date the form to certify that the information provided is accurate.

08

Submit the completed form to the appropriate county auditor or tax office.

Who needs OH DTE 23?

01

Individuals who are settling an estate in Ohio and need to report real property for tax purposes.

02

Executors or administrators of estates that include real estate valued within Ohio.

03

Heirs or beneficiaries who may need to resolve estate tax obligations related to property.

Fill

form

: Try Risk Free

People Also Ask about

What is the Homestead Exemption for 2023 in Ohio?

“Total income” is defined in R.C. 323.151(C) to be the Ohio Adjusted Gross Income (OAGI) of the owner and spouse for the year preceding the year in which a homestead application is made. The current maximum allowed is $36,100 for the 2023 application period.

What is the homestead exemption for 2023 in Ohio?

“Total income” is defined in R.C. 323.151(C) to be the Ohio Adjusted Gross Income (OAGI) of the owner and spouse for the year preceding the year in which a homestead application is made. The current maximum allowed is $36,100 for the 2023 application period.

What is the senior homestead exemption in Ohio?

The homestead exemption for senior and disabled persons allows eligible homeowners to exempt the first $25,000 of their home's auditor's appraised value from taxation. For example, an eligible owner of a home with an auditor's appraised value of $100,000 will be billed as if the home were valued at $75,000.

Who is exempt from real property transfer tax in Ohio?

Major Exemptions The tax does not apply: to sales or transfers to or from the U.S. government or its agencies, or to or from the state of Ohio or any of its political subdivisions. to gifts from one spouse to another, or to children and their spouses. to surviving spouses or to a survivorship tenant.

How much is Ohio's homestead exemption?

With homestead, eligible homeowners receive an exemption on the first $25,000 of appraised value from taxation for a single family home. Eligible Military Veterans receive an additional exemption on the first $50,000 of appraised value from taxation for a single family home.

What is the Ohio real estate exemption?

The tax exemption is limited to the homestead, which Ohio law defines as an owner's dwelling and up to one acre of land. The value of the exemption may not exceed the value of the homestead. The 2021 income threshold is $34,200, and the 2022 threshold is $34,600.

How many exemptions should I claim in Ohio?

Line 3: You are allowed one exemption for each dependent. Your dependents for Ohio income tax purposes are the same as your dependents for federal income tax purposes. See R.C.

What are reasons to be exempt from taxes?

Typically, you can be exempt from withholding tax only if two things are true: You got a refund of all your federal income tax withheld last year because you had no tax liability. You expect the same thing to happen this year. Internal Revenue Service.

What is a valid reason for tax exemption in Ohio?

Certain telecommunication services. Satellite broadcasting service. Personal care service, including skin care, application of cosmetics, manicures, pedicures, hair removal, tattoos, body piercing, tanning, massage and other similar services.

What is exempt from real property tax in Ohio?

Properties owned and operated by a municipal corporation or belonging to the state or federal government and used exclusively for public purpose are exempt from taxation. Public schools, colleges, academies and churches are also exempt from paying real estate taxes.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Where do I find OH DTE 23?

The pdfFiller premium subscription gives you access to a large library of fillable forms (over 25 million fillable templates) that you can download, fill out, print, and sign. In the library, you'll have no problem discovering state-specific OH DTE 23 and other forms. Find the template you want and tweak it with powerful editing tools.

How do I complete OH DTE 23 online?

pdfFiller has made it easy to fill out and sign OH DTE 23. You can use the solution to change and move PDF content, add fields that can be filled in, and sign the document electronically. Start a free trial of pdfFiller, the best tool for editing and filling in documents.

Can I edit OH DTE 23 on an Android device?

With the pdfFiller mobile app for Android, you may make modifications to PDF files such as OH DTE 23. Documents may be edited, signed, and sent directly from your mobile device. Install the app and you'll be able to manage your documents from anywhere.

What is OH DTE 23?

OH DTE 23 is a form used by the State of Ohio for reporting designated tax information related to income or other tax-related obligations.

Who is required to file OH DTE 23?

Individuals or businesses that meet specific tax criteria or thresholds set by the Ohio Department of Taxation are required to file OH DTE 23.

How to fill out OH DTE 23?

To fill out OH DTE 23, gather necessary financial information, follow the form instructions carefully, and complete all required sections accurately before submitting.

What is the purpose of OH DTE 23?

The purpose of OH DTE 23 is to provide the State of Ohio with essential tax-related information to ensure compliance with state tax laws.

What information must be reported on OH DTE 23?

Information that must be reported on OH DTE 23 includes income details, deductions, credits, and any other relevant financial data as prescribed by the form instructions.

Fill out your OH DTE 23 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

OH DTE 23 is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.