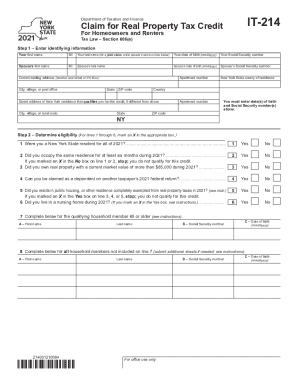

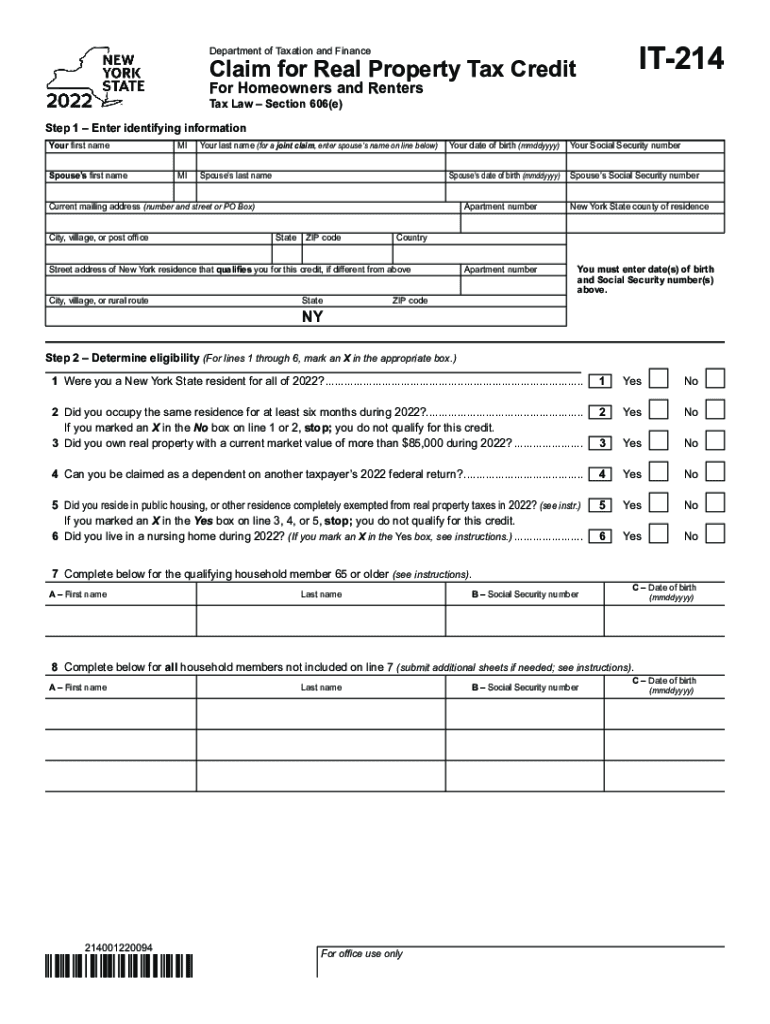

NY DTF IT-214 2022 free printable template

Instructions and Help about NY DTF IT-214

How to edit NY DTF IT-214

How to fill out NY DTF IT-214

About NY DTF IT previous version

What is NY DTF IT-214?

Who needs the form?

Components of the form

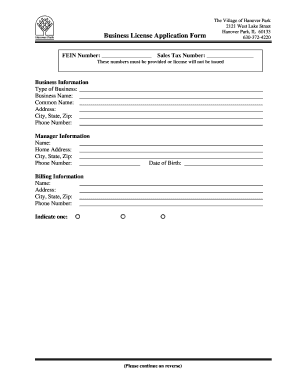

What payments and purchases are reported?

What are the penalties for not issuing the form?

Is the form accompanied by other forms?

What is the purpose of this form?

When am I exempt from filling out this form?

Due date

How many copies of the form should I complete?

What information do you need when you file the form?

Where do I send the form?

FAQ about NY DTF IT-214

What should I do if I realize I've made a mistake on my filed NY DTF IT-214?

If you discover an error after filing your NY DTF IT-214, you can submit an amended return to correct the mistake. Make sure to clearly indicate that it's an amendment and provide the correct information. Keep a copy of your amended form for your records.

How can I check the status of my submitted NY DTF IT-214?

To track the status of your NY DTF IT-214, you can use the New York State Department of Taxation and Finance online services. This will allow you to verify if your submission has been received and is being processed.

Are e-signatures accepted when filing the NY DTF IT-214?

Yes, e-signatures are accepted for the NY DTF IT-214 when you file electronically. This allows for a more streamlined filing process while maintaining the integrity of your submission.

What should I do if I receive a notice regarding my NY DTF IT-214?

If you receive a notice from the New York State Department of Taxation and Finance concerning your NY DTF IT-214, carefully read the document, as it will outline the necessary steps. Gather any required documentation and respond accordingly by the specified deadline.

What are some common mistakes to avoid when filing the NY DTF IT-214?

Common errors on the NY DTF IT-214 include incorrect Social Security numbers, missing signatures, and incomplete information. To minimize mistakes, double-check your entries before submission and consult the instructions if you're unsure about any part of the form.

See what our users say