IRS W-9 2011 free printable template

Show details

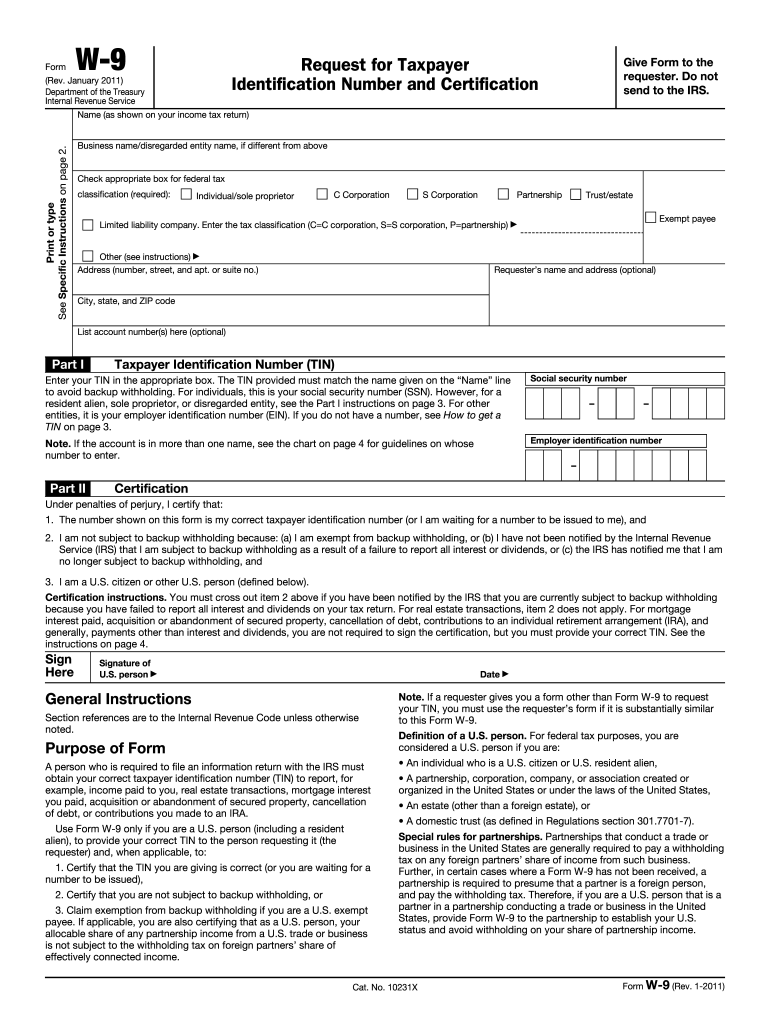

W-9 Request for Taxpayer Identification Number and Certification Form (Rev. January 2011) Department of the Treasury Internal Revenue Service Give Form to the requester. Do not send to the IRS. Print

pdfFiller is not affiliated with IRS

Instructions and Help about IRS W-9

How to edit IRS W-9

How to fill out IRS W-9

Instructions and Help about IRS W-9

How to edit IRS W-9

To edit the IRS W-9 form, you can use pdfFiller's online editing tools. Simply upload your completed form to the platform and utilize its features to make necessary changes. Once you finish editing, you can save or submit the revised form directly from pdfFiller.

How to fill out IRS W-9

Filling out the IRS W-9 form requires careful input of your personal or business information. Follow these steps:

01

Enter your name as it appears on your tax return.

02

Provide your business name if different from your personal name.

03

Select your tax classification from the options listed.

04

Enter your address, including city, state, and ZIP code.

05

Include your Social Security Number (SSN) or Employer Identification Number (EIN).

Ensure you double-check for accuracy before submitting the form to avoid potential penalties.

About IRS W-9 2011 previous version

What is IRS W-9?

What is the purpose of this form?

Who needs the form?

When am I exempt from filling out this form?

Components of the form

What are the penalties for not issuing the form?

What information do you need when you file the form?

Is the form accompanied by other forms?

Where do I send the form?

About IRS W-9 2011 previous version

What is IRS W-9?

The IRS W-9, officially known as the Request for Taxpayer Identification Number and Certification, is a tax form used by individuals and businesses to provide their taxpayer identification information. This form is particularly utilized for reporting purposes to the IRS.

What is the purpose of this form?

The primary purpose of the IRS W-9 is to collect information necessary for the payer to fulfill IRS reporting obligations. For instance, businesses may need your tax identification number to report payments made to you during the year.

Who needs the form?

Any individual or business entity that receives payments for goods and services that may be subject to IRS reporting needs to submit the IRS W-9. This includes freelancers, independent contractors, and vendors who are not employees.

When am I exempt from filling out this form?

You may be exempt from filling out the IRS W-9 if you are not receiving payments requiring reporting, or if you are classified as an exempt entity such as a corporation or tax-exempt organization. However, always confirm your status or consult a tax professional if unsure.

Components of the form

The IRS W-9 consists of several key components, including the request for your name, business name (if applicable), tax classification, address, and taxpayer identification number. Additionally, it includes a certification section where you affirm the correctness of the information provided.

What are the penalties for not issuing the form?

Failing to issue an IRS W-9 when requested can lead to withholding penalties. The payer may be required to withhold a percentage of payments made to you, which could be as high as 24% under backup withholding provisions.

What information do you need when you file the form?

When filing the IRS W-9, you will need your legal name or business name, your corresponding taxpayer identification number (SSN or EIN), your address, and your tax classification information. Ensure all details are accurate to prevent any issues with IRS audits.

Is the form accompanied by other forms?

The IRS W-9 is typically used on its own when providing information to a payer. However, in some circumstances, it may be accompanied by other forms, such as Form 1099, which reports the income you receive from that payer.

Where do I send the form?

The IRS W-9 should not be sent to the IRS. Instead, you should submit it directly to the entity requesting it, such as an employer or client. Ensure that you keep a copy for your records.

See what our users say

Read user feedback and try pdfFiller to explore all its benefits for yourself

It's cool doing everything I need done. Only problem is your month-to-month fee for personal is to high .

too new to the site ..to comment just yet ..

See what our users say