NY DTF IT-214 2021 free printable template

Show details

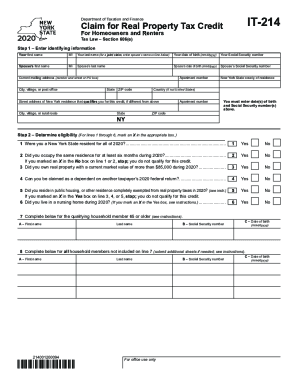

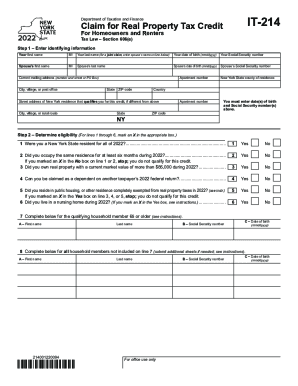

IT214Department of Taxation and FinanceClaim for Real Property Tax Credit

For Homeowners and Renters

Tax Law Section 606(e)

Step 1 Enter identifying information

Your first nameMIYour last name (for

pdfFiller is not affiliated with any government organization

Instructions and Help about NY DTF IT-214

How to edit NY DTF IT-214

How to fill out NY DTF IT-214

Instructions and Help about NY DTF IT-214

How to edit NY DTF IT-214

To edit the NY DTF IT-214 form, download it from the New York State Department of Taxation and Finance or access it through a reliable form editing service, such as pdfFiller. Use the editing tools to fill out the required fields, ensuring all information is accurate and complete. Once edited, you can save the document for submission or printing.

How to fill out NY DTF IT-214

Filling out the NY DTF IT-214 form requires specific information regarding your tax situation. Follow these steps to ensure accuracy:

01

Obtain the form from the New York State Department of Taxation and Finance.

02

Input your personal information, including your name, address, and Social Security number.

03

Report the total amount of your eligible expenses for the year.

04

Double-check all entries for accuracy before finalizing.

About NY DTF IT previous version

What is NY DTF IT-214?

What is the purpose of this form?

Who needs the form?

When am I exempt from filling out this form?

Components of the form

What are the penalties for not issuing the form?

What information do you need when you file the form?

Is the form accompanied by other forms?

Where do I send the form?

About NY DTF IT previous version

What is NY DTF IT-214?

The NY DTF IT-214 form is a New York State tax form used by residents to claim the Real Property Tax Credit for Eligible Homeowners. The credit assists homeowners who meet specific criteria by reducing their state tax burden, reflecting the state’s initiative to alleviate housing expenses.

What is the purpose of this form?

The purpose of the NY DTF IT-214 form is to provide homeowners with a mechanism to reduce their New York State tax liability through a credit based on their property taxes. This form enables eligible taxpayers to receive a direct financial relief if they meet all qualifying criteria.

Who needs the form?

Homeowners in New York who have paid property taxes and meet specific income thresholds are typically required to fill out the NY DTF IT-214 form. Individuals who own one- to four-family homes, tenant-occupied properties, and certain co-ops may qualify. It is essential to review eligibility criteria before filing.

When am I exempt from filling out this form?

Exemptions from filling out the NY DTF IT-214 form exist for individuals who do not own property or whose income exceeds the eligibility limits set by the New York State Department of Taxation and Finance. Additionally, renters and individuals who pay no property taxes are also exempt.

Components of the form

The NY DTF IT-214 form includes various components such as taxpayer information sections, lines to report total eligible property taxes paid, and instructions for claiming the credit. Each section must be completed accurately to ensure valid claims.

What are the penalties for not issuing the form?

Failing to file the NY DTF IT-214 when required may result in penalties, including fines or the denial of the credit. Taxpayers are encouraged to file on time to avoid any negative consequences on their tax filings and financial standing.

What information do you need when you file the form?

When filing the NY DTF IT-214 form, you will need personal identification details, including your Social Security number, property tax statements, and information about your total income for the year. Collecting this information in advance can expedite the filing process.

Is the form accompanied by other forms?

The NY DTF IT-214 form may require additional documentation depending on your filing situation, such as income statements or tax returns. It's recommended to check the instructions accompanying the form or consult a tax professional for specific guidance.

Where do I send the form?

The completed NY DTF IT-214 form must be submitted to the address specified in the instruction booklet of the form. Typically, this is the New York State Department of Taxation and Finance. Ensure that you send it well before the deadline to avoid processing delays.

See what our users say