Get the free CorporateInternationl tax alert

Show details

Deze alert bespreekt de wet van 14 april 2011 met wijzigingen in de vennootschapsbelasting, inclusief wijzigingen in renteaftrekken, dividendontvangen aftrekken, en maatregelen met betrekking tot

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign corporateinternationl tax alert

Edit your corporateinternationl tax alert form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your corporateinternationl tax alert form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing corporateinternationl tax alert online

To use the services of a skilled PDF editor, follow these steps:

1

Create an account. Begin by choosing Start Free Trial and, if you are a new user, establish a profile.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit corporateinternationl tax alert. Text may be added and replaced, new objects can be included, pages can be rearranged, watermarks and page numbers can be added, and so on. When you're done editing, click Done and then go to the Documents tab to combine, divide, lock, or unlock the file.

4

Get your file. When you find your file in the docs list, click on its name and choose how you want to save it. To get the PDF, you can save it, send an email with it, or move it to the cloud.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out corporateinternationl tax alert

How to fill out a corporate international tax alert:

01

Start by gathering all the necessary documents and information related to your company's international taxes. This may include financial statements, income and expense reports, employment records, and any relevant tax treaties or agreements.

02

Carefully review the corporate international tax alert form to understand the sections and requirements. Pay attention to any specific instructions or guidelines provided.

03

Begin filling out the form by entering your company's basic information, such as legal name, address, and contact details.

04

Provide accurate and up-to-date financial information, including details of income, expenses, assets, and liabilities related to international operations.

05

If applicable, indicate any tax exemptions, deductions, or credits that your company may be eligible for under international tax laws.

06

Include any relevant supporting documentation, such as receipts, invoices, or legal agreements, to substantiate the information provided.

07

Double-check all the information you have entered for accuracy and completeness.

08

Once you are confident that the form is correctly filled out, sign and date it as required.

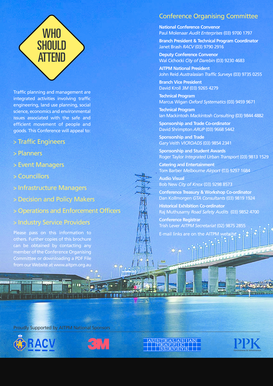

Who needs a corporate international tax alert:

01

Companies and corporations that engage in international business activities, including cross-border transactions, international investments, and global operations.

02

Entities that are subject to international tax regulations and laws, such as multinational corporations or companies with overseas subsidiaries

03

Businesses seeking to ensure compliance with international tax obligations, mitigate tax risks, and optimize their international tax strategies.

Please note that it is important to consult with a tax professional or advisor who specializes in international taxation for specific guidance related to your company's tax obligations and requirements.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I modify my corporateinternationl tax alert in Gmail?

corporateinternationl tax alert and other documents can be changed, filled out, and signed right in your Gmail inbox. You can use pdfFiller's add-on to do this, as well as other things. When you go to Google Workspace, you can find pdfFiller for Gmail. You should use the time you spend dealing with your documents and eSignatures for more important things, like going to the gym or going to the dentist.

How can I edit corporateinternationl tax alert from Google Drive?

pdfFiller and Google Docs can be used together to make your documents easier to work with and to make fillable forms right in your Google Drive. The integration will let you make, change, and sign documents, like corporateinternationl tax alert, without leaving Google Drive. Add pdfFiller's features to Google Drive, and you'll be able to do more with your paperwork on any internet-connected device.

How can I send corporateinternationl tax alert for eSignature?

When you're ready to share your corporateinternationl tax alert, you can send it to other people and get the eSigned document back just as quickly. Share your PDF by email, fax, text message, or USPS mail. You can also notarize your PDF on the web. You don't have to leave your account to do this.

What is corporateinternationl tax alert?

Corporateinternational tax alert is a notification or an update regarding international tax regulations and requirements that may impact corporations and their international operations.

Who is required to file corporateinternationl tax alert?

Corporations engaged in international business activities are typically required to file corporateinternational tax alert. The specific requirements may vary by jurisdiction.

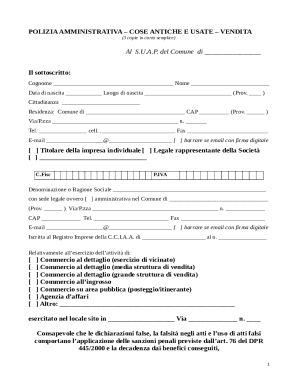

How to fill out corporateinternationl tax alert?

The process of filling out corporateinternational tax alert may vary depending on the jurisdiction and the specific form or reporting requirement. Usually, it involves providing information on the corporation's international operations, income, expenses, and any applicable tax treaties or agreements.

What is the purpose of corporateinternationl tax alert?

The purpose of corporateinternational tax alert is to ensure compliance with international tax laws and regulations, report accurate and complete information regarding corporate international activities, and facilitate the collection of taxes on international income.

What information must be reported on corporateinternationl tax alert?

The specific information required to be reported on corporateinternational tax alert may vary, but it typically includes details of international transactions, transfer pricing, foreign income, taxes paid, and any applicable tax credits or incentives.

Fill out your corporateinternationl tax alert online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Corporateinternationl Tax Alert is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.