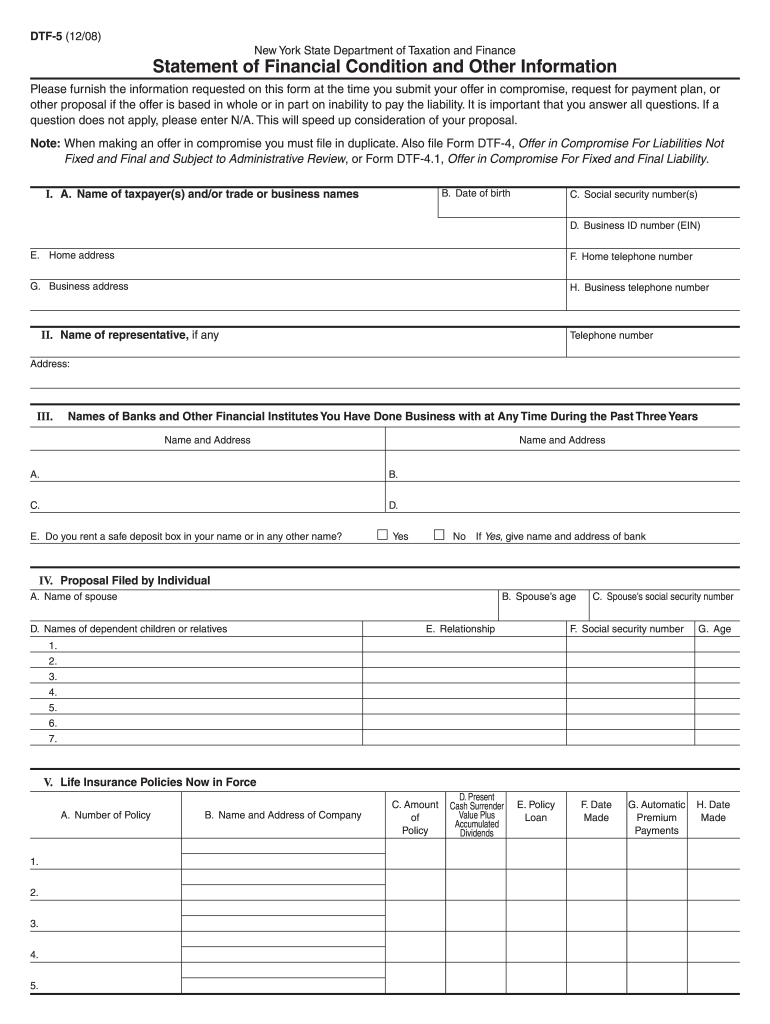

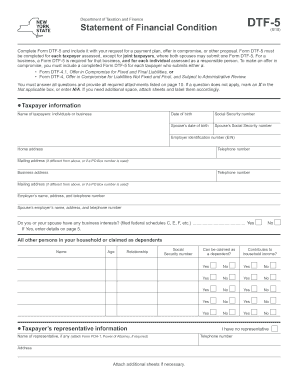

Who needs a DTF-5 form?

You will need this form if you decide to submit an offer in compromise or other proposals provided that they are based on the inability to pay the liability. Generally, the offer in compromise may allow you to pay a reduced tax debt. This form is part of a special program of the IRS and can be a salvation for taxpayers. But in order to submit the offer, you have to be eligible for it. If the IRS thinks that you have enough money to pay the taxes, your application can be denied. This is why it’s very important to providmuchcinformation non as you can. This form will help the IRS to make the decision on your case.

What is the DTF-5 form for?

This form is a Statement of Financial Condition and other Information. It’s used by the individual together with DTF-4 form to submit the offer in compromise and pay only part of the taxes owed.

Is the DTF-5 accompanied by other forms?

In case you prepare the offer in compromise, you should also file the form DTF-4 or DTF-4.1. You should also attach copies of the federal income tax returns for the last three years, a recent credit report and bank statements, and other required documents.

When is the DTF-5 form due?

You must file the above-mentioned forms by the beginning of the tax year -- all relevant tax documents must be filed in advance.

How do I fill out the DTF-5 form?

The statement asks for the following information:

-

Personal information of the taxpayer (name, date of birth, SSN, EIN, telephone number, address)

-

Information about the taxpayer’s family (spouse, children and other dependent relatives)

-

Banks and other financial institutes you’ve done business with during the past three years

-

Life insurance policies

-

Statement of assets and liabilities

-

Receivable accounts and notes

-

Real estate

-

Furniture, machinery and equipment

-

Trucks and automobiles

-

Securities

-

Judgements

-

Income (different sources)

-

Disposal of assets

-

Bankruptcy proceedings

-

Background information

The form must be signed and dated.

Where do I send the DTF-5 form?

You should send this form together with other obligatory forms and documents to the New York State Department of Taxation and Finance, Offer in Compromise Program.