Get the free Evidence of Insurability - bridgewater

Show details

A form used by employees to provide personal and medical information for life insurance underwriting by Reliance Standard Life Insurance Company.

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign evidence of insurability

Edit your evidence of insurability form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your evidence of insurability form via URL. You can also download, print, or export forms to your preferred cloud storage service.

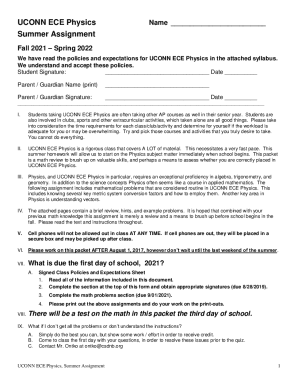

How to edit evidence of insurability online

To use the professional PDF editor, follow these steps:

1

Register the account. Begin by clicking Start Free Trial and create a profile if you are a new user.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit evidence of insurability. Text may be added and replaced, new objects can be included, pages can be rearranged, watermarks and page numbers can be added, and so on. When you're done editing, click Done and then go to the Documents tab to combine, divide, lock, or unlock the file.

4

Get your file. When you find your file in the docs list, click on its name and choose how you want to save it. To get the PDF, you can save it, send an email with it, or move it to the cloud.

The use of pdfFiller makes dealing with documents straightforward. Try it now!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

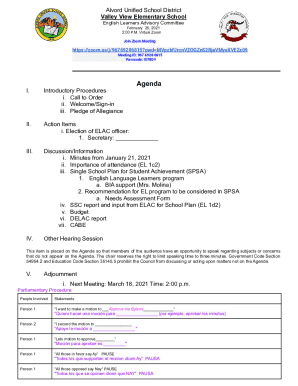

How to fill out evidence of insurability

How to fill out Evidence of Insurability

01

Obtain the Evidence of Insurability form from your insurance provider.

02

Fill in your personal details such as name, address, and date of birth at the top of the form.

03

Answer all health-related questions honestly and thoroughly, including medical history and current health status.

04

Provide details of any medications you are currently taking.

05

Include any relevant information about surgeries or treatments you’ve undergone.

06

Sign and date the form to certify that the information provided is accurate.

07

Submit the completed form to your insurance provider as instructed.

Who needs Evidence of Insurability?

01

Individuals applying for life insurance or an increase in coverage.

02

Participants in employee-sponsored insurance plans who exceed certain coverage limits.

03

Applicants with specific health conditions that require additional assessment.

04

Those seeking insurance after a significant life event, such as marriage or childbirth.

Fill

form

: Try Risk Free

People Also Ask about

Where do I get evidence of insurability?

Insurance companies provide an EOI form, either in paper or digital format. This general insurance questionnaire will request various information, including medical history, lifestyle habits, life events, and other relevant details.

How do you get an EOI?

Evidence of Insurability (EOI) is documented proof of good health. An applicant begins the EOI and medical underwriting process by submitting a Medical History Statement (MHS). This, along with other information obtained during the underwriting evaluation is used by The Standard to make the underwriting determination.

What does an EOI consist of?

The EOI application is a questionnaire on which you and/or your dependent answer “yes” or “no” to questions concerning certain medical conditions. If you answer “yes” to any question(s), you are asked to provide details of the condition, such as pertinent dates, treatments, and names of physicians.

How do you get evidence of insurability?

Evidence of Insurability (EOI) is documented proof of good health. An applicant begins the EOI and medical underwriting process by submitting a Medical History Statement (MHS). This, along with other information obtained during the underwriting evaluation is used by The Standard to make the underwriting determination.

What type of insurance does not require proof of insurability?

Group Life Insurance is typically purchased in full or part by an employer for a group of employees. No proof of insurability is required, and premium rates may be lower than premiums for individual policies.

How to obtain an EOI?

In most cases, employees can complete the entire evidence of insurability process directly through the insurance company. In this digital age, many insurers provide online platforms and portals that allow employees to fill out and submit the form.

Who fills out an EOI?

In most cases, employees can complete the entire evidence of insurability process directly through the insurance company. In this digital age, many insurers provide online platforms and portals that allow employees to fill out and submit the form.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is Evidence of Insurability?

Evidence of Insurability (EOI) is a form used by insurance companies to assess an individual's health status and medical history when applying for insurance coverage, particularly for life or health insurance policies.

Who is required to file Evidence of Insurability?

Individuals applying for certain insurance benefits, especially those that exceed predetermined limits or those who are applying for coverage after an initial eligibility period, are typically required to file Evidence of Insurability.

How to fill out Evidence of Insurability?

To fill out Evidence of Insurability, individuals must provide personal information including their name, address, and date of birth, along with detailed medical history, including any current medications, existing medical conditions, and information about past medical treatments.

What is the purpose of Evidence of Insurability?

The purpose of Evidence of Insurability is to allow insurance companies to evaluate the risk associated with insuring an individual, determining the pricing of the policy and whether to offer coverage at all.

What information must be reported on Evidence of Insurability?

The information that must be reported on Evidence of Insurability typically includes personal health information, medical history, current health status, medications taken, and any pertinent lifestyle information such as smoking or drinking habits.

Fill out your evidence of insurability online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Evidence Of Insurability is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.