NY DTF IT-214 2011 free printable template

Show details

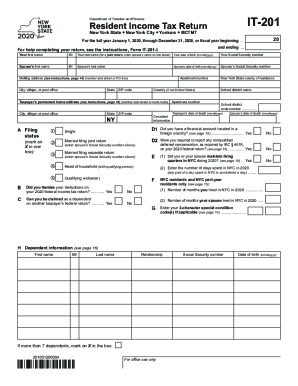

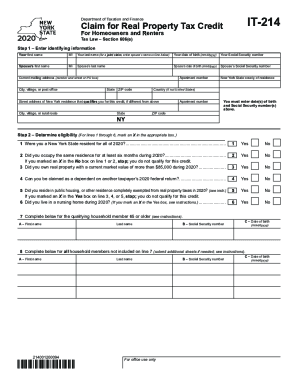

This is the credit for your household. If more than one member of your household is filing Form IT-214 see instructions. 33 If you are filing this claim with your New York State income tax return Enter the line 33 amount on Form IT-201 line 67. If you are not filing this claim with a New York State income tax return see instructions Mark one refund choice direct deposit fill in line 34 - or - debit card - or - paper check Step 6 Enter account...

pdfFiller is not affiliated with any government organization

Instructions and Help about NY DTF IT-214

How to edit NY DTF IT-214

How to fill out NY DTF IT-214

Instructions and Help about NY DTF IT-214

How to edit NY DTF IT-214

To edit the NY DTF IT-214 tax form, you can use a PDF editor such as pdfFiller. This platform allows you to fill in the required fields directly, making it easier to correct any mistakes or update information.

Simply upload the form to pdfFiller, make your edits, and save the changes. You can also add electronic signatures if needed. This process streamlines the editing phase, ensuring your form is accurate before submission.

How to fill out NY DTF IT-214

Filling out the NY DTF IT-214 requires specific information about your tax situation. Start by gathering the necessary documentation, including your income records and any deductions you plan to claim. You will need to enter personal identification details, such as your name, address, and Social Security number.

Follow structured steps to ensure completeness:

01

Enter your personal information in the designated fields.

02

Provide your total income and any adjustments.

03

List any applicable deductions or credits you are claiming.

04

Double-check for accuracy and completeness before finalizing.

About NY DTF IT previous version

What is NY DTF IT-214?

What is the purpose of this form?

Who needs the form?

When am I exempt from filling out this form?

Components of the form

What are the penalties for not issuing the form?

What information do you need when you file the form?

Is the form accompanied by other forms?

Where do I send the form?

About NY DTF IT previous version

What is NY DTF IT-214?

NY DTF IT-214 is a tax form used by New York State taxpayers to claim credits for various personal circumstances, including homeownership and certain educational expenses. This form is part of the tax compliance process for both individuals and businesses within the state.

What is the purpose of this form?

The purpose of the NY DTF IT-214 is to allow taxpayers to report information pertinent to their eligibility for tax credits. This includes personal exemptions and credits aimed at reducing the tax burden on eligible taxpayers.

Who needs the form?

Taxpayers who qualify for specific credits and deductions must complete the NY DTF IT-214 form. This generally includes homeowners, individuals with dependents, or those with certain educational expenses that may be eligible for credits.

When am I exempt from filling out this form?

You may be exempt from filling out the NY DTF IT-214 if your income does not subject you to tax liability or if you do not qualify for any credits detailed in the form. Always verify your current tax situation before deciding not to complete the form.

Components of the form

The NY DTF IT-214 consists of several key components, including personal information sections, credit claim areas, and signature lines. Each section is designed to capture important information relevant to the claims being made.

What are the penalties for not issuing the form?

Failing to issue the NY DTF IT-214 when required can lead to penalties imposed by the New York State Department of Taxation and Finance. These penalties may involve fines and an increased likelihood of audits, stressing the importance of compliance.

What information do you need when you file the form?

When filing the NY DTF IT-214, you will need to gather various pieces of information, including your Social Security number, income details, and any relevant documentation to support your claims for credits. This information is crucial to ensuring the accuracy of your submission.

Is the form accompanied by other forms?

The NY DTF IT-214 may need to be submitted alongside other tax forms depending on your specific tax situation. Check the instructions accompanying the form for guidance on any additional documentation that may be required.

Where do I send the form?

The completed NY DTF IT-214 should be mailed to the address designated by the New York State Department of Taxation and Finance. Ensure you check the latest instructions for the most accurate mailing information to avoid delays in processing.

See what our users say