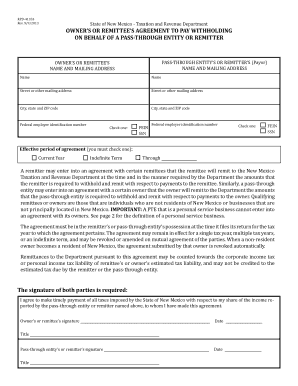

NM RPD-41353 2012 free printable template

Get, Create, Make and Sign NM RPD-41353

Editing NM RPD-41353 online

Uncompromising security for your PDF editing and eSignature needs

NM RPD-41353 Form Versions

How to fill out NM RPD-41353

How to fill out NM RPD-41353

Who needs NM RPD-41353?

Instructions and Help about NM RPD-41353

Hello my name is Dustin and IN×39’into Toto bee teaching you how to make a fillableform on Microsoft Word okay so um what you want to do is open up a new document and make the title mine×39’s gointhebe titleded survey and then go down and then make your questions size twelve or fourteen depending on what you want to make it, and then you're going to need to tout another tab on your ribbon up various×39’re going to neecustomizedit pretty much so to do that go up to wherein shares this little eject button it says customize quick access toolbar make that as a drop that down and then click on more commands than go over nowhere it says customize ribbon click on that and then go over here where it says customize the ribbon and make sure main tabs is checked off right here up hairband then go all the way down to where it says developer you want to make that you want to click that so it×39’ll adrift UUP here and then click on OK, and then you want to click on developer now Todd your questions you×39’re unneeded Toto input them first so name and then Like that a cool one um date and um toucan add your questions like um birthday uh favorite color, and then you can make all this capitalized um favorite food Music let me know in the comments what you think I should add to this survey umwhat you think I should make is more questions uh favorite TV show favorite movie that×39’s all reallgoingng to do I'm going to show you how to make it so that you can pick a date instead of just typing it in makedrop-down boxes so to make a box that just you can type in you want to go to developer and then go to where it says controls then before you start this you have to click on design mode you must Dothan or this is all for nothing pretty much and then click on the where it set click on here where it says rich text content control as it shows whenever Hover over it this one is basically the same thing but um this makes a bolderthat'’s solos solo you want to click on that, and then you want to UM and whenever you×39’re in design mode billhook like this, so you can add here ah put your name so it×39’liken an instruction on I put your name or put yourfull name, and you can change the color of what this looks like so instead of having it gray you can make it black toucan change the size so IN×39’ll make it 12and then I can underline full name and then whenever you go out of developer mode I mean whenever you go out of design mode it'll, you click on it and then you×39’re supposed to input your name but we×39’re not going to do thalogogo back into design mode and then to put agate so that you don't just type it in you can pick it um you go back up hereto where it says hover over the date icon denotes a date picker content control click on that and the nah highlight this and put an instructionlike click on a date and then we×39

People Also Ask about

How much does New Mexico withhold for taxes?

What is a RPD 41359 form?

Where to get New Mexico state Tax Forms?

What is the gross receipts tax in New Mexico for LLC?

Do I need to file New Mexico tax return?

What is the New Mexico non resident Withholding Tax?

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I execute NM RPD-41353 online?

How do I fill out NM RPD-41353 using my mobile device?

Can I edit NM RPD-41353 on an iOS device?

What is NM RPD-41353?

Who is required to file NM RPD-41353?

How to fill out NM RPD-41353?

What is the purpose of NM RPD-41353?

What information must be reported on NM RPD-41353?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.